September 26, 2024 /SemiMedia/ — Chinese storage module manufacturers accelerated efforts to clear excess inventory in the second quarter of 2024, with a wave of low-priced sell-offs driving a significant drop in solid-state drive (SSD) prices. Weak consumer demand and tighter government scrutiny are the main factors behind the market disruption.

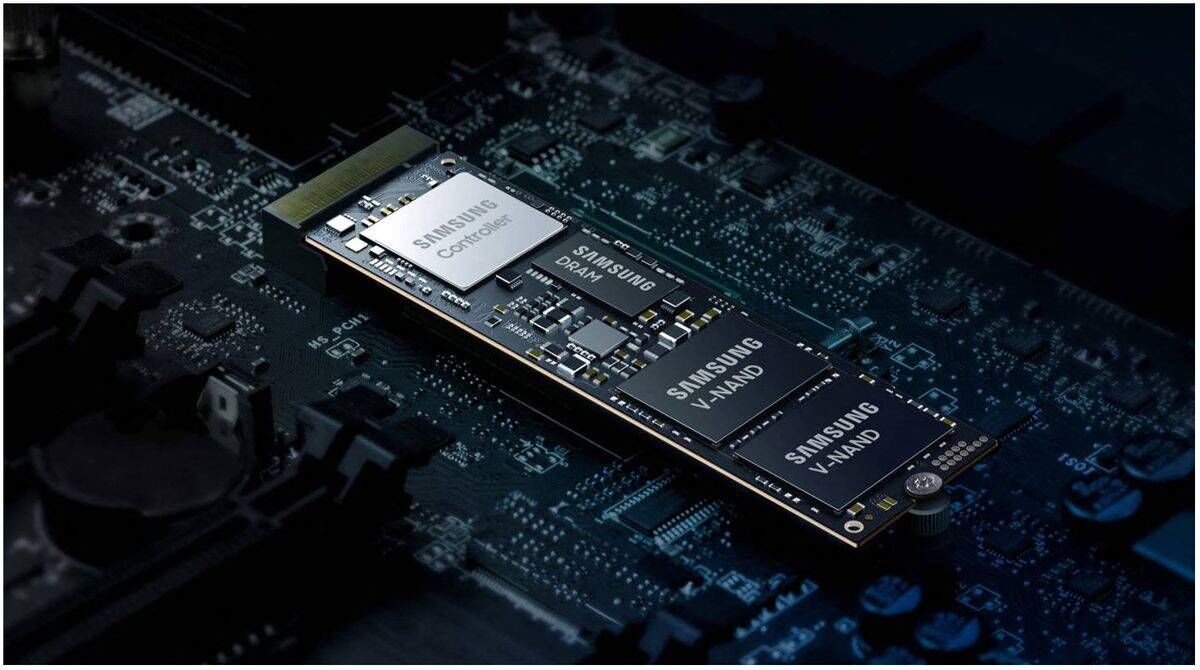

While NAND wafer prices remain high, SSD prices in the spot market have fallen back to early 2023 levels. Analysts expect market turbulence in China to continue through the end of the year, with some specialty products potentially facing temporary shortages.

The sell-off stems from an inventory surplus built up by suppliers earlier in the year. Many had anticipated a recovery in the second half of 2024, but with terminal market demand still sluggish in September, the downward pressure on prices has intensified. In response, some companies have resorted to offloading their remaining stock.

The weak demand extends beyond China. Overseas markets such as Europe, Southeast Asia, and South America are also underperforming expectations, adding further strain to the SSD sector. Industry sources said that although companies had braced for a slow season, the scale of the decline has been much larger than anticipated.

According to data from market research firm Omdia, prices for triple-level cell (TLC) 256Gb NAND flash are expected to drop 2.6% in the third quarter, from $1.54 to $1.50 per unit. The ongoing softness in demand for key consumer products, including smartphones and PCs, has hindered any price recovery.

However, the enterprise SSD market is showing a different trend. Omdia projects that prices for quad-level cell (QLC) 256Gb NAND will rise to $1.36 by the fourth quarter, up from $1.23 in the second quarter. This divergence between falling consumer SSD prices and rising prices for server-focused products highlights the current complexity in the storage market.

In the near term, SSD prices are expected to remain under pressure as Chinese module makers continue to offload inventory, leaving little room for a quick rebound.

All Comments (0)