At present, the electronic components shortage is the biggest problem encountered in the global electronics industry supply chain. From 2016 to now, the shortage has been going on for nearly two years, and the products that started to be in short supply at the end of 2017 have a commonality. That is, its wafers are mainly produced by 8-inch wafer fabs, the reason is considered to be insufficient production capacity of 8-inch wafers. This report aims to analyze the reasons for the shortage of 8-inch wafers and future trends by reviewing the entire industry chain.

Development path: Cost Advantages and Special Processes Make 8-inch Wafers Significant in Competitive Advantage

Driven by Moore's Law, the wafer size grows from 6-inch to 8-inch and 12-inch. The larger the silicon single wafer, the more integrated circuits are produced on the same wafer, which can reduce the cost, but also improve the yield, in this case, the material technology and production technology requirements will be higher. Under the promotion of Moore's Law, the degree of integration of integrated circuits continues to increase, that is, the number of integrated components on a silicon wafer increases. The three main technical factors for the increase in integration are: reduce the device size, increase the chip area, and improve the chip integration efficiency. On the one hand, the edge portion of the silicon wafer is uneven and there are a large number of defects. Therefore, when manufacturing a device on a silicon wafer, only the middle portion of the silicon wafer can be actually used. When the area of a single device chip is increased, the yield of the silicon wafer is lowered, so needs to increase the silicon area. On the other hand, the larger the wafer, the more ICs can produce the same specification on the same wafer, which can effectively reduce the IC cost and increase the profit margin.

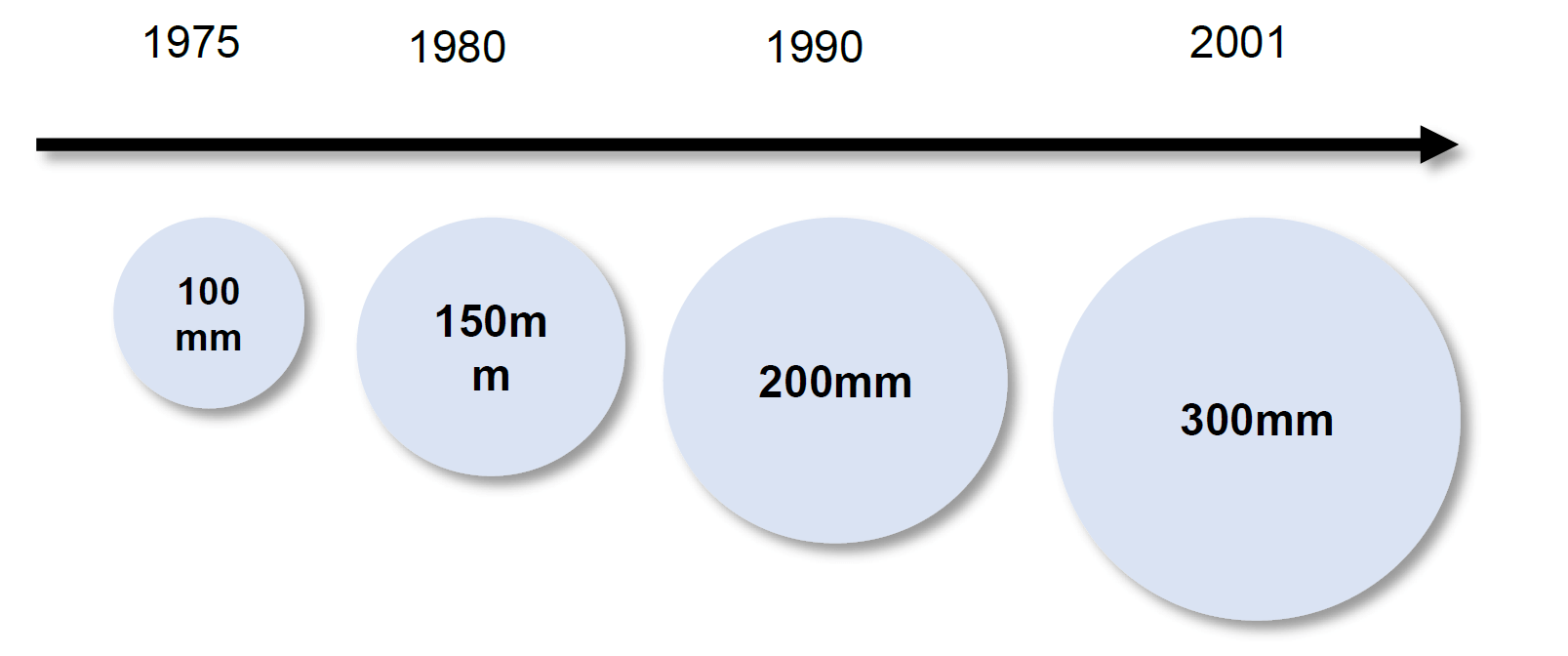

Wafer size development history

The current industry is dominated by 8-inch and 12-inch silicon wafers. Among them, 8-inch silicon wafers are mainly used in characteristic or differentiated technologies. Products include power chips, sensors for photography/fingerprint recognition, MCUs, wireless communication chips, etc., covering consumer electronics, communications, computing, industrial, automotive, and other fields. The 12-inch silicon chip is mainly used for manufacturing high-performance chips such as CPUs, logic ICs, and memories, and is used in many fields such as PCs, tablets, and mobile phones. As time goes on, the size of silicon wafers continues to grow.

