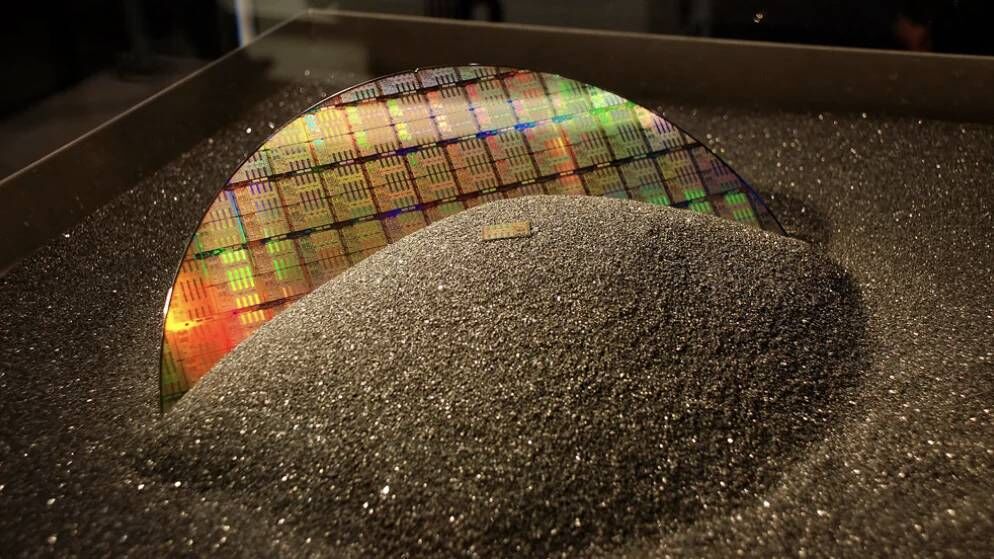

August 15, 2024 /SemiMedia/ -- According to recent reports, Shin-Etsu Chemical and SUMCO, two leading players in the global silicon wafer market, experienced a year-on-year decline in demand during the second quarter of 2024. This trend highlights a slow recovery in the market, despite some positive signs.

Shin-Etsu Chemical reported a decrease in wafer demand in Q2 2024 compared to the same period in 2023. However, there was an improvement compared to Q1 2024, indicating that the market may be entering a recovery phase. Driven by increasing demand for artificial intelligence (AI) technologies, Shin-Etsu Chemical expects a gradual rise in shipments of 12-inch silicon wafers in Q3. In contrast, demand for 8-inch wafers is expected to remain sluggish.

On the other hand, data released by SUMCO reflects a similar downturn. The company saw a 10.1% year-on-year decline in revenue for the first half of 2024, with operating profit plummeting by 55.5%. SUMCO also forecasts a 7.1% year-on-year decline in revenue for the first nine months of 2024.

Despite these challenges, SUMCO believes that demand for 12-inch wafers used in logic ICs and memory has started to rebound from the Q1 bottom, although demand for 8-inch wafers remains weak. SUMCO estimates that, in Q3, inventory levels for 12-inch wafers in advanced process chip customers are low. However, it may take time for inventory levels of mature process chips to return to normal.

The report also notes that while inventory destocking for industrial and automotive chips is expected to continue, strong AI demand is driving a recovery in wafer shipments related to data centers. Additionally, the PC and smartphone markets are showing signs of recovery, contributing to a gradual increase in overall shipment volumes. SUMCO estimates that each AI server requires approximately two 12-inch silicon wafers (excluding memory), with the wafer area required by AI servers being 3.8 times that of a general server.

Overall, while the silicon wafer market is showing some signs of recovery in certain segments, the overall recovery process remains slow. The insights provided by Shin-Etsu Chemical and SUMCO offer valuable perspectives on the future trajectory of the market, particularly as AI technology continues to evolve rapidly.

All Comments (0)