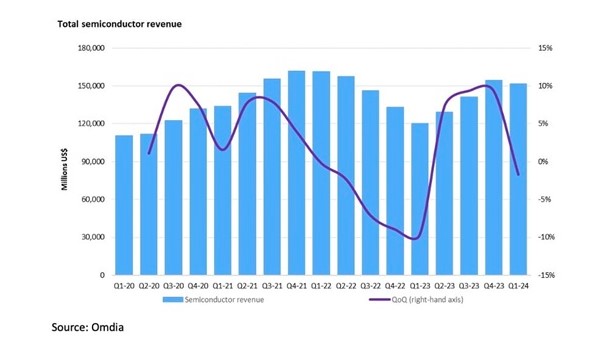

June 26, 2024 /SemiMedia/ -- According to Omdia, global semiconductor market revenue in the first quarter of 2024 fell by about 2% month-on-month to US$151.5 billion, a year-on-year increase of 25.7% from US$120.5 billion in the same period last year.

Omdia pointed out that most sub-categories of the semiconductor market declined last quarter due to weak overall demand. Among them, the consumer segment revenue fell 10.4% from the fourth quarter of 2023, while the industrial segment fell 8.5% due to inventory adjustments. Even the automotive market experienced negative growth in the first quarter of 2024, down 5.1%.

However, declines in those categories were offset by quarterly gains in data-processing chips, which grew 3.7%, driven by continued high demand for Nvidia chips and other AI-related products.

Omdia pointed out that starting from the third quarter of 2020, after experiencing 13 consecutive quarters of revenue growth, the automotive semiconductor market saw a slight quarter-on-quarter decline of 0.6% in the fourth quarter of last year, and the decline widened further in the first quarter of this year, falling sharply by 5.1% from the previous quarter. However, despite these challenges, the automotive semiconductor market remains a promising long-term growth field, expected to continue climbing over the next five years.

From the perspective of semiconductor manufacturing and pure-play foundries, the report shows that semiconductor demand peaked in early 2022, but utilization fell sharply in the second half of 2022 due to sharply weakened demand and record inventory levels. Although semiconductor revenue has been growing throughout 2023, fab utilization remains at a low of 80%.

Omdia said utilization rates start to rise slightly in the second half of 2023 as the market begins to seek balance. Demand will continue to improve in the second half of 2024, which will lead to inventory adjustments, pushing up production line utilization again.

All Comments (0)