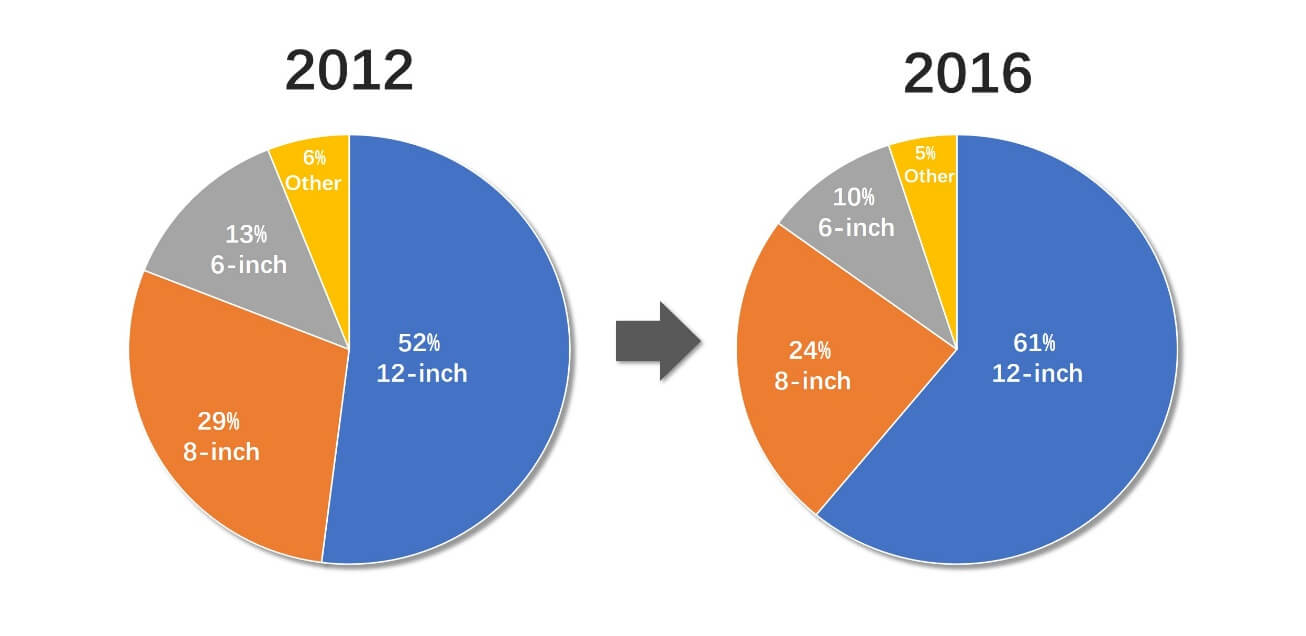

Change in the share of different size silicon wafers

Compared to 12-inch wafer production lines, the advantages of 8-inch wafer fabs are:

1) owns special wafer process.

