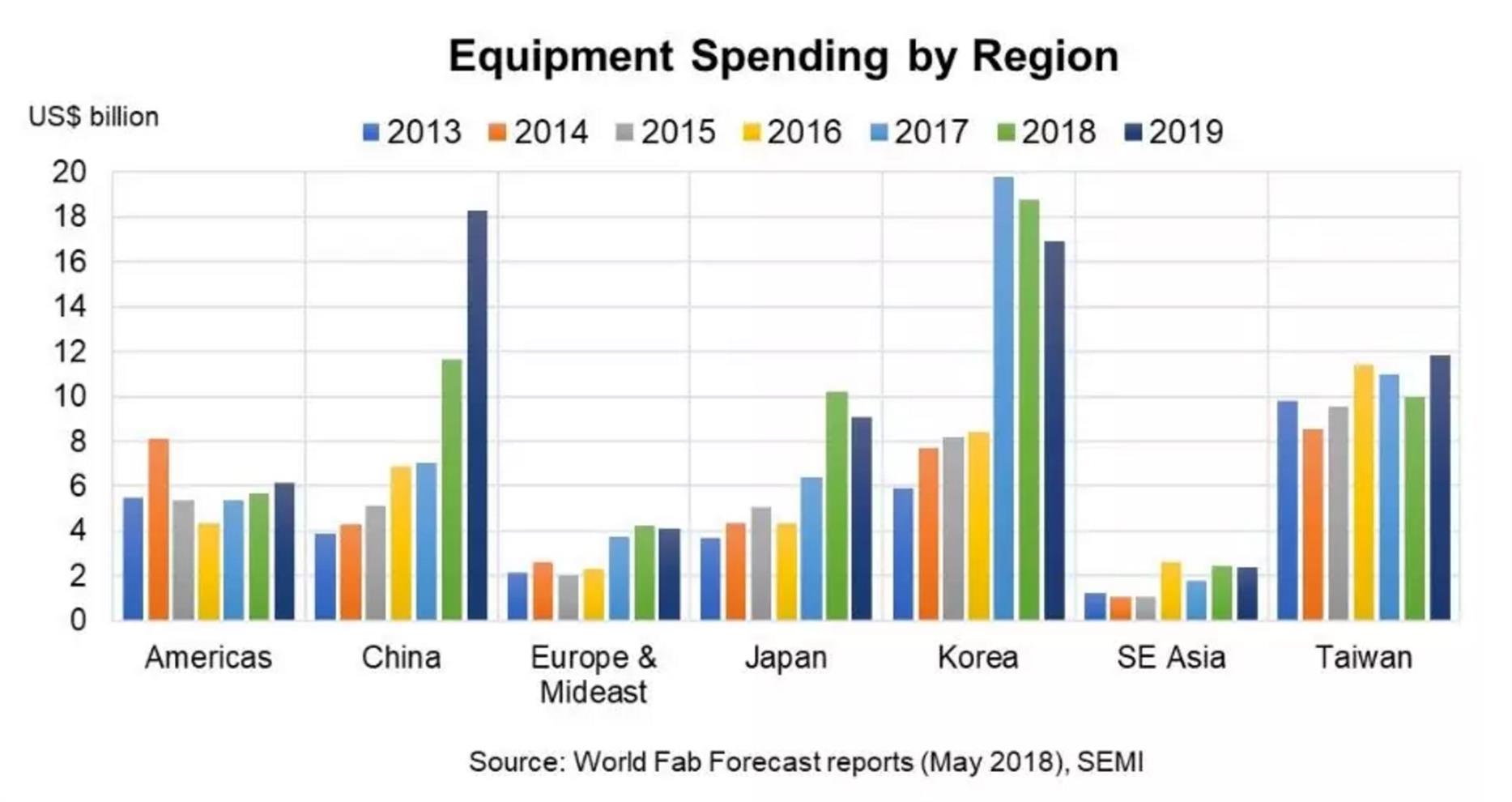

SEMI (International Semiconductor Industry Association) recently announced the latest content of the "World Fab Forecast" (World Fab Forecast) report that the semiconductor industry is set to hit a record high for equipment spending for three consecutive years, and is expected to be 2018 and 2019 respectively (year) grew by 14% and 9%, writing a historical record of four consecutive years of growth. Since the semiconductor industry was founded 71 years ago, equipment spending has only grown for four consecutive years in the mid-1990s.

As shown in the above chart, Samsung has dominated the global expenditure, and China has led the global growth, It shows that South Korea and China will lead the growth. Cao Shilun, President of SEMI Taiwan, stated that “In Taiwan, the amount of semiconductor equipment spending has not grown as fast as South Korea and China in the absence of an outbreak investment in new memory factories. However, Taiwan’s foundries have continued to invest in advanced processes and production capacity. In the future, overall spending will continue to show a steady growth trend. With Taiwan’s accumulated investment over the years, it has made us a global semiconductor advanced manufacturing and production center. We are still happy to see Taiwan’s future leadership position in the semiconductor industry.”

In 2018, Samsung’s equipment spending is expected to decrease, but the company still accounts for 70% of all equipment investment in South Korea. At the same time, SK Hynix is increasing its investment in equipment in South Korea.

China's equipment expenditure is expected to increase by 65% in 2018 and by 57% in 2019. However, it is noteworthy that 58% and 56% of China's investment in 2018 and 2019 were from foreign companies, such as Intel ( Intel, SK hynix, TSMC, Samsung and GLOBALFOUNDRIES. With the support of the government, Chinese domestic companies are building a large number of new fabs and will begin installing equipment in 2018. In 2019, the investment in equipment of these companies is expected to double.

The amount of investment in other regions also rose steadily. In 2018, the amount of investment in Japan increased by 60%, with the highest increases including Toshiba, Sony, Renesas, and Micron.

In 2018, the investment in Europe and the Mediterranean will increase by 12%. The largest contributors include Intel, GlobalFoundries and STMicroelectronics.

In 2018, the amount of investment in Southeast Asia will grow by more than 30%, but it is limited by the size of the market and the overall expenditure is also lower than other regions. The largest contributors include Micron, Infineon and Global, but companies such as OSRAM and Ams continue to increase their investment.

All Comments (0)