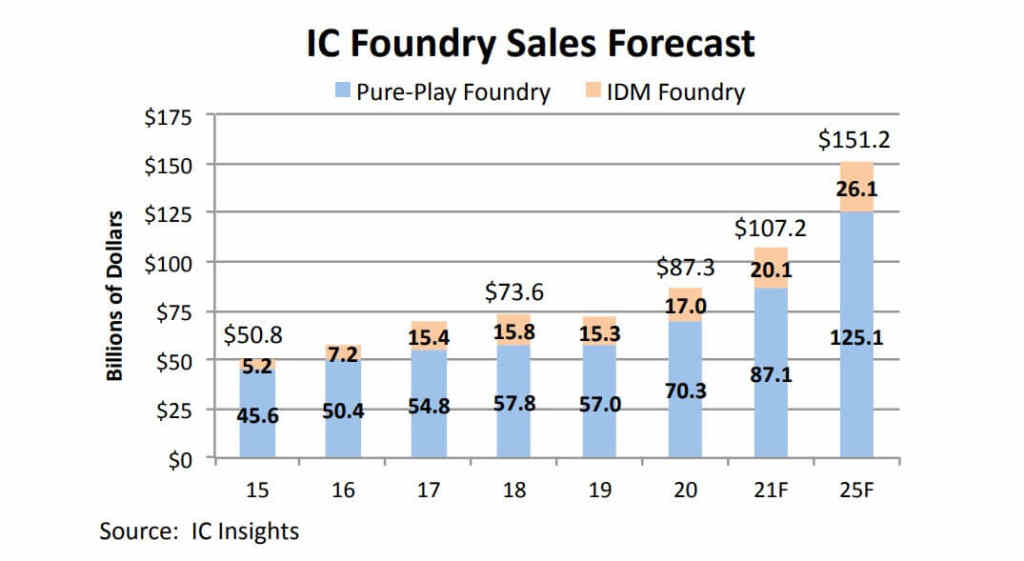

According to the latest report from IC Insights, robust demand for advanced processors used in networking and data center computers, new 5G smartphones, and ICs used in other high-growth market applications such as robotics, self-driving vehicles and driver-assist automation, artificial intelligence, machine-learning and image recognition systems, is forecast to lift total foundry sales to $107.2 billion in 2021, a 23% increase that would match the record growth rate set in 2017. It is worth noting that the strong growth rate in 2017 was primarily due to Samsung re-classifying its System LSI internal transfers as foundry sales, rather than strong organic market growth.

Total foundry sales this year are forecast to surpass the $100-billion mark for the first time and continue increasing at a strong 11.6% average annual growth rate through 2025 when total foundry sales are expected to reach $151.2 billion.

IC Insights pointed out that the pure-play foundry market is forecast to expand by a strong 24% this year to $87.1 billion, which would surpass the 23% growth witnessed in the pure-play foundry market just last year (2020). The pure-play foundry market is expected to grow to $125.1 billion in 2025, resulting in a 5-year (2020-2025) CAGR of 12.2%, accounting for 82.7% of total foundry sales in 2025, compared to 81.2% in 2021. TSMC, UMC, and several specialty foundries are expected to post healthy sales growth this year. These same suppliers are also investing heavily in new capacity to support anticipated demand for their services during the forecast period.

Samsung, whose external sales are primarily driven by customers like Qualcomm, accounts for most of the IDM foundry market. IC Insights anticipates the IDM foundry market will grow by a solid 18% this year to $20.1 billion. The IDM foundry market is forecast to increase to $26.1 billion in 2025, resulting in a 5-year CAGR of 9.0%.

All Comments (0)