October 3, 2024 /SemiMedia/ — The global semiconductor industry is expected to invest a record $400 billion in 300mm fab equipment between 2025 and 2027, according to SEMI’s latest 300mm Fab Outlook Report. This surge in spending is largely driven by the increasing demand for artificial intelligence (AI) chips used in data centers and edge devices, as well as the regionalization of semiconductor fabs.

Growth in spending projections

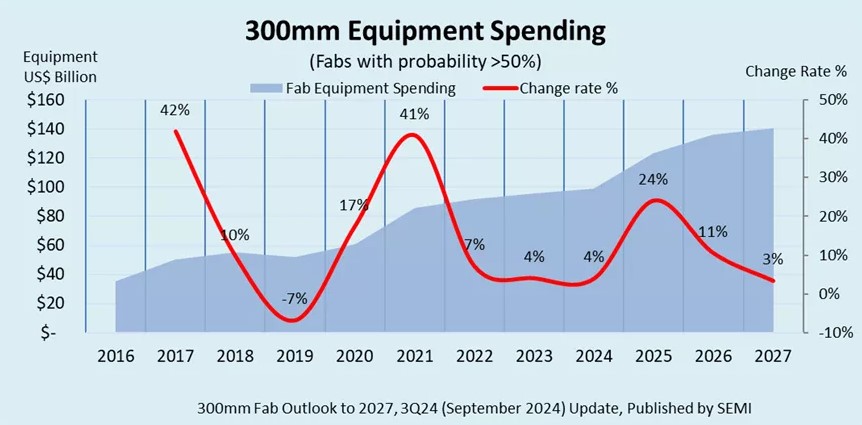

Worldwide, 300mm fab equipment spending is projected to grow by 4% to $99.3 billion in 2024 and rise further by 24% to $123.2 billion in 2025, marking the first time spending will surpass the $100 billion threshold. The trend is expected to continue with 11% growth in 2026, reaching $136.2 billion, followed by a 3% increase to $140.8 billion in 2027.

“The magnitude of the expected ramp of global 300mm fab equipment spending in 2025 sets the stage for a record-setting three-year period of semiconductor manufacturing investments,” said Ajit Manocha, SEMI President and CEO. “The world’s ubiquitous need for chips is boosting spending on equipment for both leading-edge technologies addressing AI applications and mature technologies driven by automotive and IoT applications.”

Regional investments

China is forecast to remain the top spender on 300mm equipment, with an estimated $100 billion in investments over the next three years. However, its spending is expected to gradually decline from a peak of $45 billion in 2024 to $31 billion by 2027, driven by its national self-sufficiency policies. Korea is projected to follow with $81 billion in spending, primarily focused on memory technologies like DRAM, high-bandwidth memory (HBM), and 3D NAND Flash.

Taiwan is expected to invest $75 billion in 300mm equipment, ranking third, with its focus on leading-edge logic processes below 3nm. The Americas is projected to invest $63 billion, while Japan, Europe & the Mideast, and Southeast Asia are expected to invest $32 billion, $27 billion, and $13 billion, respectively, over the same period. Policy incentives to mitigate supply chain concerns are expected to drive equipment investment growth in these regions, more than doubling by 2027 compared to 2024 levels.

Segment-specific growth

The Logic and Micro segment is expected to lead the spending surge, with a projected investment of $173 billion from 2025 to 2027. Memory is expected to follow, with $120 billion in spending during the same period, including over $75 billion for DRAM-related equipment and $45 billion for 3D NAND.

Foundry equipment spending is forecast to reach $230 billion between 2025 and 2027, fueled by investments in sub-3nm cutting-edge nodes and ongoing spending on mature nodes. Critical investments in 2nm logic processes, including gate-all-around (GAA) transistor structure and back-side power delivery technology, will be essential for future AI applications.

The power-related segment is expected to see over $30 billion in investments, including $14 billion for compound semiconductor projects. Analog and Mixed-signal spending is projected to hit $23 billion, followed by Opto/Sensors at $12.8 billion.

This strong global investment in semiconductor manufacturing equipment is expected to shape the industry’s growth over the next several years, responding to the evolving demands of AI, automotive, and IoT technologies.

For more information on the report, please visit https://www.semi.org/en/products-services/market-data/300mm-fab-outlook.

All Comments (0)