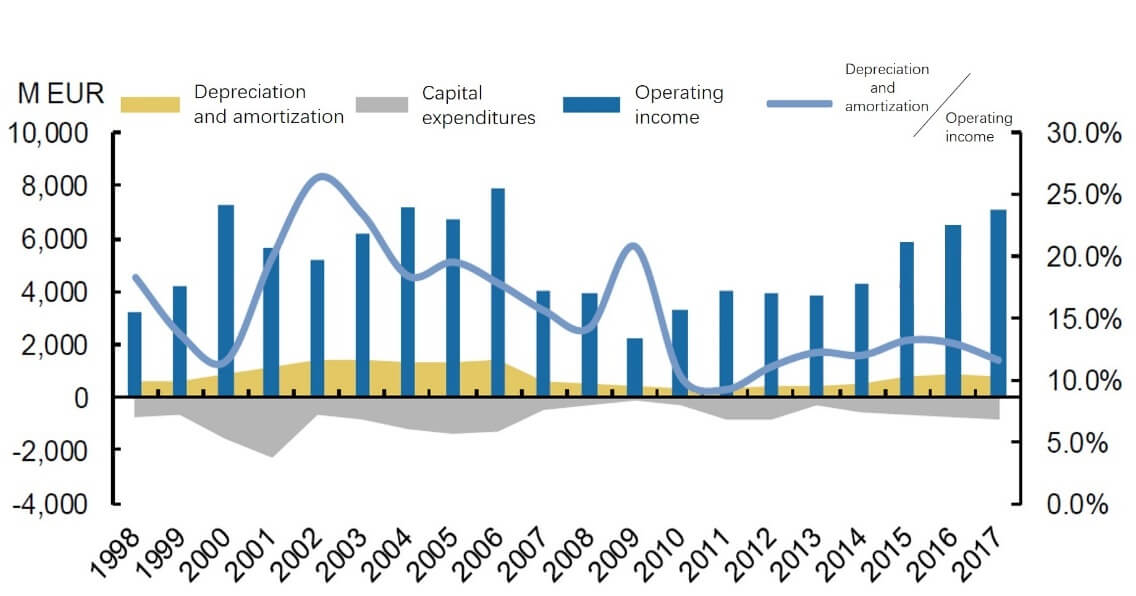

2) The fixed costs of fully or largely depreciated fixed assets are low.

3) Lower quantity requested for cost-effective production.

4) The corresponding costs of masks and design services are low.

In view of the above advantages, 8-inch wafers and 12-inch wafers can realize complementary advantages and long-term coexistence.

The important competitiveness of 8-inch wafers is that they have formed a mature specialty wafer process. Special process technologies include high-precision analog CMOS, RF CMOS, embedded memory CMOS, CIS, high voltage CMOS, BiCMOS, and BCDMOS. These special technologies are for wafers. These special technologies have strict tolerance limits on the fab's process parameters, and the yield is higher in mature 8-inch fabs. ICs in commonly-used DC-DC converters, motor drivers, and battery chargers typically use 8-inch wafers.

