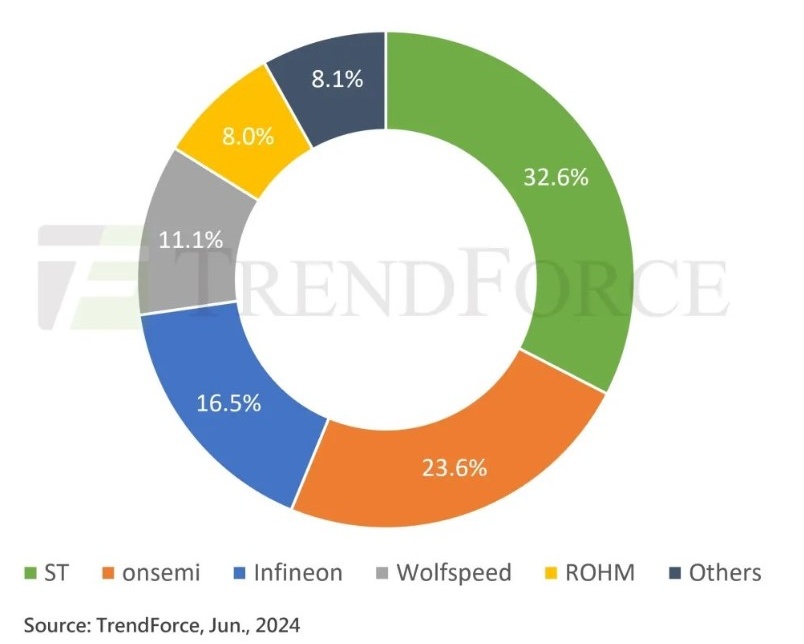

June 25, 2024 /SemiMedia/ -- According to the latest report from TrendForce, the global SiC power device industry maintained strong growth in 2023, driven by pure electric vehicle applications. The top five SiC power component suppliers account for approximately 91.9% of the total revenue, among which STMicroelectronics leads other competitors with a market share of 32.6%, and onsemi rises from fourth place in 2022 to second place with a market share of 23.6%.

The report shows that demand from fields such as AI servers will increase significantly in 2024. However, the significant slowdown in pure electric vehicle sales growth and weakening industrial demand are affecting the SiC supply chain. It is expected that the annual growth rate of global SiC power component industry revenue in 2024 will converge significantly compared with the past few years.

As a key supplier of automotive SiC MOSFETs, ST is building a full-process SiC factory in Catania, Italy, which is expected to be put into production in 2026. In addition, the 8-inch SiC joint venture factory established by ST and Sanan Optoelectronics in China is expected to be put into operation as early as the end of this year. By then, ST can combine the local back-end packaging and testing production line and the supporting substrate material factory provided by Sanan Optoelectronics to achieve vertical integration benefits.

onsemi's SiC wafer fab in Bucheon, South Korea, completed its expansion in 2023 and plans to switch to 8-inch wafers after completing relevant technical verification in 2025. Currently, ON Semiconductor's SiC substrate material self-sufficiency rate has exceeded 50%. With the increase in internal material production capacity, the company is moving towards the goal of a gross profit margin of 50%.

Infineon Technologies ranked third with a market share of 16.5%. Nearly half of its SiC revenue comes from the industrial market. Compared with ST and onsemi, Infineon lacks the internal production capacity of SiC crystal materials, so it actively promotes a diversified supplier system to ensure a stable supply chain.

As the world's largest supplier of SiC materials, Wolfspeed ranks fourth in revenue, accounting for 11.1%. As the company's The JP factory in North Carolina, USA, is about to go into operation, it is expected to significantly increase material production capacity and promote the start-up of the Mohawk Valley Factory (MVF).

ROHM Semiconductor ranks fifth in terms of revenue share. The company recently acquired Solar Frontier's Kunitomi-cho factory as its fourth SiC factory, and plans to start producing 8-inch SiC substrates this year, and will subsequently invest in the manufacture of power components.

TrendForce believes that, overall, SiC is in a fast-growing and highly competitive market, where economies of scale are more important than any other factor. So far, more than 10 manufacturers around the world are investing in building 8-inch SiC wafer fabs. It is foreseeable that as the market scale continues to expand in the future, competition in the SiC field will become more intense.

All Comments (0)