The MLCC shortage and price increase has been more than half a year since mid-2017, and the price has not seen a downward trend so far. This market report explains the reasons and provide the future forecasts.

1. The core reason for the shortage of MLCC supply and price increases since 2017 is the imbalance between supply and demand.

The core driver of price increase in this round of MLCC is the imbalance between supply and demand. The main factors that contribute to the imbalance between supply and demand are: (1) Rapid growth in high-end applications such as automobiles and industrial control; insufficient production capacity results in tight supply; (2) After the Samsung Note 7 explosion issue, the MLCC stopped production for three months, and the subsequent release of production capacity was slow; (3) The MLCC leading companies such as Murata, Samsung, TDK, and Taiyo Yuden, adjusted production capacity and abandoned high-end applications such as autos, industrial control, and ICT.

1.1 Rapid growth of high-end applications such as automotive and industrial control

The automotive MLCC market has grown rapidly under the trend of vehicle electrification and intelligence. In 2012, the global automotive MLCC market was 793 million U.S. dollars and increased to 1.61 billion U.S. dollars in 2017, with a compound annual growth rate of 15%. We believe that the future production and sales of new energy vehicles will accelerate, besides, ADAS and other intelligent application are growing, as prediction, the vehicle MLCC market will grow at a CAGR of more than 20% over the next five years.

The electrification increased the MLCC usage per vehicle from 1000-3000pcs to 3000-6000pcs, and the power system brought the largest increment of MLCC. According to Murata’s data, the number of MLCCs used in electric vehicles is 2700-3100pcs, and all of them are special high-end products. The number of MLCCs used in conventional fuel vehicle power systems is 450-600pcs, and all are conventional products.

Figure 1: The MLCC usage of pure electric vehicles is 5 times that of fuel vehicles

|

|

Conventional products | Middle end products | High end products | Special high-end products |

|

Fuel vehicles |

Hybrid subcompacts |

Plug-in hybrids |

Pure electric vehicles |

|

|

Power System |

450-600 | 800-1000 | 1900-2300 | 2700-3100 |

| Safety System |

1000-1400 |

|||

| Comfort System |

500-800 |

|||

| Entertainment System |

400-700 |

|||

| Others |

500 |

|||

Note: MLCC high-end products have both small size and high-capacity characteristics. The power system of pure electric vehicles has high requirements for ECU miniaturization and high voltage.

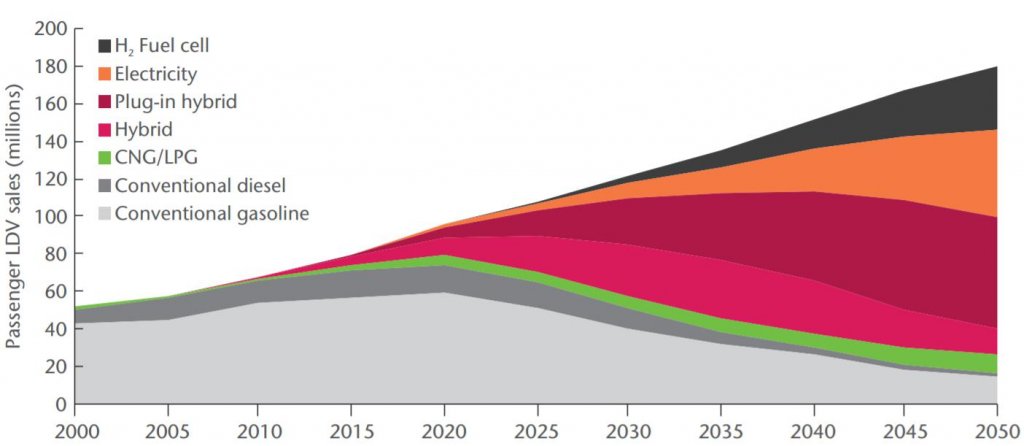

Driven by the investment of governments and car companies and the drop in the battery prices, pure electric vehicles have experienced explosive growth. According to estimates by Bloomberg New Energy Finance (BNEF), global sales of automobiles will be 86 million in 2020, pure electric vehicles will account for 3%, global automobile sales will be 93 million in 2025, and pure electric vehicles will account for 8%; according to IEA data, In 2017, the global pure electric vehicle sales volume was 1.22 million, and the compound growth rate exceeded 20 percent from 2018 to 2025. After 2025, the production and sales volume of pure electric vehicles will accelerate.