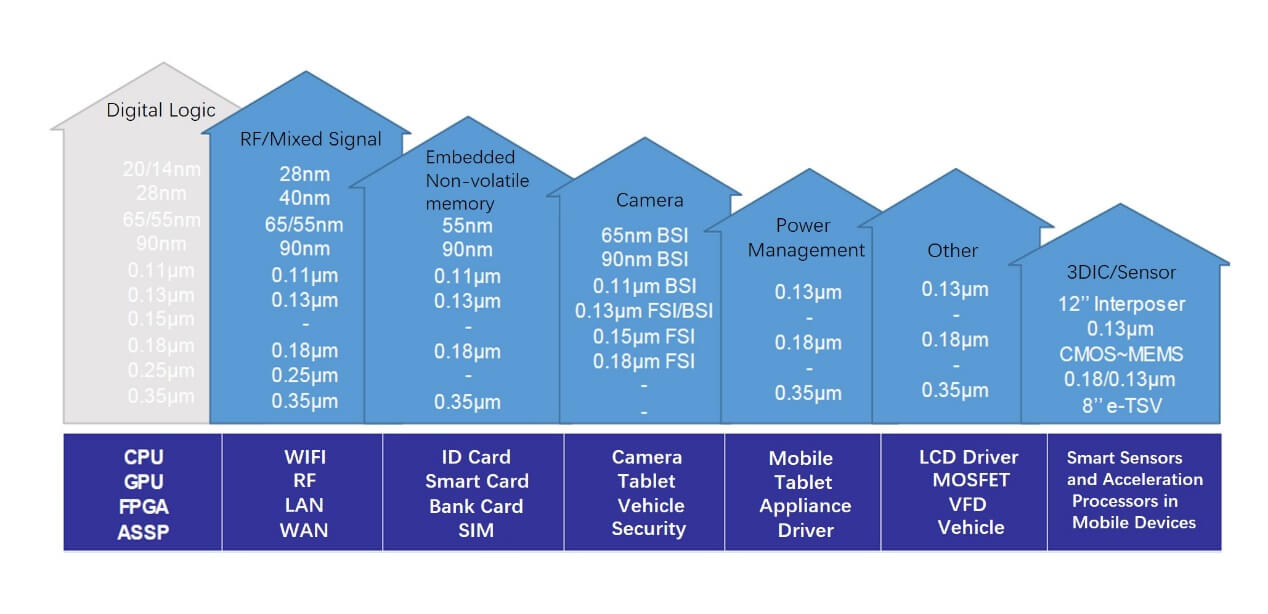

Source: SMIC

The technical node of the IC used by each application

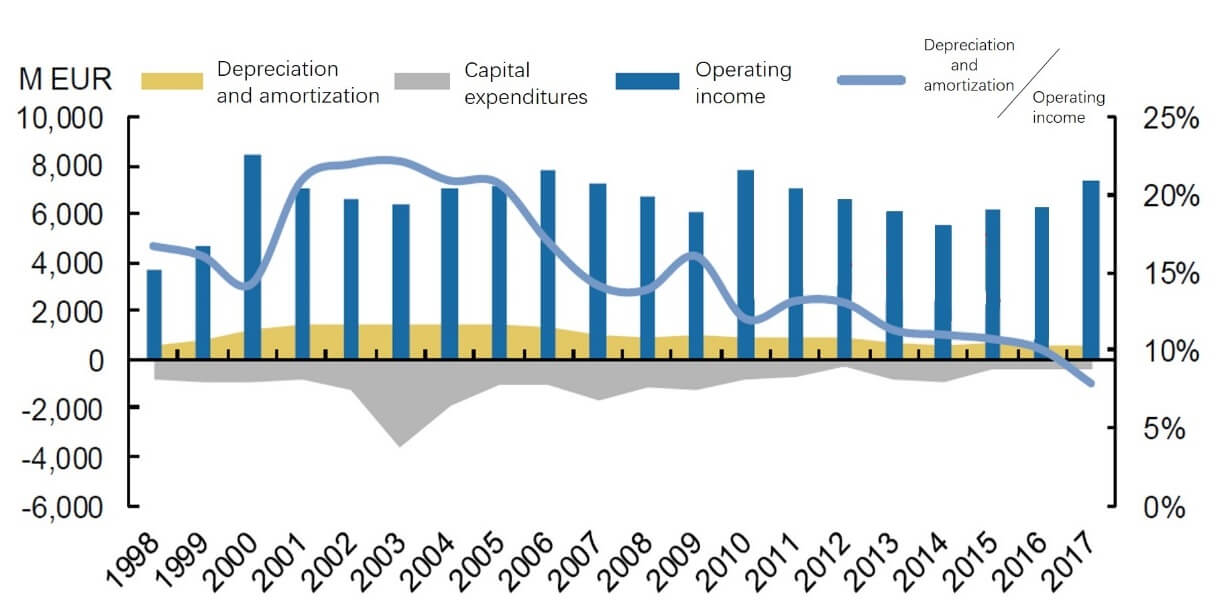

The capacity of 8-inch fabs began to increase in the late 1990s. Most fabs are now completely depreciated and their fixed costs are relatively low. Therefore, 8-inch wafer fabs are extremely competitive in terms of operating costs. Although current equipment suppliers no longer manufacture new equipment for 8-inch wafer fabs, they often work closely with 8-inch fabs to extend the life of the equipment by 10 to 15 years in a cost-effective manner.

Depreciation and Capital Expenditure of STMicroelectronics, 1998-2017

8-inch wafer have the advantage of lower cost-effective production requirements. The advanced cleanroom and equipment of the 12-inch wafer production line can ensure high yields, tighter, smaller size designs and higher profits, but the tolerance requirements are very stringent. Therefore, despite the rapid growth of the market, it is necessary to invest between US$5 billion and US$10 billion per year to achieve both R&D and effective competitiveness in the market. The 8-inch fab, which is dominated by process technology nodes of 90nm, 130nm and above, requires less capital expenditure, so even if the small batch is produced, the fixed cost is lower.

Depreciation and Capital Expenditure of Infineon, 1998-2017

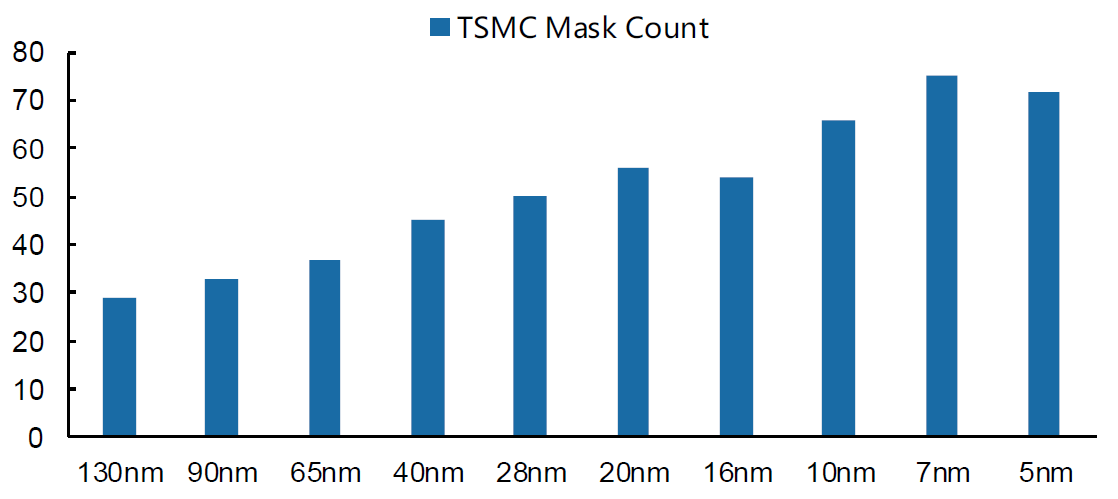

The corresponding costs of photomasks and design services are lower: the number of metal layers in the process increases with the evolution of the process. Typical processes at 130nm have six layers of metal, and at the 5nm node, at least 14 layers of metal are expected, it means that the wafer costs is higher under the advanced technology node. In addition, advanced technology nodes need to introduce new technologies and accordingly increase the cost of masks. Take TSMC as an example, a 130nm technology node requires about 30 masks, and a technology node below 28nm needs at least 50 masks.

