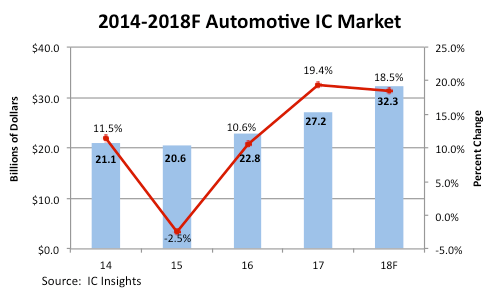

It is estimated that the automotive IC market will grow by 18.5% this year to reach a new high of US$32.3 billion, which exceeds last year’s US$27.2 billion. The data supporting this digit is the demand of consumers, the requirements of governments on automotive electronic security systems and the price of memory components rise.

In the past few years, the global automotive IC market has experienced some extraordinary growth. The automotive IC market decreased by 2.5% in 2015 after growing 11.5% in 2014, but then rebounded. In 2016, it achieved a stable growth of 10.6%. It is worth noting that the decline in sales in 2015 was mainly due to the drop in the prices of all key automotive IC products - microcontrollers, analog ICs, DRAM, flash memory, and general-purpose and special-purpose logic ICs. These products offset the stable growth of automotive ICs that year.

IC Insights' latest automotive IC market forecast shows that the automotive IC market will grow to US$43.6 billion in 2021 and its CAGR will be 12.5% from 2017 to 2021, which is the highest among the six major terminal applications

It is estimated that by 2018, the total flow of automotive IC will only account for about 7.5% of the entire integrated circuit market, but it is expected that this proportion will increase to 9.3% by 2021. Analog integrated circuits - including general-purpose analog and dedicated automotive simulation - are expected to account for 45% of the automotive IC market in 2018, and MCUs have a 23% share. There are many suppliers of automotive analog devices, but in recent years some of these acquisitions have reduced the number of large manufacturers. Some acquisitions that affect the automotive simulation market include NXP's acquisition of Freescale in 2015. NXP is now in the process of being acquired by Qualcomm; Analog Devices acquired Linear Technology in March 2017, and Renesas Acquisition of Intersil.

All Comments (0)