Recently, IC Insights, the market analysis agency, announced the semiconductor market analysis report for the first quarter of 2018. The contents of this report will include: discussing the IC industry market situation in the first quarter of 2018, routinely predicting the capital expenditure of semiconductor companies in 2018, and ranking semiconductor suppliers in the first quarter of 2018.

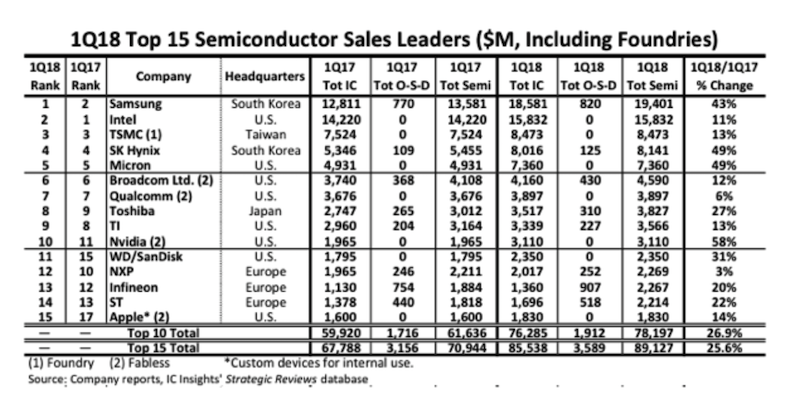

Table 1 lists the top fifteen companies in global semiconductor supplier sales in the first quarter of 2018 (data is divided into IC and optoelectronics, sensors, and discrete components). These include eight U.S.-based companies, three European companies, two South Korean companies, one company in Taiwan, and one Japanese company.

The report pointed out that after Broadcom announced in April this year that it would relocate its headquarters from Singapore to the United States, Broadcom was listed as a U.S. company in this report.

In addition, the top fifteen major semiconductor suppliers include a pure wafer foundry - TSMC, and four Fabless companies. If TSMC is excluded from the top fifteen rankings, Fabless MediaTek in Taiwan will be ranked 15th.

Overall, the top 15 suppliers listed in Table 1 provide a clearer guide for the industry to determine which companies are top-tier semiconductor suppliers, whether they are IDMs, Fabless or foundries.

Table 1

Overall, the sales of the top fifteen semiconductor companies increased by 26% year-on-year in the first quarter of 2018, while the global semiconductor industry grew by only 6% over the same period. The top fifteen largest semiconductor companies are up 20 percentage points higher than the global growth rate. What is even more surprising is that the three major memory providers Samsung, SK Hynix, and Micron have grown by more than 40% year-on-year.

In terms of sales, 14 of the top 15 semiconductor companies had sales of at least 2 billion U.S. dollars, and four companies surpassed the same period last year.

As the chart shows, semiconductor company's quarterly sales only need to reach 1.8 billion US dollars, it can be included in the world's top 15 semiconductor suppliers.

In the first quarter of 2017, Intel was still the No. 1 supplier of semiconductors, but from the second quarter of 2017 and in the 2017 ranking, Samsung surpassed Intel. In particular, with the rapid growth of the DRAM and NAND flash memory markets in the past year, Samsung’s sales in the first quarter of 2018 exceeded Intel’s 23%, and in the first quarter of 2017, Samsung was also behind Intel’s 5%. What is more interesting is that the proportion of storage in Samsung's business is increasing. In the first quarter of 2018, storage accounted for 83% of Samsung's semiconductor sales. This figure was 77% a year ago, an increase of 12% from two years ago.

In addition, Samsung’s sales of non-storage products in the first quarter of 2018 were only US$3.3 billion, an increase of only 6% from US$3.12 billion in the first quarter of 2017.

According to IC Insights estimates, taking into account possible or impending mergers and acquisitions this year, such as the acquisition of Qualcomm and NXP, as well as the possible market fluctuations in the future memory market, the next 15 years, the world's top 15 semiconductor suppliers may usher in dramatic changes and gradually mature.

All Comments (0)