Source: EEFOCUS

Source: EEFOCUS

The number of mask layers required by different technology nodes

When the wafer size is getting bigger and bigger, the 8-inch factory is still the backbone.

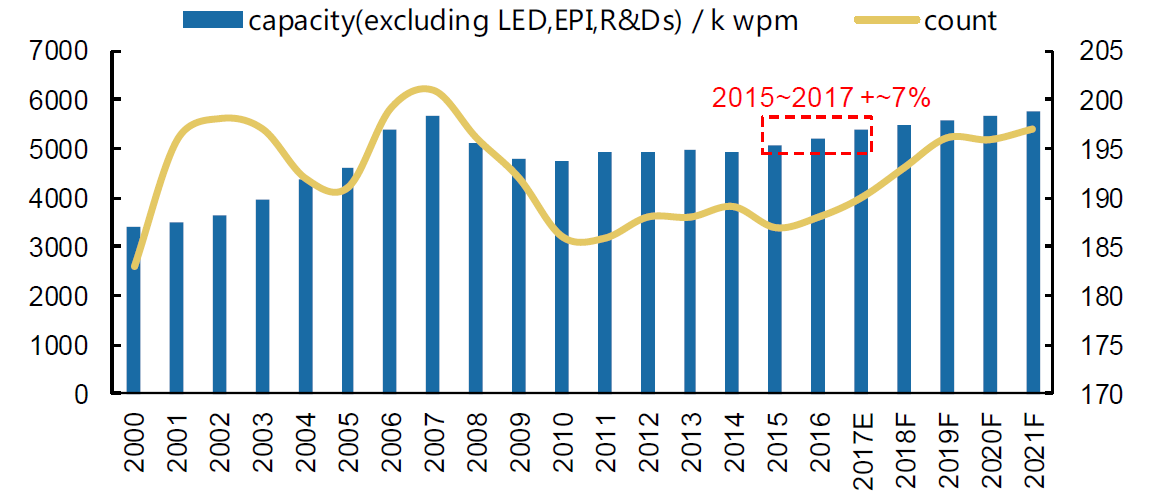

After the first 8-inch wafer fab was established by IBM in cooperation with Siemens in 1990, the number of 8-inch wafer fabs increased rapidly. It reached 70 in 1995 and peaked in 2007 with 200 seats. Then the number of 8-inch fabs gradually decreased. From 2008 to 2016, 37 8-inch wafer fabs were closed, while 15 fabs were switched from 8-inch to 12-inch wafers. By 2016, the number of 8-inch wafer fabs worldwide was reduced to about 180.

Source: SEMI

Global 8-inch wafer fab capacity and fab number

From the data above, it can be seen that the global 8-inch wafer fab capacity is growing at a very low rate, which only increased by about 7% from 2015 to 2017.

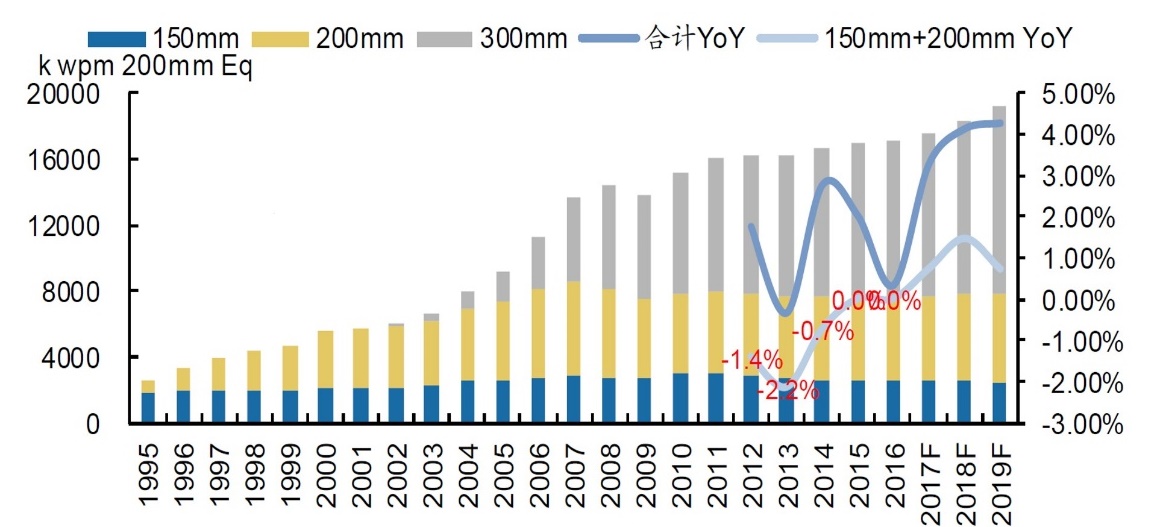

The closure of some 6-inch production lines led to the transfer of production to the 8-inch production line. From the perspective of the number of fabs, approximately 25 6-inch wafer fabs were closed between 2010 and 2016, and the corresponding 6-inch wafer production capacity was reduced by approximately 453k/wpm (wpm: wafers per month). After the 6-inch line capacity is reduced, the products (such as discrete devices, power devices, MEMS, analog chips) switched to 8-inch wafer production line.

