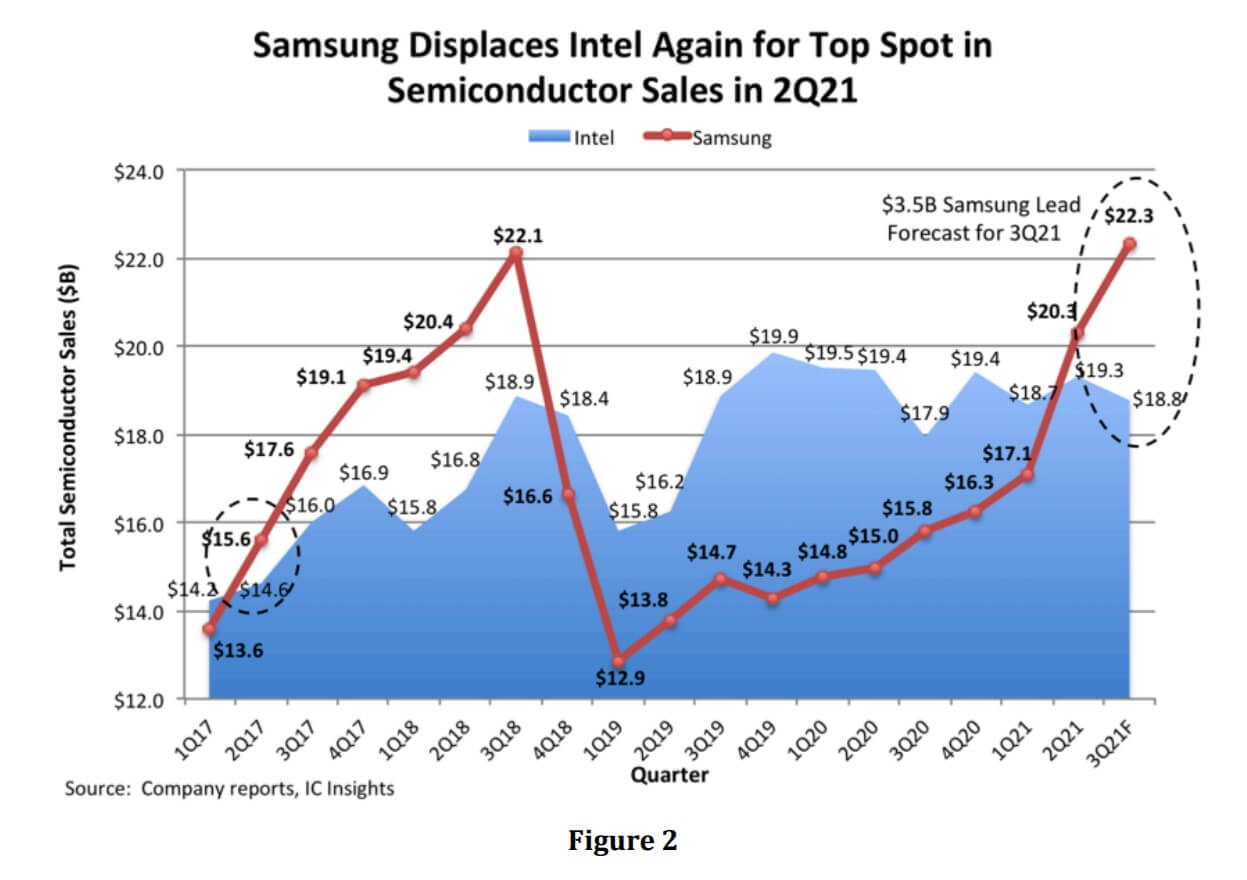

According to IC Insights' latest ranking of the top 10 global semiconductor sales leaders, Samsung Semiconductor has surpassed Intel to become the world's largest semiconductor manufacturer.

