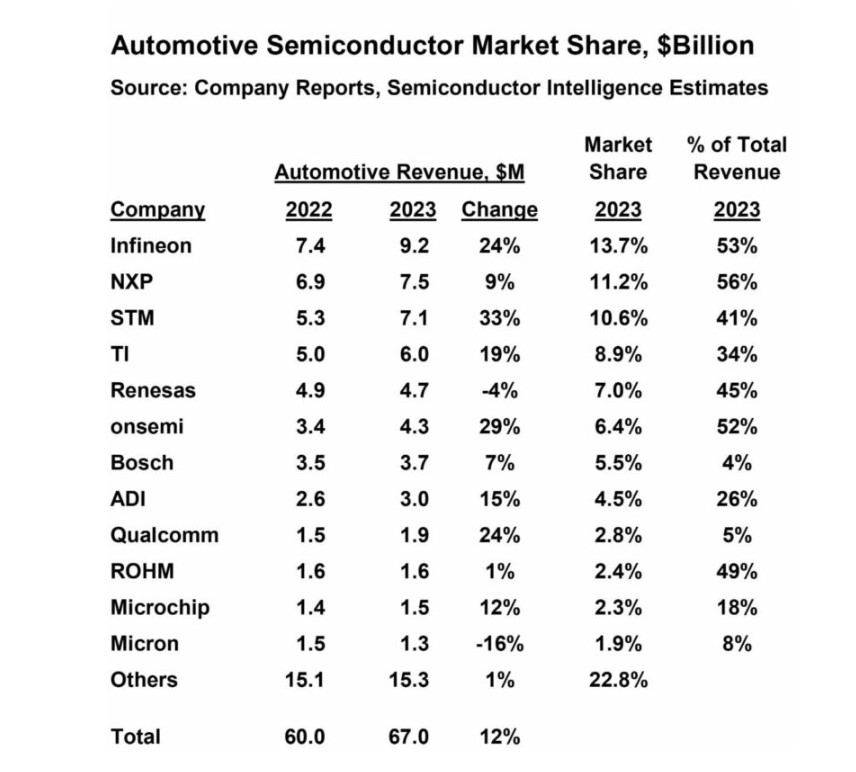

July 15, 2024 /SemiMedia/ -- According to a report released by Semiconductor Intelligence, the automotive semiconductor market size in 2023 was $67 billion, an increase of 12% over 2022, and the top twelve suppliers accounted for more than three-quarters of the market share.

According to the ranking released by Semiconductor Intelligence, Infineon is the largest automotive semiconductor supplier with a scale of $9.2 billion and a market share of 13.7%; NXP Semiconductors ranks second with a market share of 11.2%; STMicroelectronics ranks third with a market share of 10.6%. These three companies account for more than one-third of the market share. For most companies, the automotive business is an important part of their total revenue. Among the top six companies, the revenue share of the automotive business ranges from 34% to 56%.

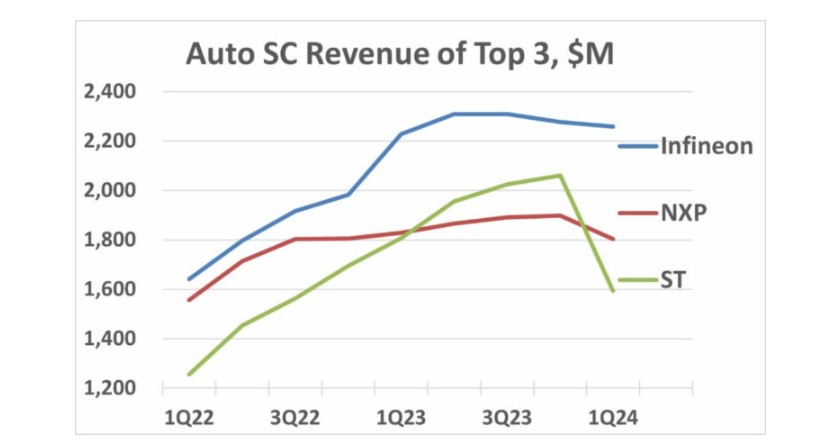

The report pointed out that as the automotive semiconductor industry recovered from epidemic-related shortages, the industry has shown strong growth since 2021. However, there are signs of a slowdown in the market. The quarterly automotive semiconductor revenues of the top three suppliers reflect this trend.

Infineon reported strong growth in automotive semiconductor revenue in 2022 and early 2023, but it peaked in the second quarter of 2023 and has been declining since then. However, Infineon's outlook for automotive revenue in the second quarter of 2024 is a 5% quarter-over-quarter increase.

NXP achieved quarterly revenue growth in the fourth quarter of 2023, but reported a 5% revenue decline in the first quarter of 2024. NXP's first quarter of 2024 report pointed to continued inventory reductions in the first half of 2024 and overall automotive market weakness.

ST had strong quarterly revenue growth in 2022 and 2023, averaging 7%. This growth trend ended in the first quarter of 2024, when ST reported a 23% decline in automotive revenue and said it entered a deceleration phase.

All Comments (0)