Plug-in hybrid new energy vehicles sell better. According to Clean Technica’s data, in 2017, the total sales volume of plug-in hybrid and pure electric new energy vehicles exceeded 3 million. Combined with IEA’s data, it can be concluded that in 2017, the global sales volume of hybrid new hybrid vehicles are total about 1.8 million; According to the IEA Electric and Plug-in Hybrid Vehicle Roadmap, by the year 2025, the sales volume of plug-in hybrid new energy vehicles will be approximately 11 million units, and the composite growth from 2018 to 2025 will be 25.4%.

Similarly, according to the IEA’s data, the sales of hybrid vehicles in 2017 will be approximately 6.8 million units, reaching 23 million units by 2025 and compounding at 16.5% from 2018 to 2025.

Figure 2:Electric and Plug-in Hybrid Vehicle Roadmap

In addition, the application and rapid growth of ADAS and Vehicular Networking not only increase the volume of MLCC, but also request the MLCCs to meet the requirements of high frequency, high capacity, and high accuracy.

Figure 3: MLCC performance request of some applications

|

Applications |

Run Time | lifespan request | Working temperature |

|

PC |

13000 H | 5 Y |

10℃-30℃ |

|

Mobile phone |

43800 H | 5 Y |

-40℃-40℃ |

|

Server |

94000 H | 11 Y |

10℃-30℃ |

|

Telecommunication |

131000 H | 15 Y |

-40℃-85℃ |

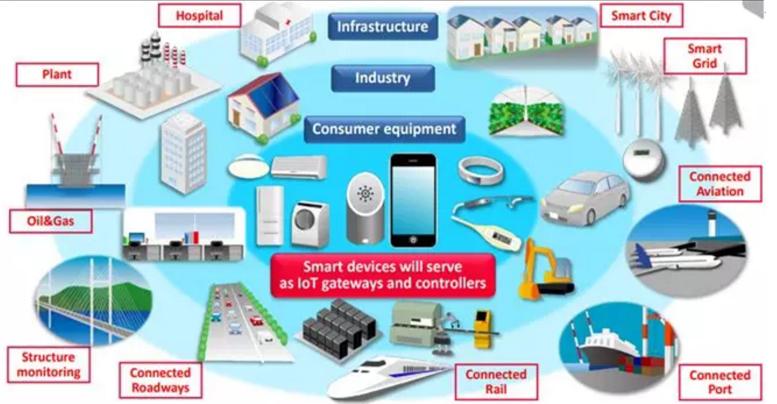

The compound growth rate of the industrial MLCC in the coming years will exceed 10%. According to Murata’s Data, the compound growth rate of industrial control applications, including communication equipment, increased by 17% in 2012-2017. The 5G infrastructure will start large-scale construction starting next year, and the growth of industrial automation, will bring greater impact to MLCCs. Incremental, considering comprehensively that we expect the compounded growth rate of the industrial control MLCC market including communication equipment to exceed 10% in the next few years.

