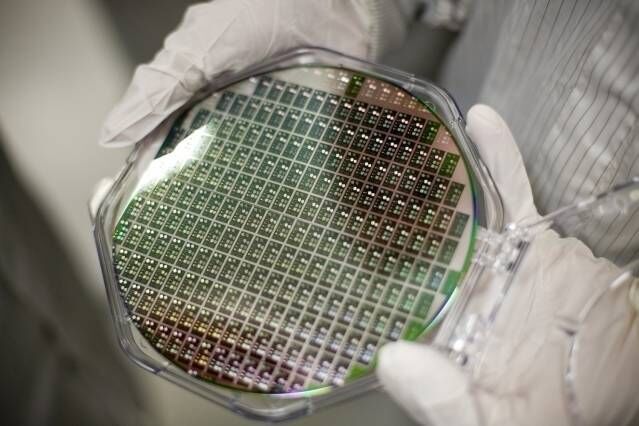

March 14, 2025 /SemiMedia/ — Taiwan Semiconductor Manufacturing Company (TSMC) is negotiating with NVIDIA, AMD, and Broadcom to establish a joint venture to manage Intel’s foundry business. Under the proposal, TSMC would oversee operations but would not hold more than a 50% stake.

The discussions are still in the early stages, and any deal would require U.S. government approval to ensure Intel’s foundry unit does not fall under full foreign control. Sources indicate that the U.S. government sees this potential partnership as a way to revitalize Intel and strengthen domestic semiconductor manufacturing.

TSMC began exploring this partnership even before its March 3 announcement of a $100 billion U.S. investment plan, which includes building five new chip plants over the coming years. Within Intel, board members support the deal, but some executives strongly oppose it and refuse to separate the chip design and foundry divisions for sale.

TSMC also invited Qualcomm to join the venture, but the company has withdrawn from discussions. Meanwhile, NVIDIA and Broadcom are conducting test runs on Intel’s cutting-edge Intel 18A (1.8nm) process, with AMD also evaluating its feasibility. However, Intel 18A has been a major sticking point in the negotiations. In February talks, Intel executives reportedly told TSMC that their 18A process outperforms TSMC’s 2nm technology.

Intel faces mounting challenges, with its stock price plummeting over 50% in the past year and a reported net loss of $18.8 billion in 2024—its first loss since 1986. The company’s foundry unit holds assets valued at $108 billion, but whether this joint venture can turn things around remains uncertain.

All Comments (0)