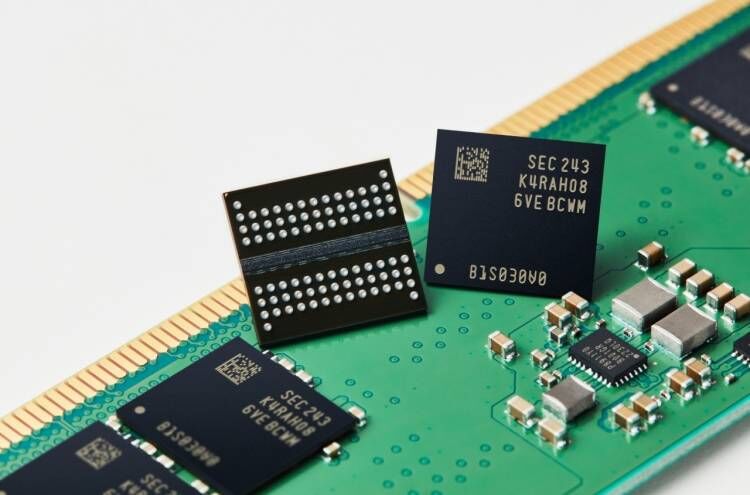

December 2, 2024 /SemiMedia/ — According to TrendForce's latest research, the global DRAM market reached $26 billion in revenue in the third quarter of 2024, marking a 13.6% increase compared to the previous quarter. The growth was primarily driven by rising demand for DRAM and HBM products from data centers. However, shipments of LPDDR4 and DDR4 saw declines due to reduced inventory levels from Chinese smartphone brands and expanded production capacities from Chinese DRAM suppliers.

Average selling prices (ASP) continued their upward trend from the previous quarter, with contract prices increasing by 8% to 13%, largely influenced by the shift towards HBM production. TrendForce forecasts that DRAM shipments will increase in Q4 2024, but due to production constraints caused by HBM manufacturing, price increases may be lower than expected. Additionally, increased capacity from Chinese suppliers could encourage PC OEMs and smartphone brands to actively reduce their inventory, which may lead to a drop in contract prices for traditional DRAM and a mixed pricing trend between DRAM and HBM.

In terms of market leaders, Samsung maintained its top position with $10.7 billion in revenue, up 9% from the previous quarter. SK Hynix generated $8.95 billion, marking a 13.1% increase, while Micron saw a substantial 28.3% growth, reaching $5.78 billion, thanks to strong sales of server DRAM and HBM3e.

On the other hand, Nanya Technology and Winbond Electronics struggled due to weak demand for consumer DRAM and fierce competition in the DDR4 market. Nanya’s shipments dropped by more than 20%, while Winbond’s revenue fell 8.6%. Powerchip Semiconductor Manufacturing’s DRAM revenue increased by 18%, driven by strong foundry business, although its own DRAM shipments were down 27.6%.

Overall, while the DRAM market saw solid growth in Q3, challenges remain, including capacity limitations and fierce market competition, particularly in the consumer DRAM sector.

All Comments (0)