July 12, 2024 /SemiMedia/ -- According to the latest report released by SEMI, the global total sales of semiconductor manufacturing equipment are expected to reach a record high of US$109 billion in 2024, a year-on-year increase of 3.4%. In addition, driven by the front-end and back-end market segments, the sales of semiconductor manufacturing equipment in 2025 are expected to achieve a strong growth of about 17%, setting a new high of US$128 billion.

“The global semiconductor industry is demonstrating its strong fundamentals and growth potential to support a variety of disruptive applications emerging from the wave of artificial intelligence (AI),” said Ajit Manocha, president and CEO of SEMI.

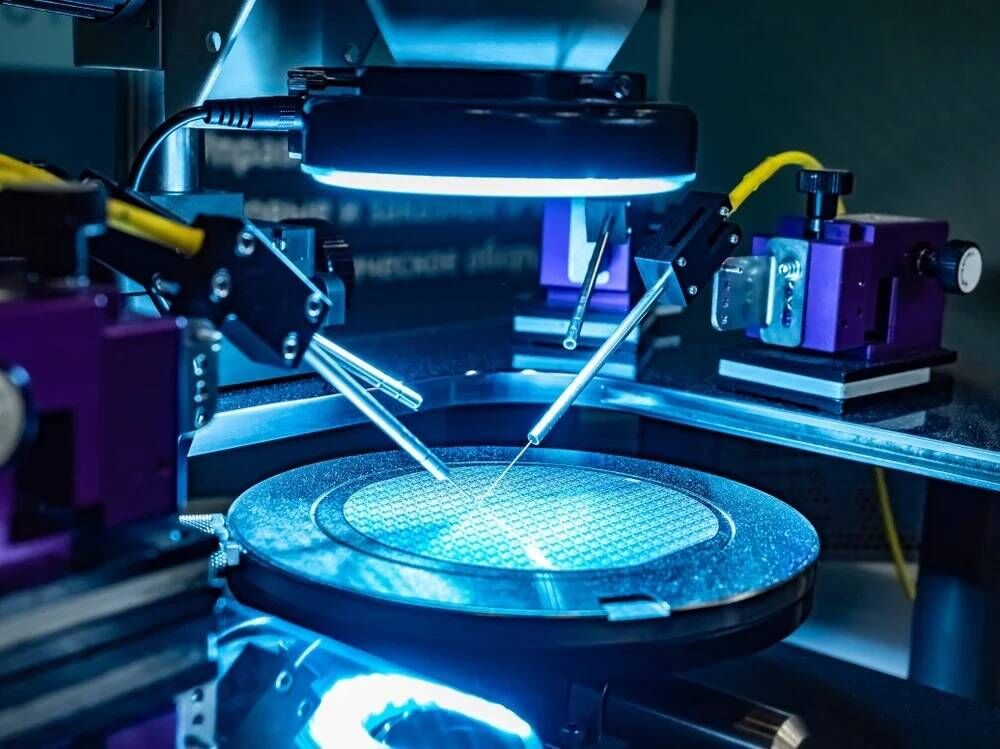

After generating $96 billion in sales in 2023, sales in the fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, are expected to grow 2.8% to $98 billion in 2024. Continued strong equipment spending in mainland China, driven by AI computing, and large investments in DRAM and high-bandwidth memory (HBM) have driven the upward forecast.

Looking ahead to 2025, sales in the fab equipment segment are expected to grow 14.7% to $113 billion, driven by increased demand for advanced logic and memory applications.

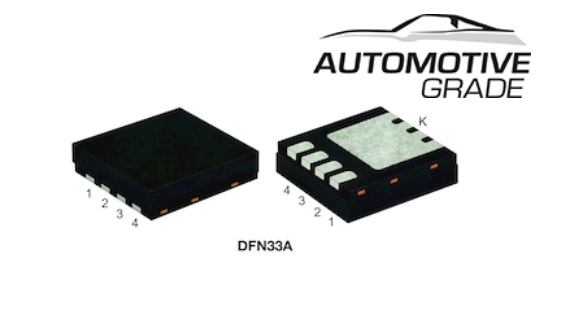

The report said that after two years of contraction caused by macroeconomic conditions and weak semiconductor demand, the back-end equipment sector is expected to begin to recover in the second half of 2024. Specifically, sales of semiconductor test equipment are expected to grow 7.4% to $6.7 billion in 2024, while packaging equipment sales are forecast to grow 10.0% to $4.4 billion in the same year. In addition, growth in the back-end market segments is expected to accelerate in 2025, with test equipment sales surging 30.3% and packaging equipment sales surging 34.9%.

The increasing complexity of semiconductor devices for high-performance computing (HPC) and the expected recovery in demand in the automotive, industrial and consumer electronics end markets support the growth of these market segments. In addition, back-end growth is expected to increase over time to meet the increasing supply of new front-end wafer fabs.

All Comments (0)