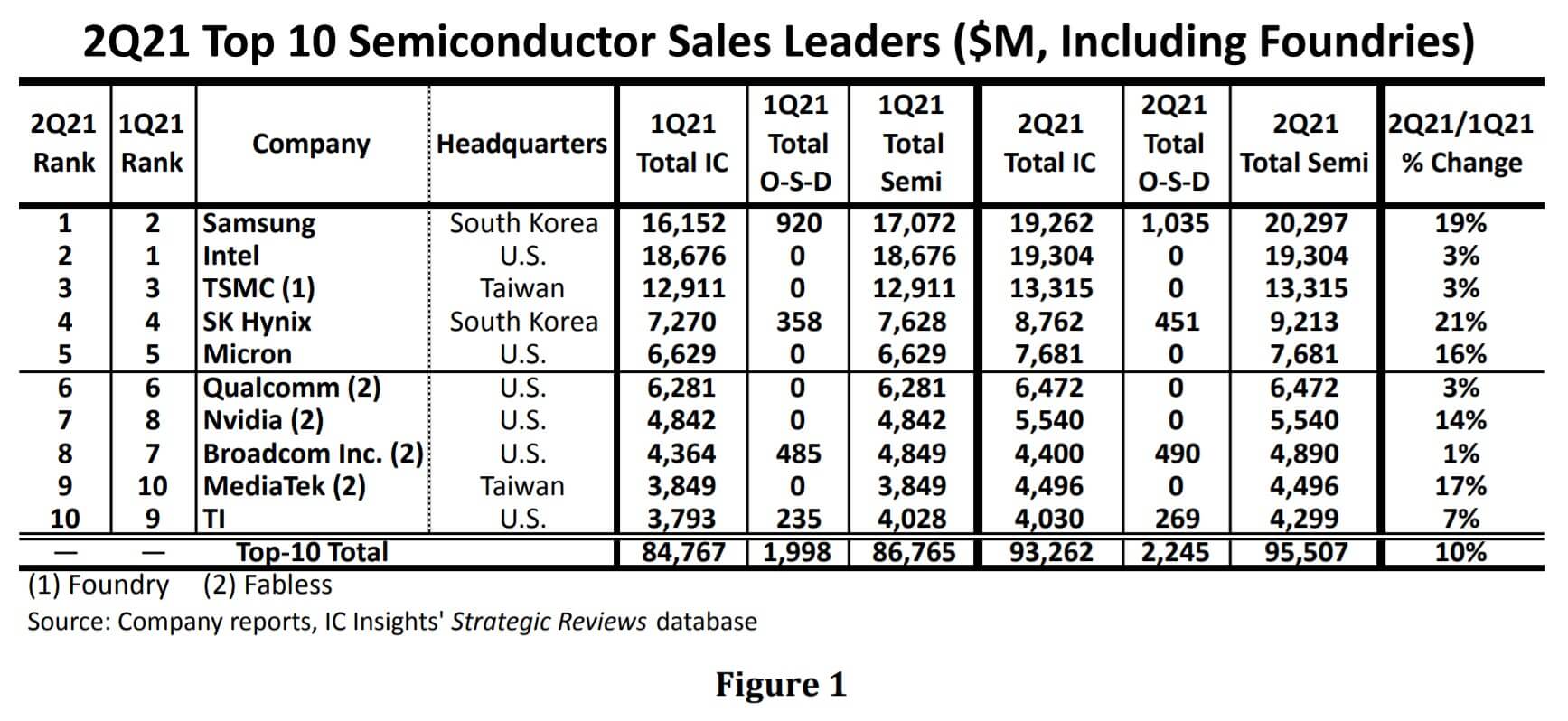

According to the report, it took $4.3 billion in semiconductor sales to be ranked as a top-10 semiconductor supplier in 2Q21. Collectively, these 10 suppliers saw their 2Q21 sales rise 10% to $95.5 billion, outpacing the 8% growth for the total semiconductor industry.

Driven by surging demand and rising prices for DRAM and flash memory, Samsung, the world’s largest memory supplier, saw its semiconductor sales increase 19% in 2Q21 to $20.3 billion, moving it past Intel and into first place to become the world’s largest semiconductor supplier for 2Q21 (Figure 2). Samsung was previously ranked as the top semiconductor supplier through much of 2017 and 2018 when the memory market experienced its last cyclical upturn. And, the company last enjoyed quarterly sales in excess of $20.0 billion in 2018 during the peak of the previous memory upturn. Demand for memory ICs is forecast to continue this quarter with Samsung’s semiconductor sales projected to rise another 10% to $22.3 billion in 3Q21, further widening its lead over Intel.

The IC Insights report shows that Nvidia and MediaTek also rose in the second quarter. Nvidia’s 14% second-quarter increase came on the strength of continued growth of the company’s important data center and gaming segments. Meanwhile, MediaTek’s sales increased 17% in 2Q21, continuing an impressive sales upturn driven by strong demand for 5G smartphones and consumer multimedia systems that first ramped up during the Covid-19 virus pandemic in 2020. Memory suppliers SK Hynix and Micron also enjoyed strong quarterly sales increases of 21% and 16%, respectively, though their positions in the top-10 remained unchanged.

IC Insights pointed out that Intel, TSMC and Qualcomm’s sales increased only 3% in the second quarter of 2021, while Broadcom’s sales increased only 1%. Intel’s semiconductor sales were $19.3 billion in 2Q21, far greater than most others but its 3% growth rate was far smaller than some of its key rivals. (AMD was ranked just outside the top 10 list with sales that increased 12% in 2Q21).

All Comments (0)