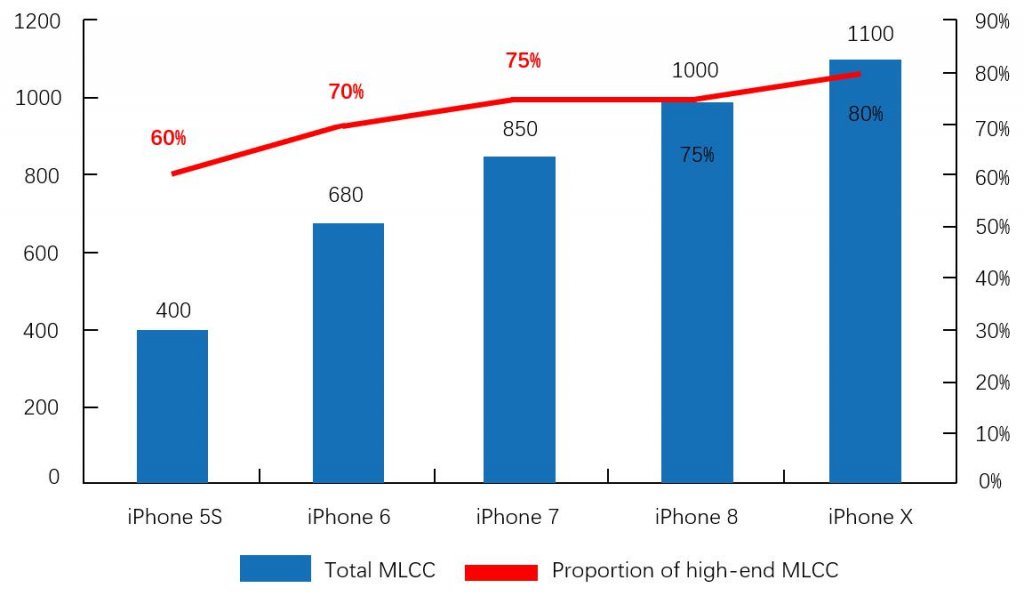

The usage of smart phone MLCCs is still growing. The processing capability of smart phones continues to increase and performance is enhanced. With the increase in the number of single-device MLCCs used, the miniaturization and high-capacity requirements are even higher. Taking the iPhone as an example, the iPhone 5S has a MLCC usage of 400, iPhone 6 is 780, iPhone 7 is 850, iPhone 8 is 1000, iPhone X is 1100, and the proportion of high-end MLCC continues to grow.

Figure 4: iPhone MLCC usage and high-end MLCC accounting

- Japanese and South Korean companies such as Samsung and Murata have reduced supply due to production capacity adjustments.

Samsung’s production capacity contraction has two factors: passive and active.

The passive reason for Samsung's production capacity adjustment is the note 7 mobile phone accident. In September 2016, Samsung cell phone explosion occurred on note 7 phones. Samsung immediately stopped the production of note 7 and conducted investigations, which caused the MLCC business to stop production for three months. As Samsung MLCC's production capacity accounts for a high proportion of the world's total (22% in 2017), quality control after resume production is very strict, and its suspension of production is the beginning of the global MLCC supply shortage.

Samsung took the initiative to adjust its production capacity, focusing on driverless vehicles, electric vehicles, 5G, and industrials, and expanded the proportion of high-end products. After Samsung resumed production, the production capacity has not been fully released. In addition to strengthening quality control, it also adjusted the low-end production capacity to emerging applications such as automotive, industrial control, and 5G, as well as emerging directions such as AI and VR.