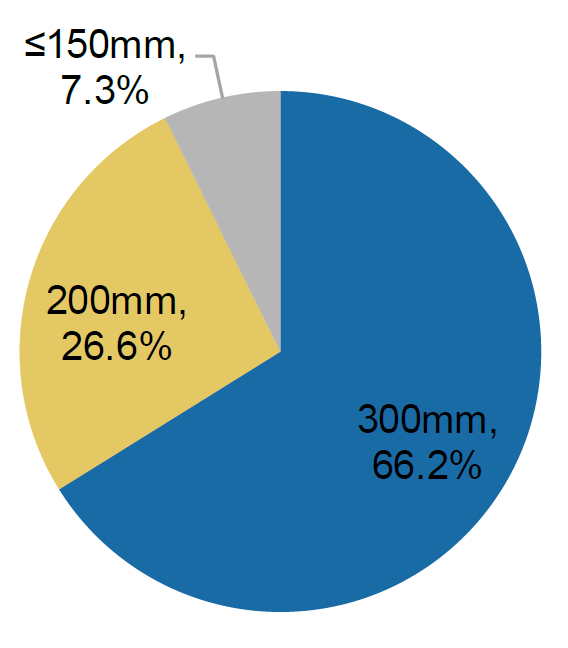

Worldwide wafer capacity distribution by wafer size

Worldwide wafer capacity distribution by wafer size

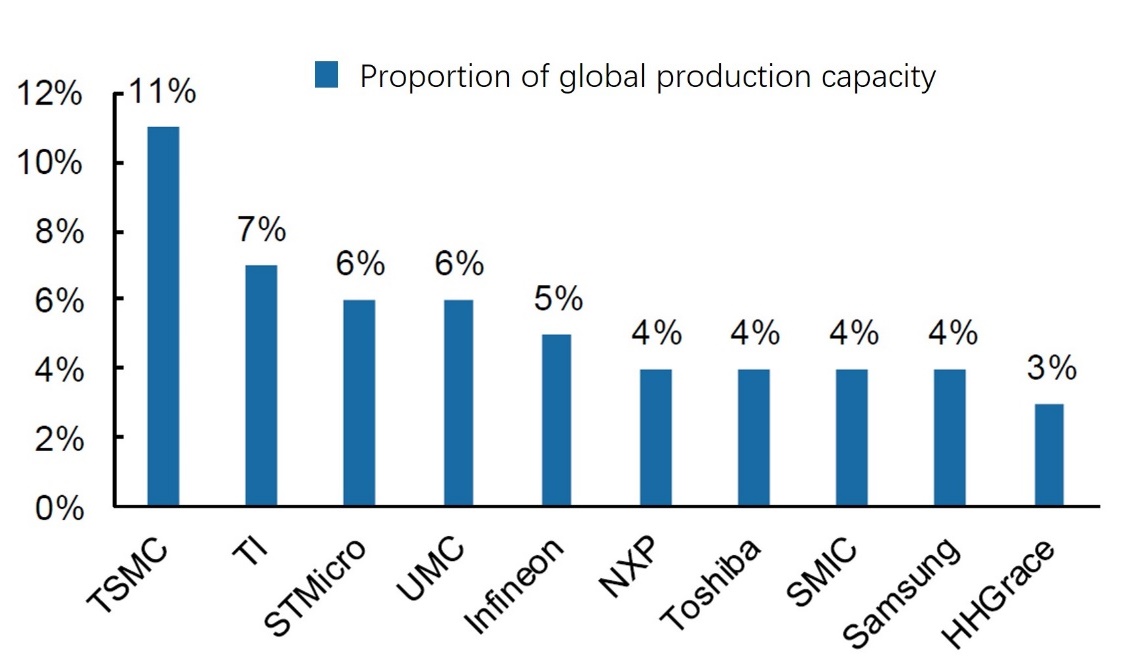

According to data from SEMI and IC insight, global wafer production capacity in 2017 was 17.9M/wpm, of which 8-inch wafer production capacity was approximately 5.2M/wpm, and the top ten 8-inch wafer fabs were accounts for 54% of the world’s total 8-inch wafer capacity.

