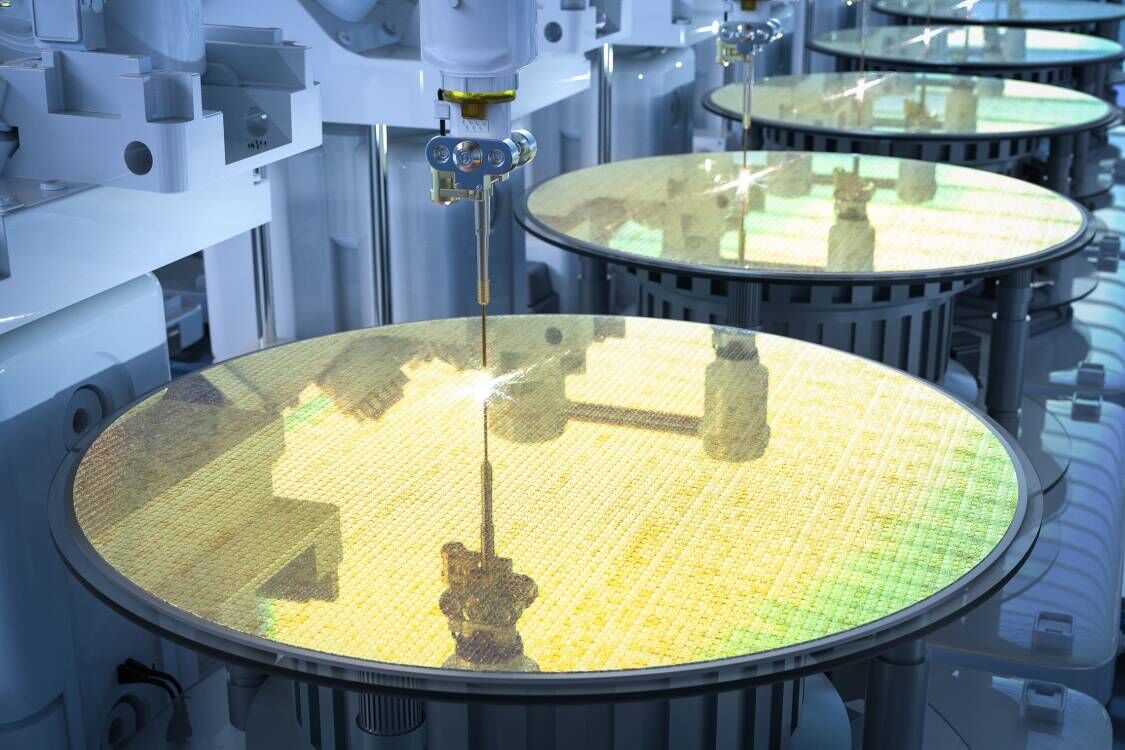

August 26, 2024 /SemiMedia/ — According to the latest report from Counterpoint Research, the global wafer foundry market saw a revenue increase of approximately 9% quarter-over-quarter and 23% year-over-year in Q2 2024, driven largely by robust AI demand. TSMC, Samsung, and SMIC lead the market.

The report highlights that while the recovery in demand for non-AI semiconductors (such as those for automotive and industrial applications) has been slow, certain areas, including IoT and consumer electronics, have experienced urgent orders. Notably, China’s wafer foundry market is rebounding faster than its global counterparts, with firms like SMIC and Hua Hong reporting strong quarterly performance, thanks to early inventory adjustments by China’s fabless customers.

TSMC led with a 62% market share in Q2 2024, up 4 percentage points year-over-year. The company’s quarterly revenue slightly exceeded expectations, fueled by sustained strong demand for AI accelerators. TSMC has revised its annual revenue growth forecast from the lower range of 20% to the mid-20% range and anticipates that supply and demand for AI accelerators will remain tight through late 2025 or early 2026. The company plans to at least double its CoWoS capacity by 2025 to meet robust AI demand.

Samsung held a 13% market share in Q2, up 1 percentage point from the previous year. The report attributes Samsung’s revenue growth to inventory pre-building and restocking for smartphones. Samsung continues to focus on acquiring more mobile and AI/HPC customers for advanced nodes and expects its annual revenue growth to surpass the industry average.

SMIC maintained a 6% market share in Q2, consistent with both year-over-year and quarter-over-quarter figures, securing its position as the third-largest foundry globally for the second consecutive quarter. The report notes SMIC’s strong quarterly performance and positive guidance for Q3, driven by ongoing recovery in China’s demand across applications such as CIS, PMIC, IoT, TDDI, and LDDIC. SMIC's 12-inch wafer demand is improving, with an expected rise in average selling prices, and the company remains cautiously optimistic about its annual revenue growth.

Counterpoint Research analyst Adam Chang commented, “In Q2 2024, the global foundry industry demonstrated resilience, with most growth driven by strong AI demand and smartphone inventory restocking. While cutting-edge applications like AI semiconductors are experiencing robust growth, the recovery of traditional semiconductors is slower. Chinese foundries are rebounding faster due to early inventory adjustments and increased restocking by local fabless customers, whereas non-Chinese foundries are seeing a slower recovery.”

All Comments (0)