Figure 5: Murata Product Strategic Direction

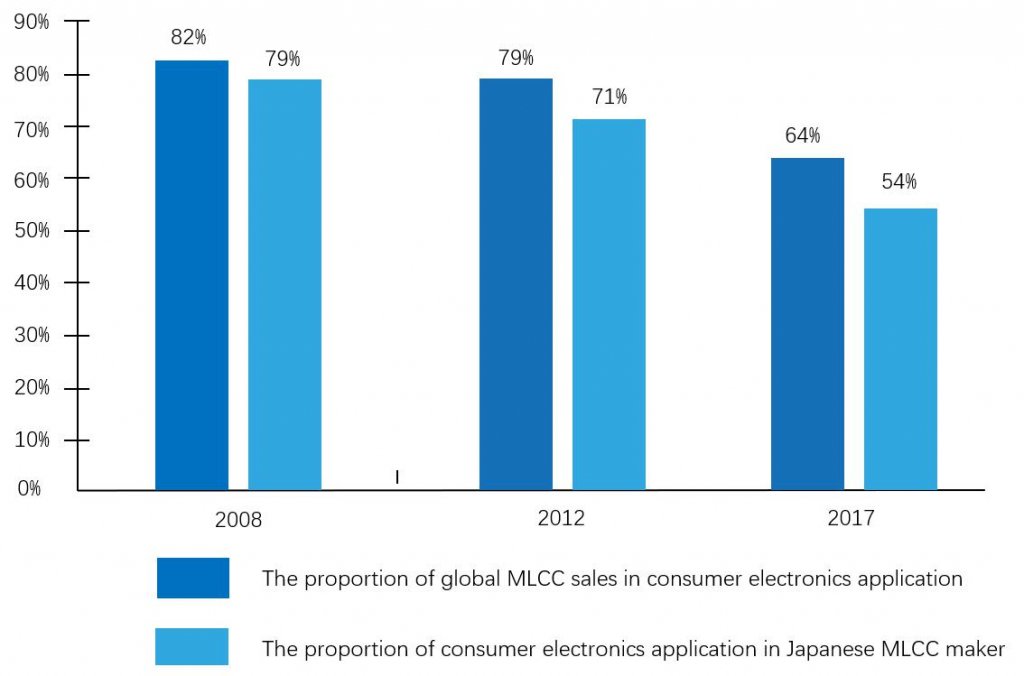

Figure 6: Japanese maker’s MLCC revenue declines in consumer electronics

Murata and other Japanese companies have adjusted their production capacity. With the rapid rise of high-end applications such as automobiles and industrial control, MLCC manufacturers have actively adjusted their production capacity while expanding production. Since the Japanese companies have made great adjustments, the revenue from consumer electronics (mobile phones, computers, TVs, digital cameras, entertainment electronics, etc.) accounted for from 2012. 71% year-on-year fell to 54% in 2017, and from the perspective of global revenue structure, the proportion of consumer electronics fell from 79% in 2012 to 64%. Murata said at the beginning of March that the continuous reduction of production capacity for the "old product groups" of miniaturized alternatives is the company's long-term strategy, and the company will reduce its production capacity to 50% of 2017.

2. The MLCC price increase will continue until 2020

2.1. The price increase is similar to 2006-2008

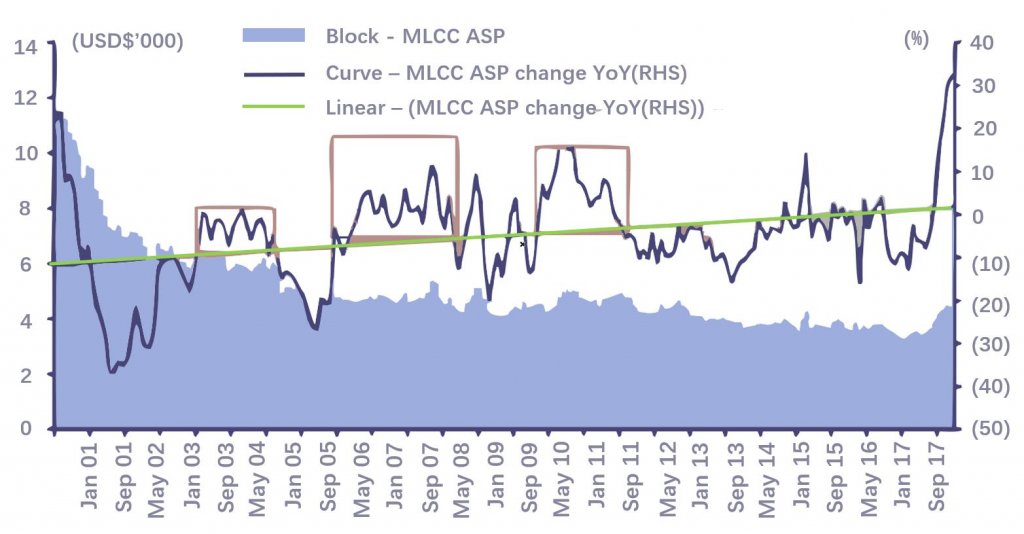

Figure 7: MLCC Price Trends from 2001 to 2017

Since 2000, MLCC has experienced three price surges: 2003-2005, 2006-2008 and 2009-2010, 2003-2005 and 2009-2010 were affected by the macro environment, 2003-2005 MLCC price increase was mainly due to the economic recovery after the US Internet bubble, and the increase in prices during 2009-2010 was driven by the global economic recovery after the financial crisis.

