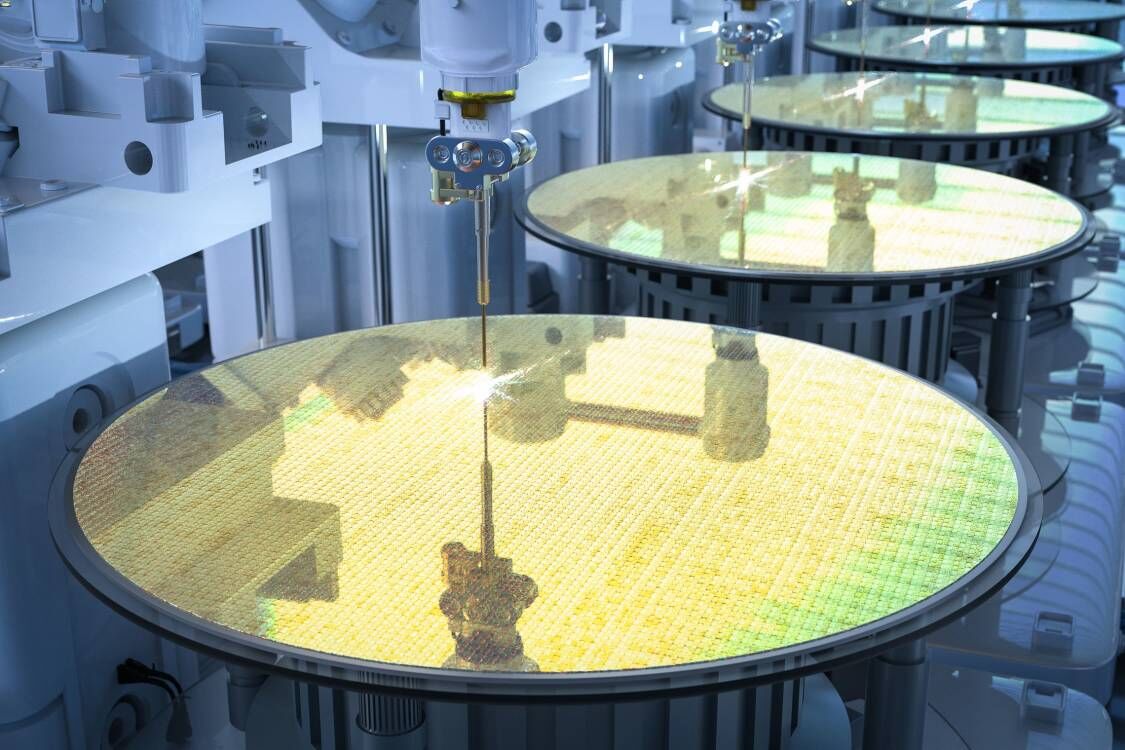

December 4, 2024 /SemiMedia/ — According to Counterpoint Research, the global wafer foundry rankings for Q3 2024 are as follows: TSMC, Samsung, SMIC, UMC, GlobalFoundries, and HuaHong. The industry revenue grew 27% year-on-year and 11% quarter-on-quarter, driven primarily by strong AI demand and the robust recovery of the Chinese market.

TSMC retained its top position, with advanced nodes like N3 and N5 driving high utilization rates. Its Q3 revenue share increased to 64%, up 2% from the previous quarter. This growth stems from strong AI accelerator demand and seasonal smartphone sales. TSMC anticipates that AI server revenue will continue to expand in the coming years, further boosting its market share.

Samsung holds 12% of the market, ranking second. Although weakened by softer-than-expected Android smartphone demand, Samsung is advancing its 2nm GAA process, targeting mass production in 2025. The company is focusing on mobile, high-performance computing (HPC), AI, and automotive sectors to secure future growth.

Chinese foundries SMIC and HuaHong claimed third and sixth places, respectively. SMIC benefited from a recovery in consumer electronics and IoT demand, leading to higher 12-inch wafer shipments and a utilization rate of 90.4%. HuaHong leveraged localization strategies and early demand recovery to solidify its position in the global market. These results highlight China's stronger-than-expected market recovery.

UMC ranked fourth, driven by robust demand for its 22/28nm nodes, while focusing on specialized high-voltage technologies to maintain competitiveness. GlobalFoundries took fifth place, supported by stable demand in automotive and communications sectors, though its smartphone business is expected to decline seasonally in Q4.

AI demand is driving rapid growth in advanced nodes, reinforcing the dominance of TSMC and Samsung in the market. However, with Chinese companies expanding under localization policies, SMIC and HuaHong are poised to capture greater global market share. At the same time, increasing competition in mature nodes is expected to challenge profitability across the industry.

the global wafer foundry market for 2024 is characterized by strong innovation driven by AI and region-specific recoveries, showcasing robust growth momentum.

All Comments (0)