Global wafer production capacity by size

Source: IC Insight

2016 Top 10 Top 8-inch wafer manufacturers

Current status: A variety of factors lead to tight supply and demand for 8-inch fabs

The lack of production capacity in fabs is caused by many factors. The first is the supply side. The shortage of core equipment is the main limitation of the expansion of 8-inch wafer production capacity.

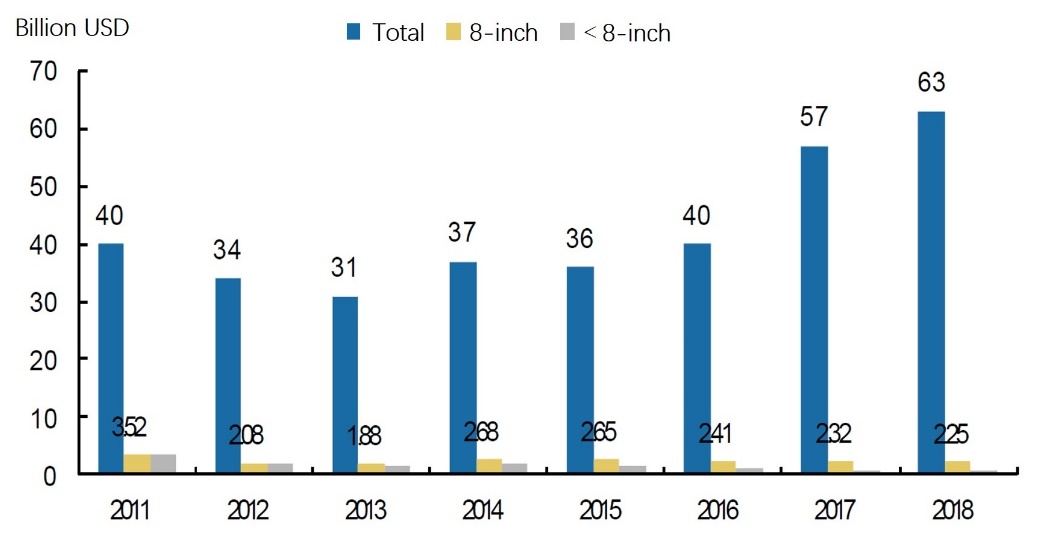

Global wafer manufacturing equipment capital expenditure

Most 8-inch fabs have been built earlier and have been operating for more than a decade. Some 8-inch wafer fabs are too old or difficult to repair. At the same time, due to the huge capital expenditures of current 12-inch fabs, some manufacturers stopped the production and sales of 8-inch wafers. The 8-inch wafer production line equipment mainly comes from the second-hand market, mostly from memory manufacturers that have been upgraded from 8-inch to 12-inch, such as Samsung and Hynix. Currently, resources of the old equipment are getting fewer and fewer. Therefore, 8-inch wafer equipment is in short supply after 2014, in which the etching machine, lithography machine, and measurement equipment are the most difficult to obtain.

Source:SurplusGlobal

Global wafer manufacturing used equipment inventory

Second, on the demand side, orders for new applications have driven demand for 8-inch fabs.

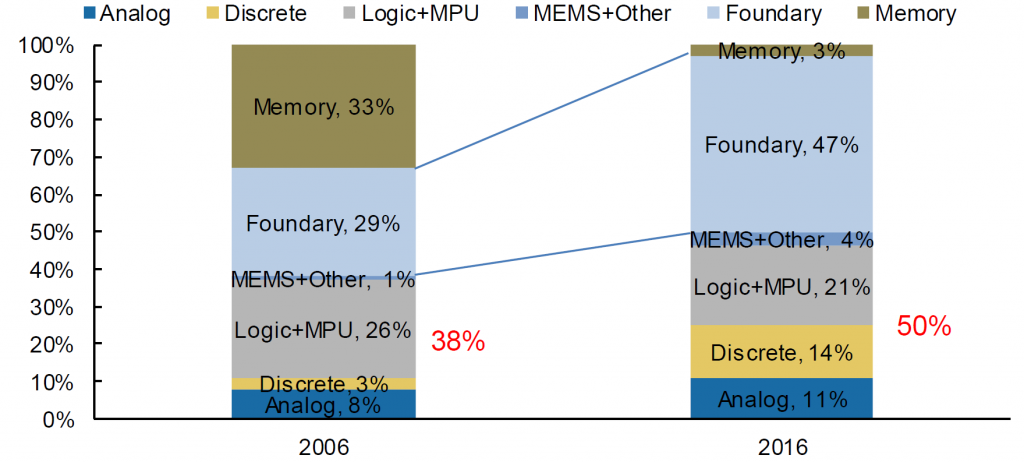

The main demand for 8-inch wafer production comes from analog chips, discrete devices, MEMS and some logic chips. With the gradual production of a large number of 12-inch wafers, production of some microprocessors, basebands, DRAMs, and NAND switches from 8-inch wafers to 12-inch wafers. In 2006, 33% of 8-inch wafers were manufactured for memory chips, and by 2016, the capacity for memory accounts for 3% only, and it is expected to further reduce to 2% in 2018. About 47% of the current 8-inch wafer production capacity is for foundary. The demand for the remaining capacity mainly comes from analog chips, discrete devices, logic chips, MEMS and other products. Among them, the analog chips, discrete devices, logic chips and MEMS accounts for 50% of the total production capacity.

