October 15, 2024 /SemiMedia/ — According to TrendForce, high-bandwidth memory (HBM) prices are expected to rise in Q4 2024, while general DRAM prices will likely see minimal growth of 0% to 5%. The increasing share of HBM in the DRAM market is projected to push average DRAM prices up by 8% to 13%.

General DRAM prices saw an 8% to 13% increase in Q3, but the market is expected to stagnate in Q4 due to weakened consumer demand amid economic recession and increased supply from Chinese manufacturers. Although manufacturers are expanding HBM production, leading to a slight reduction in general DRAM supply, it won't be sufficient to counteract the demand slowdown.

Samsung Electronics, facing delays in supplying its 8-layer HBM3E to key client NVIDIA, reported a challenging Q3 with preliminary operating profit at 9.1 trillion won, a 12.8% decline from the previous quarter. The company attributed the drop to poor performance in its Device Solutions (DS) division, affected by mobile chip inventory adjustments, increased supply from Chinese manufacturers, and currency impacts.

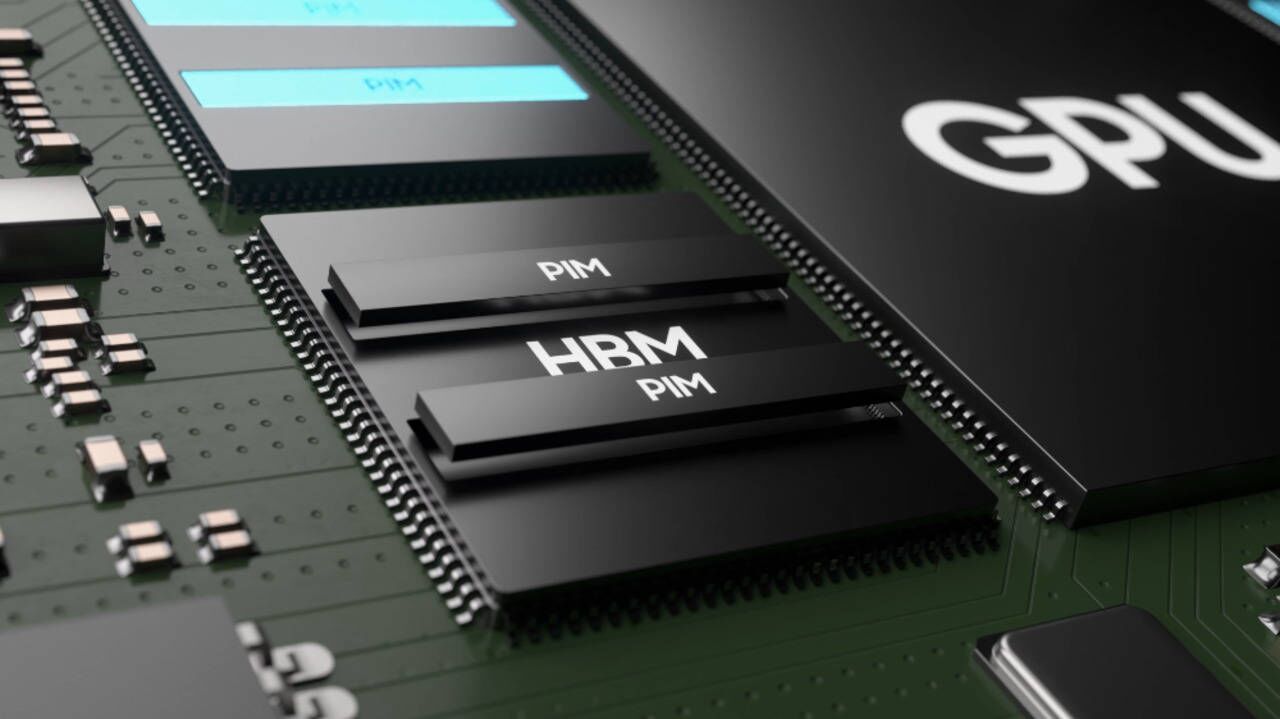

A key issue for Samsung is its delayed entry into the HBM3E market, while competitors like SK hynix began mass production of 12-layer HBM3E in September, planning to supply NVIDIA by Q1 next year. The growing demand for HBM, driven by advancements in AI, highlights the need for Samsung to catch up in this segment.

TrendForce forecasts HBM’s share of total DRAM revenue to grow from 8% in 2023 to 21% in 2024, and exceed 30% by 2025. HBM3E is set to dominate the market, with 12-layer products leading the bit demand.

All Comments (0)