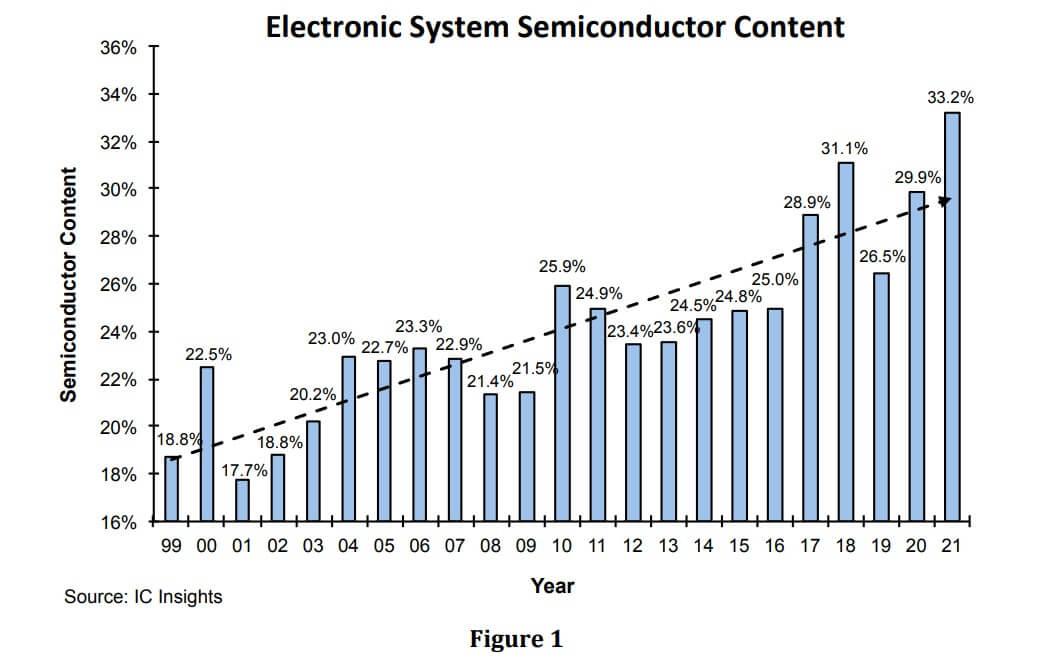

According to IC Insights’ latest report, the driving force behind the higher average annual growth rate of the semiconductor industry as compared to the electronic systems market is the increasing value or content of semiconductors used in electronic systems (Figure 1).

IC Insights stated in the report that with global unit shipment growth rates of cellphones, automobiles, and PCs showing maturity and slowing over the past 10 years, the disparity between the 3.5% 2011-2021 CAGR registered in the electronic systems market and 6.5% 2011-2021 CAGR displayed by the semiconductor market is directly due to the increasing content/value of semiconductors in electronic systems.

The report noted that the first year on record that showed an increase in semiconductor content in electronic systems during a year when the semiconductor market declined was 2009. This situation repeated itself once again in 2015. The total semiconductor market declined by 1% but the semiconductor content figure rose from 24.5% in 2014 to 24.8% in 2015. Until 2017, 2010 was the all-time high for semiconductor content in electronic systems at 25.9%. That mark was easily surpassed in 2017 with a 28.9% figure.

IC Insights' chart shows that the semiconductor content figure took another big jump in 2018 and set a new high at 31.1%. However, driven by a 25% increase in semiconductor sales last year, semiconductor content in electronic systems reached 33.2% in 2021, a new all-time high. Of course, the trend of increasingly higher semiconductor value in electronic systems has a limit. Extrapolating an annual increase in the percent semiconductor figure indefinitely would, at some point in the future, result in the semiconductor content of an electronic system reaching 100%. Whatever the ultimate ceiling is, once it is reached, the average annual growth for the semiconductor industry will closely track that of the electronic systems market (i.e., about 4% per year). In IC Insights’ opinion the “ceiling” is at least 40% but is not expected to be reached within the next five years.

All Comments (0)