According to Semiconductor Industry Association’s latest report, global chip sales from mainland Chinese companies are on the rise, largely due to increasing U.S.-China tensions and a whole-of-nation effort to advance mainland China’s chip sector, including government subsidies, procurement preferences, and other preferential policies.

SIA pointed out that just five years ago, mainland China’s semiconductor device sales were $13 billion, accounting for only 3.8% of global chip sales. In 2020, however, the Chinese semiconductor industry registered an unprecedented annual growth rate of 30.6% to reach $39.8 billion in total annual sales, according to an SIA analysis. The jump in growth helped mainland China capture 9% of the global semiconductor market in 2020, surpassing Taiwan region for two consecutive years and closely following Japan and the EU, which each took 10% of market share.

The report said that if mainland China’s semiconductor development continues its strong momentum – maintaining 30% CAGR over the next three years – and assuming growth rates of industries in other countries stay the same, the mainland Chinese semiconductor industry could generate $116 billion in annual revenue by 2024, capturing upwards of 17.4% of global market share. This would place mainland China behind only the United States and South Korea in global market share.

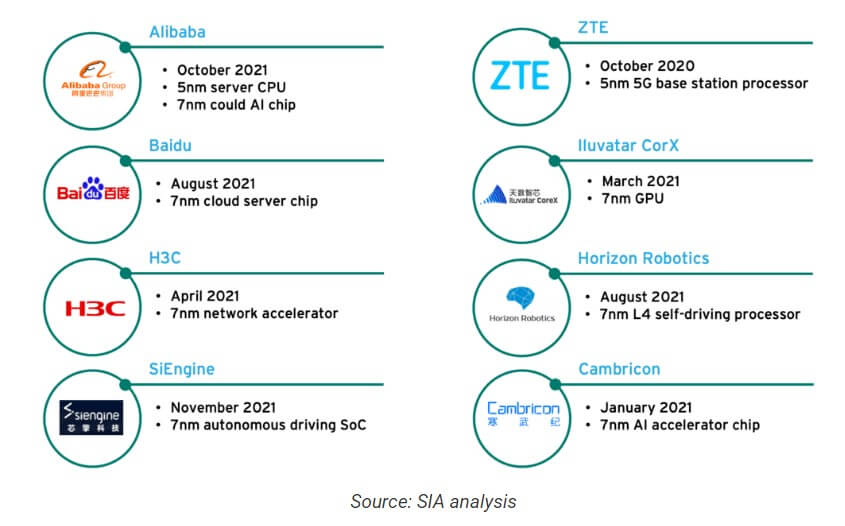

Equally startling is the number of new firms in mainland China rushing into the semiconductor industry. Nearly 15,000n mainland Chinese firms registered as semiconductor enterprises in 2020. A large number of these new firms are fabless start-ups specializing in GPU, EDA, FPGA, AI computing, and other higher-end chip design. Many of these firms are developing advanced chips, designing and taping out devices on bleeding-edge process nodes. Sales of mainland Chinese high-end logic devices are also accelerating, with the combined revenue of mainland China’s CPU, GPU, and FPGA sectors growing at an annual rate of 128% to nearly $1 billion in revenue in 2020, up from a meager $60 million in 2015.

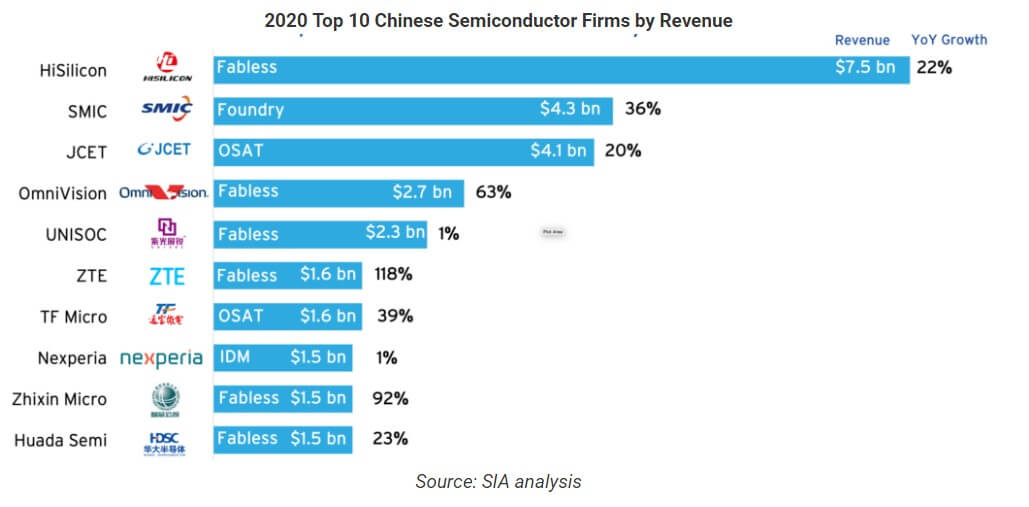

Across all four subsegments of the Chinese semiconductor supply chain – fabless, IDM, foundry, and OSAT – Chinese firms recorded rapid increases in revenue last year, representing annual growth rates of 36%, 23%, 32%, 23%, respectively, based on an SIA analysis. Leading Chinese semiconductor firms are on track to expand domestically, and even globally, in several submarkets.

All Comments (0)