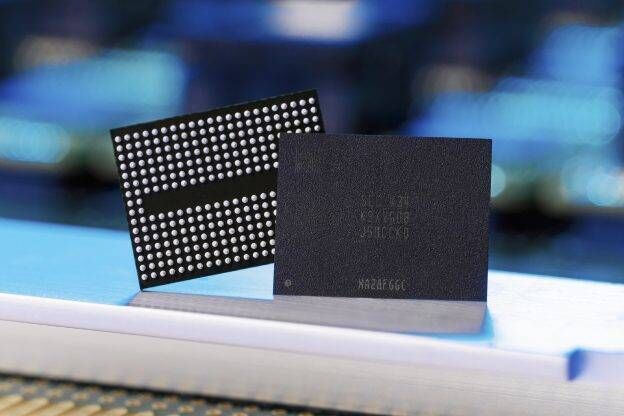

March 18, 2025 /SemiMedia/ — The global NAND flash market is facing a new wave of price increases. Following SanDisk’s announcement of a 10% price hike in April, market reports indicate that Micron, Samsung Electronics, and SK Hynix are also preparing to raise NAND prices.

Supply constraints are the primary driver of these increases. Korean manufacturers have been cutting production, and a power outage at Micron’s Singapore facility in January has further tightened supply. Pan Jiancheng, chairman of Phison Electronics, revealed that despite placing orders with Micron in December 2024, his company has recently faced unexpected delivery shortages. Industry sources suggest that the power outage at Micron’s Singapore NAND fab led to production losses, disrupting shipments. While Micron has not officially responded to the incident, the company announced in early March that the average price of new orders would increase by 11%.

Samsung and SK Hynix are also set to raise prices in April to align with market trends. Both companies have significantly reduced output, leading to a more than 10% drop in total production in Q1 2024 compared to the end of 2024. Reports indicate that Samsung’s March deliveries accounted for only 20% to 25% of original orders. While these companies cite supply constraints, analysts believe the price hike strategy is already in motion. NAND prices are expected to rise by 10% or more after supply normalizes in April.

Although the current production cuts are not as severe as in previous downturns, they are helping to rebalance supply and demand. Initially, analysts forecasted that NAND prices would decline through the first half of 2025 before recovering later in the year. However, since March, manufacturers have begun discussing price increases ahead of schedule, which could shift market expectations.

According to DRAMeXchange data from March 13, the spot price of general-purpose DRAM DDR4 8Gb products reached $1,466, marking five consecutive days of increases since March 7. Meanwhile, the spot price of 16Gb DDR5 products rose by more than 6% month-over-month to $5,068 on March 12, indicating a broader upward pricing trend in the memory market.

All Comments (0)