May 27, 2024 /SemiMedia/ -- According to the latest report released by Counterpoint, global foundry industry revenue in the first quarter of 2024 fell by 5% month-on-month, but increased by 12% year-on-year. Counterpoint said the revenue decline in the first quarter was not only affected by seasonal factors, but also by slowdown in demand for non-artificial intelligence (AI) semiconductors such as smartphones, consumer electronics, Internet of Things, automotive and industrial fields.

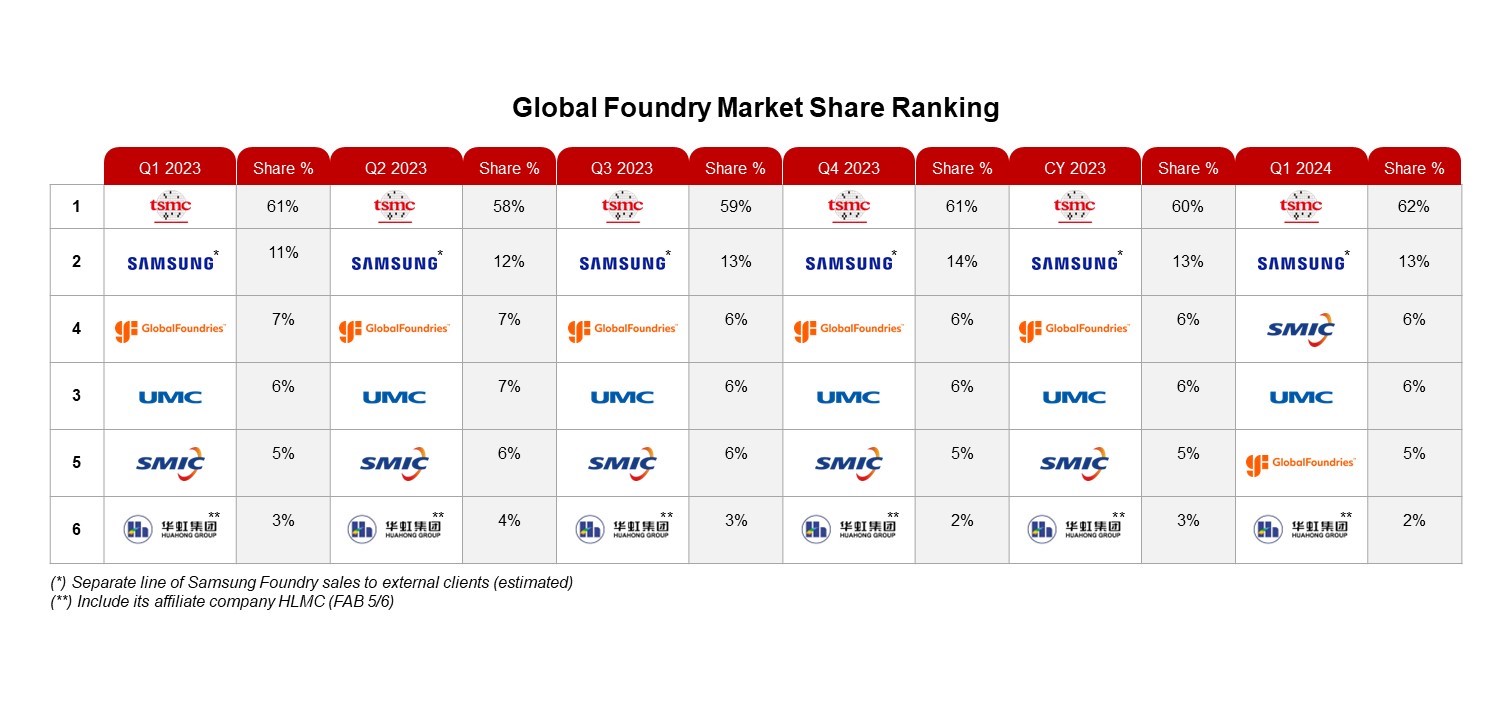

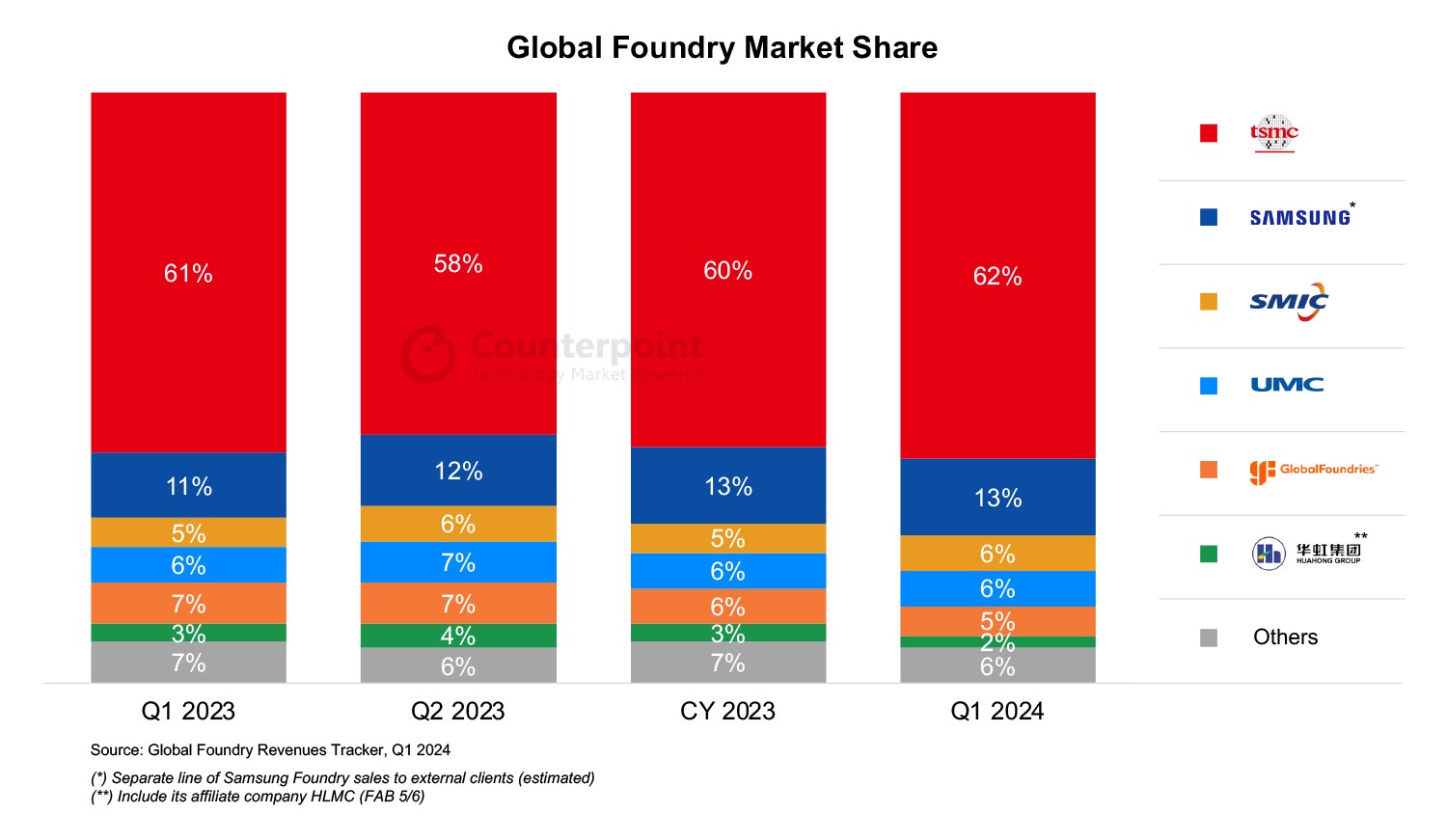

According to the report, among the world's top six foundry companies, TSMC's first-quarter performance still topped the list, with a share of 62%, exceeding expectations. TSMC also extended the duration of its AI-related revenue CAGR of 50% to 2028.

Samsung ranked second with a 13% share. Samsung expects foundry revenue to rebound by a double-digit percentage as demand improves in the second quarter.

SMIC surpassed GlobalFoundries and UMC to become the world's third largest wafer foundry in the first quarter, and its performance exceeded market expectations. The rise in the ranking is due to business growth and market recovery in CMOS image sensors, power management ICs, IoT chips and display driver ICs. SMIC expects continued growth in the second quarter as customers' demand for restocking expands.

UMC and GlobalFoundries ranked fourth and fifth respectively. Both said that demand for consumer electronics and smartphones had bottomed out, but demand for automotive semiconductors was mixed. UMC expects auto demand to slow in the short term, and GlobalFoundries expects second-quarter revenue to trend upward.

Counterpoint said that entering the first quarter of 2024, the semiconductor industry is showing signs of demand recovery, although progress is slow. After several consecutive quarters of destocking, inventory levels have normalized.

Counterpoint believes that strong demand for AI and recovery in demand for end products will become the main growth drivers for the foundry industry in 2024.

All Comments (0)