The price increase in 2006-2008 is brought about by the miniaturization and thinning of the consumer electronics market, mainly including mobile phones, tablet computers, digital cameras, and game controllers. The trend toward miniaturization and thinning of the consumer electronics market has greatly increased the demand for small, high-capacitance MLCC products, resulting in higher prices for high-end products. As manufacturers expand their production, they also shift low-end capacity to small-capacity products, leading to the price increase of low-end products.

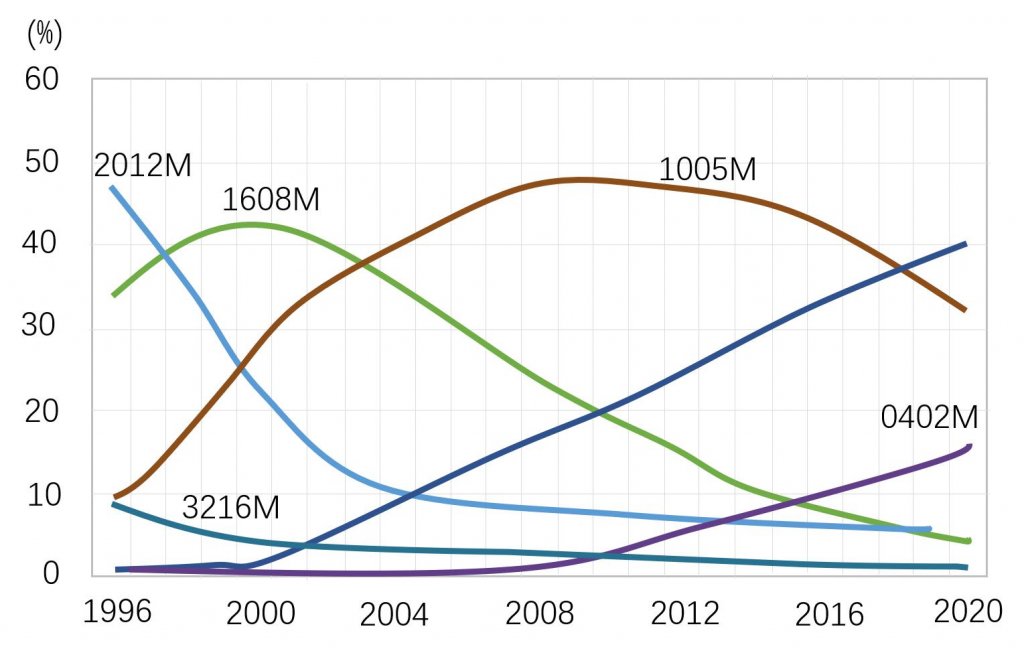

Figure 8: Murata MLCC product trend

The current surge in MLCC product prices is similar to that in 2006-2008. The demand for high-end applications such as automobiles, industrial controls, and ICTs surged, while the shortage of product supply led to higher prices for high-end products. Major manufacturers such as Japan and South Korea reduced their mid- to low-end capacitance to high-end products, and lead to low-end product prices increase.

