Total microprocessor sales are expected to maintain double-digit growth in 2022, rising nearly 12% to a record $114.8 billion forecast, driven by higher average selling prices (ASPs), according to the latest report from IC Insights.

The report shows that total MPU sales are up 13% in 2021 and 16% in 2020, when the Covid-19 virus crisis disrupted the global economy but also boosted demand for microprocessors as more personal computers, smartphones and internet connections are needed amid the pandemic.

IC Insights noted that total MPU shipments rising just 3% this year, which will lift unit volume to an all-time high of nearly 2.5 million processors following increases of 6% in 2021 and 5% in 2020. MPU revenues in 2022 are expected to get a boost from an 8% increase in ASPs after average prices grew 7% last year and 10% in 2020, says IC Insights’ 2Q Update

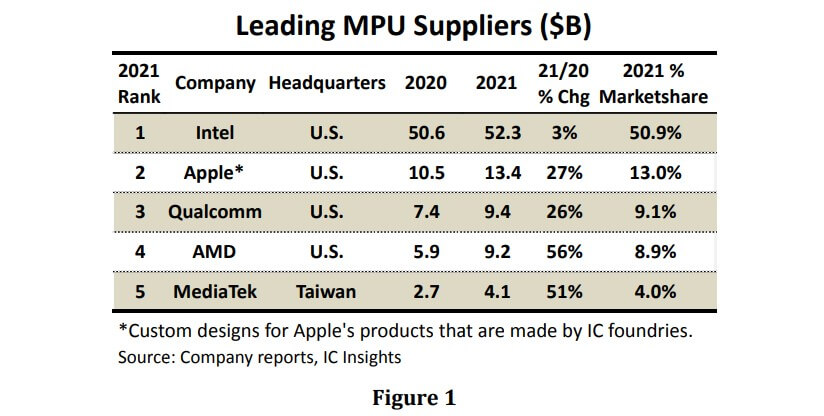

The figure below shows that the ranking of the top five microprocessor suppliers was unchanged in 2021 compared to 2020, with their combined revenue values of MPUs shipped last year rising 15% to $88.3 billion.

IC Insights note that the combined 2021 marketshare of the five largest microprocessor suppliers reached 86.0% of the world’s total $102.7 billion MPU sales last year compared to 85.0% in 2020 and 82.1% in 2016. The next five largest MPU suppliers Nvidia, Samsung, UNISOC, HiSilicon, and NXP, collectively held a 4.3% share of the 2021 total (or $4.4 billion) versus 5.0% in 2020.

It is important to note that IC Insights’ MPU ranking is based on sales of computer CPUs, embedded microprocessors, and cellphone application processors but excludes co-processors, such as AI/machinelearning accelerators and standalone graphics processing units (GPUs). Many application-specific systemon-chip (SoC) designs with integrated CPU cores are also not counted in the MPU ranking.

More information on the IC Insights report, please visit https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

All Comments (0)