February 17, 2025 /SemiMedia/ — South Korean semiconductor foundries are seeing a significant rise in utilization rates, driven by China's "trade-in" policy aimed at stimulating domestic consumption. The policy, which encourages consumers to replace old electronic devices with new ones, has fueled a surge in demand for semiconductors since early 2025, boosting production orders for South Korean contract chip manufacturers.

DB HiTek, a key beneficiary, has reported that its Bucheon and Sangwoo plants have reached a combined utilization rate of nearly 85%, up from 74.4% in Q3 2023. The company expects its overall utilization rate to remain between 80% and 85% in 2024, reflecting the positive impact of China's policy on its operations.

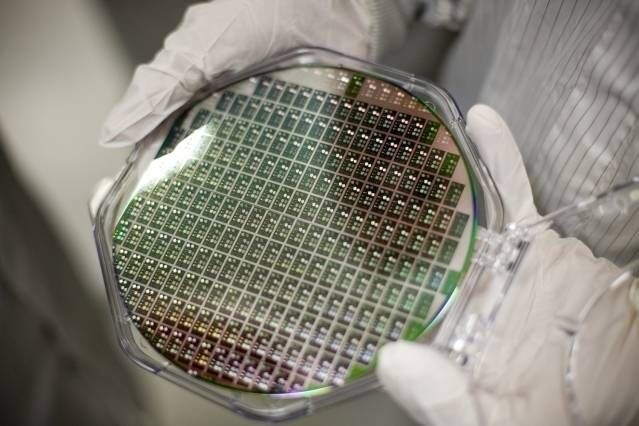

Industry experts highlight the semiconductor sector’s critical role in the global electronics supply chain, with foundries like DB HiTek specializing in mature-node chip manufacturing. The increase in utilization rates signals a recovery from last year’s downturn. In 2022, DB HiTek’s operating profit fell 26.52% to KRW 195 billion due to economic headwinds.

Beyond DB HiTek, another major South Korean 8-inch foundry, SK Key Foundry, has also exceeded 80% utilization. This rise is not only driven by Chinese demand but also by increased orders from fabless companies in the U.S. and Europe, which rely on foundries for production and benefit from growing component sales to China.

"Orders from U.S. and European fabless companies supplying to China are also rising, further driving up foundry utilization rates," an industry analyst said. This trend underscores the interconnected nature of the global semiconductor supply chain and the critical role foundries play in meeting international demand.

As the semiconductor industry continues to respond to economic stimulus measures, companies like DB HiTek are expected to sustain growth. The ongoing demand surge in China is likely to provide long-term support for foundries and contribute to a broader industry recovery.

All Comments (0)