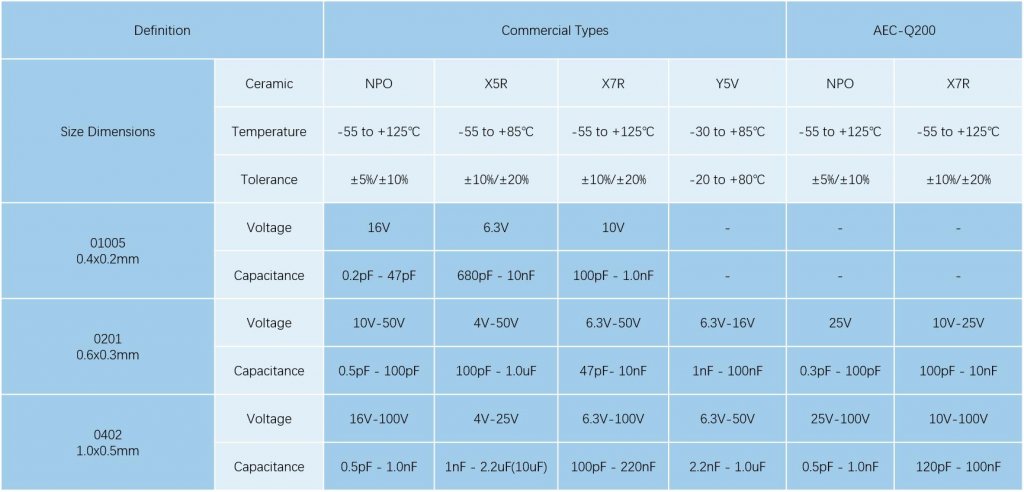

Figure 9: Small size high capacitance MLCC parameter standard

The current MLCC surge started from mid of 2017 and will last longer than the 2006-2008 price increase due to:

(1) In 2006-2008, the trend of price increase of MLCC was interrupted by the financial crisis. From the subsequent price increase of 2009-2010 MLCC, if there is no impact of the financial crisis, the 2006-2008 price increase driven by the miniaturization and lightness of consumer electronics may last longer.

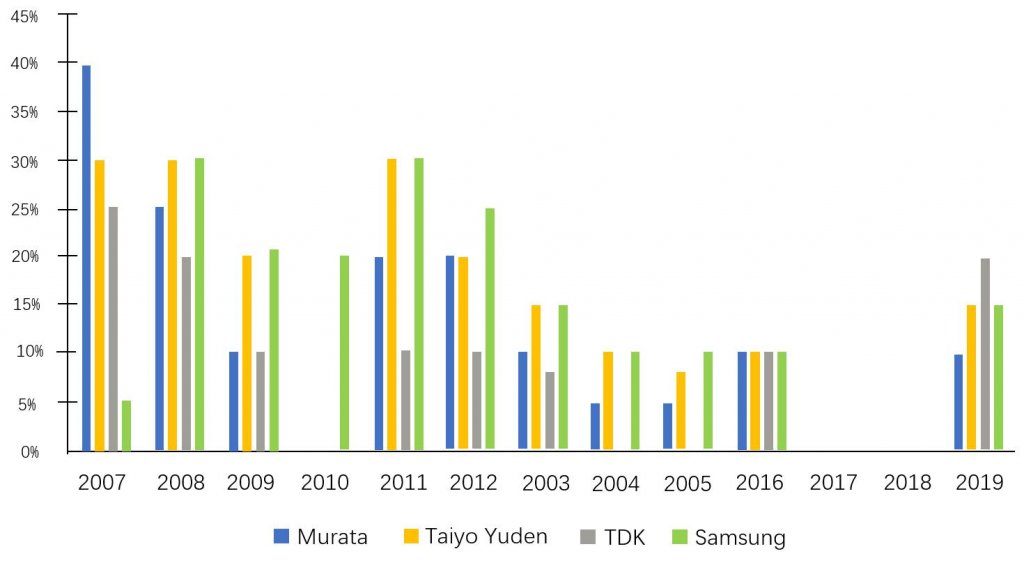

(2) In this price increase period, the expansion of production is more cautious than last time. In 2006-2008 and 2009-2010, MLCC's price hikes resulted in the substantial expansion of Murata, Samsung, Taiyo Yuden, and TDK. As a result, MLCC prices decline continuously, resulting in impaired profitability. The tide of price increase has already happened. Manufacturers have not announced large-scale expansion plans, this will delay the current cycle of price increase.

Figure 10: Japan & Korea MLCC maker 2007 – 2019 production expansion overview

All Comments (0)