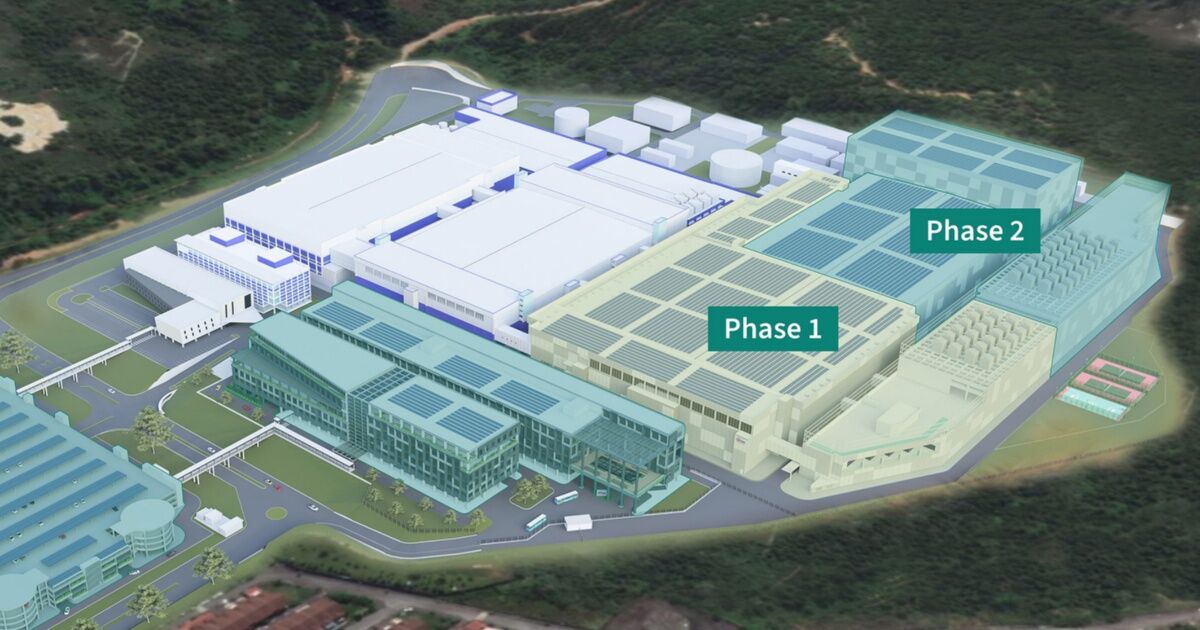

November 13, 2024 /SemiMedia/ — Infineon Technologies announced a delay in the second-phase expansion of its new fab in Kulim, Malaysia, and will reduce its planned investment by 10%, citing ongoing weakness in the semiconductor market and sluggish recovery across most end markets.

In its 2024 fiscal year report, Infineon stated that it will cut capital expenditures by 10% and continue workforce reductions in the coming months. CEO Jochen Hanebeck noted, “Apart from artificial intelligence (AI), our end markets are showing little to no growth momentum, and the cyclical recovery is being delayed.” As a result, Infineon is preparing for a potentially subdued business environment in 2025. Hanebeck added that the current capacity at the Kulim plant is sufficient, leading to the postponement of further cleanroom expansions.

The company expects its revenue in fiscal 2025 to fall short of the 2024 figure of €14.96 billion, below the analysts' consensus estimate of €15.75 billion. Management forecasts a decline in its segment result margin to between 15% and 20% from 20.8% in 2024.

The automotive sector, which accounts for over half of Infineon's total revenue, has yet to see the anticipated recovery. Competitive pressure in the electric vehicle market, particularly from low-cost Chinese models, has intensified. Infineon issued three revenue downgrades during its 2024 fiscal year and anticipates Q1 2025 revenue of approximately €3.2 billion, falling short of market expectations of €3.8 billion. CFO Sven Schneider highlighted ongoing inventory adjustments, especially with excess automotive chip stock remaining a significant challenge.

Despite the broader market downturn, Infineon's data center power business showed strong performance. Hanebeck pointed out that recent advancements in 300mm GaN wafers and thin-wafer technology are pivotal for future growth. “Investment in AI data centers remains robust, and we expect this segment to double within two years, reaching €1 billion,” he said.

For fiscal 2025, Infineon plans to invest €2.5 billion, focusing primarily on its Dresden facility to develop smart power technologies aimed at AI-driven applications. Hanebeck also commented on the potential impact of changing U.S. trade policies toward China, noting that it is still too early to assess the effects but emphasizing that the company's production footprint is largely based in Europe and Southeast Asia, which helps mitigate potential risks.

Faced with increasing uncertainty in the semiconductor market, Infineon is adopting a conservative investment approach and deferring expansion plans. The company will concentrate on growth areas such as data centers and AI, while adjusting capacity to address the ongoing automotive chip inventory issues.

All Comments (0)