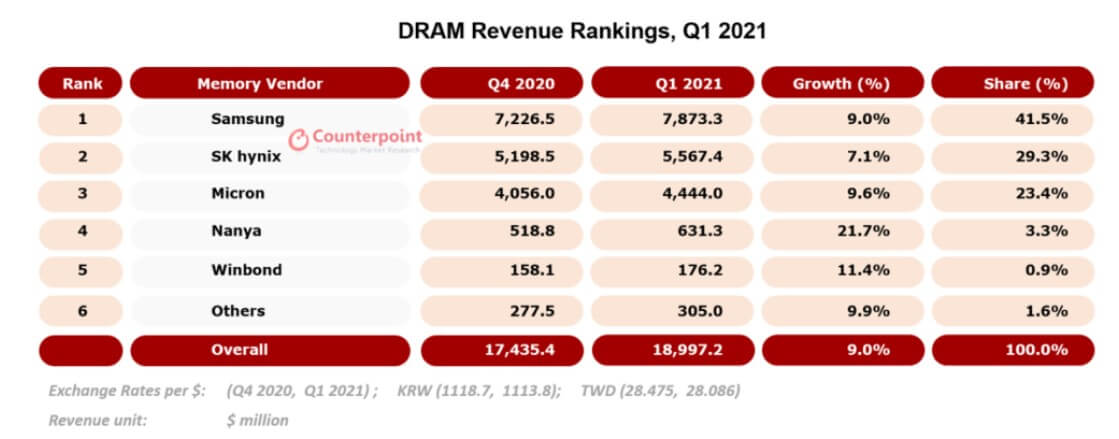

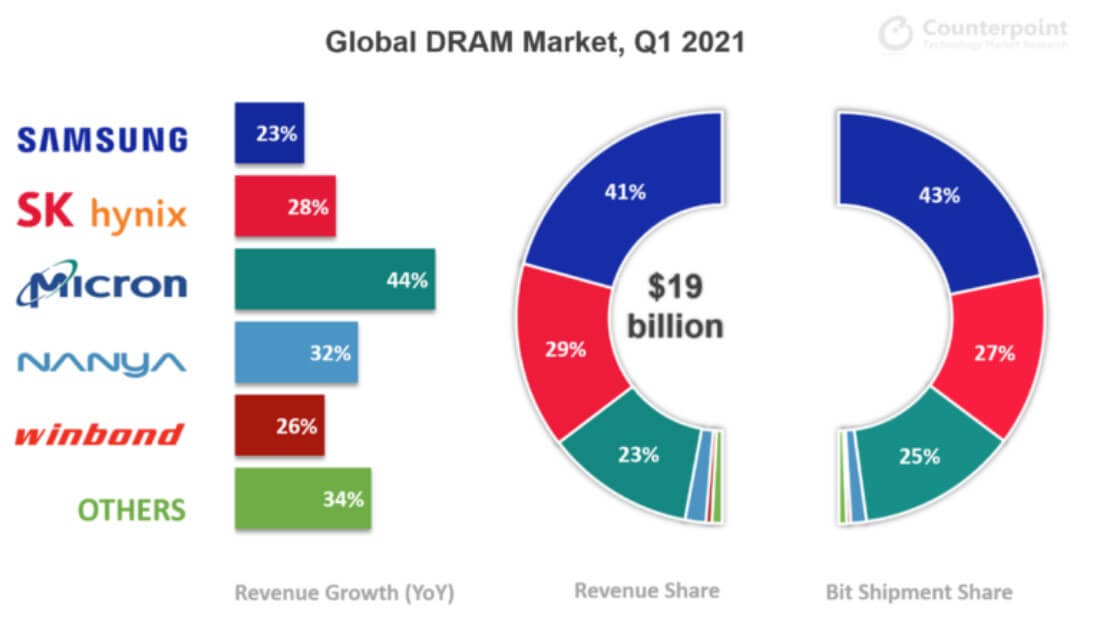

According to a recent report by Counterpoint Research, global DRAM revenues rose to $19 billion in Q1 2021, increasing by a solid 30% YoY and 9% QoQ. Distance education and work from home (WFH) continued propelling a substantial demand for smartphone and laptop DRAM, resulting in a 6% growth in bit shipment and a 3% rise in ASP over the previous quarter.

Brady Wang, associate director of Counterpoint, said that the Chinese handset makers stepped up their smartphone shipments in the first quarter, intending to gain shares from the beleaguered Huawei. In addition, the high-density LPDDR4x memory prices softened in H2 2020, increasing smartphone DRAM content and making 6GB the minimum standard for mid- to high-end smartphones since 2021. As a result, the average DRAM capacity in smartphones clocked at 5.3GB in Q1 2021, rising impressively by around 21% YoY and 7% QoQ. Similarly, servers experienced recovery in demand, and the adoption of a new data-center CPU bumped up server content per box. Therefore, the server segment’s DRAM demand rose as well.

According to Wang, DRAM is already an oligopolistic market with an Herfindahl-Hirschman Index (HHI) of 3,138. A significant capacity expansion by any player will soon turn around market status and reduce the overall profitability. Therefore, this year, all three major players will spend most of their resources in migrating to advanced nodes, a process that is bound to reduce production capacity. In addition, transportation and component shortage concerns will force device vendors to place orders earlier than usual. When coupled with the growing demand for personal computers, games and servers, these factors signal the possibility of the DRAM market turning to a shortage this year. The smartphone market is recovering at present, but its cost sensitivity means that a DRAM price spike may put the brakes on smartphone DRAM content growth.

Counterpoint issued the latest global market share of the DRAM industry showing that the DRAM industry is dominated by three major players: Samsung, Micron and Hynix, which together account for about 95% of the market's shipments and revenue.

All Comments (0)