8-inch wafer capacity requirements (categorized by product type)

On the industry downstream side, the chips used in automotive electronics and internet of things, including Advanced Driver Assistance Systems and sensors, automotive current control ICs, and IoT MCUs, have been put into mass production in 8-inch wafer fabs, making the demand for 8-inch fabs in the second half of 2016 increased rapidly.

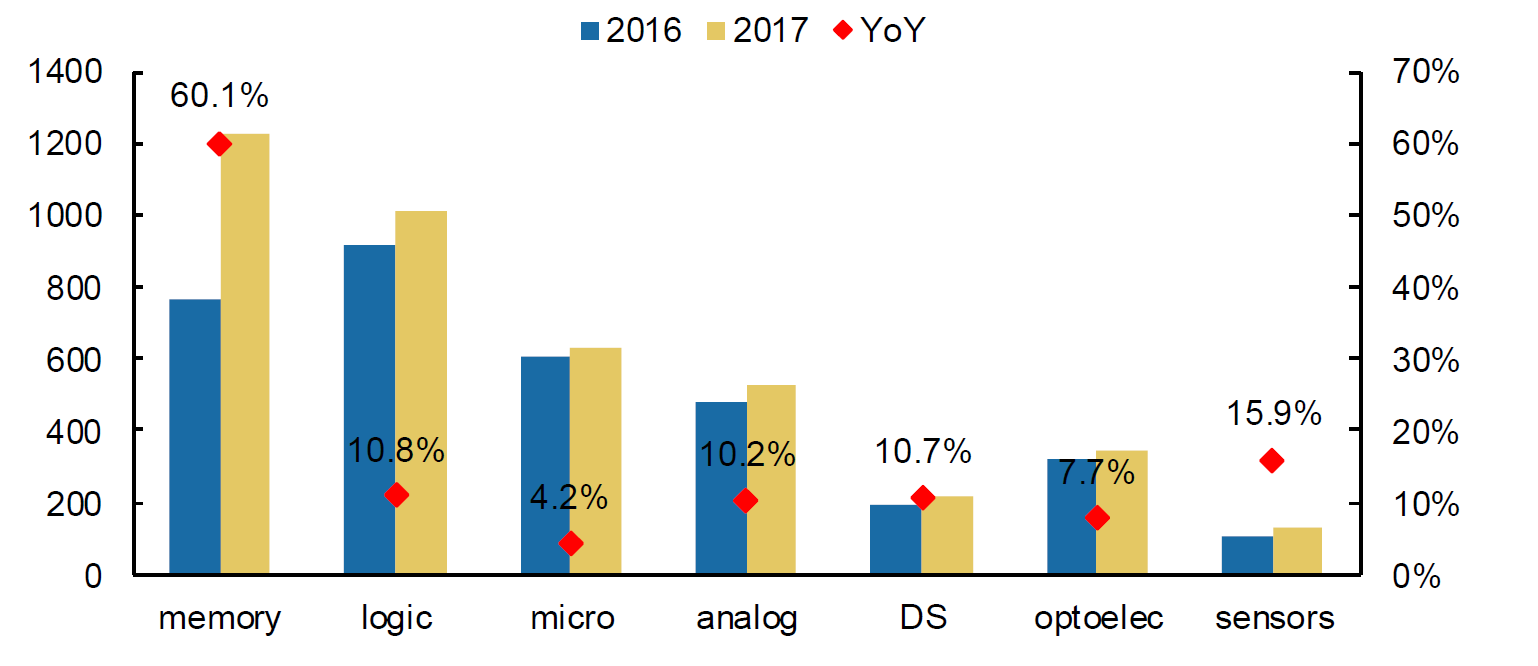

According to SIA's data, in addition to memory, semiconductor sales in 2017 grew at a rate of 9%, while monthly sales of non-storage semiconductors used in the automotive and industrial sectors were both above 10%, far higher than the global overall growth rate of semiconductor sales, it shows that automobiles and industries are becoming global high-growth semiconductor applications. Take the automobile as an example. With the increase of electrification and intelligence, the demand for semiconductors from a single car is gradually increasing. For example, the demand for chips in a Tesla Model X car equal to an 8-inch wafer. According to strategy analytics, the value of semiconductors in a single vehicle rose from US$317 in 2016 to US$330 in 2017, representing a year-on-year growth of 4.1%.

Non-memory semiconductor sales growth in automotive and industrial sectors is faster than average

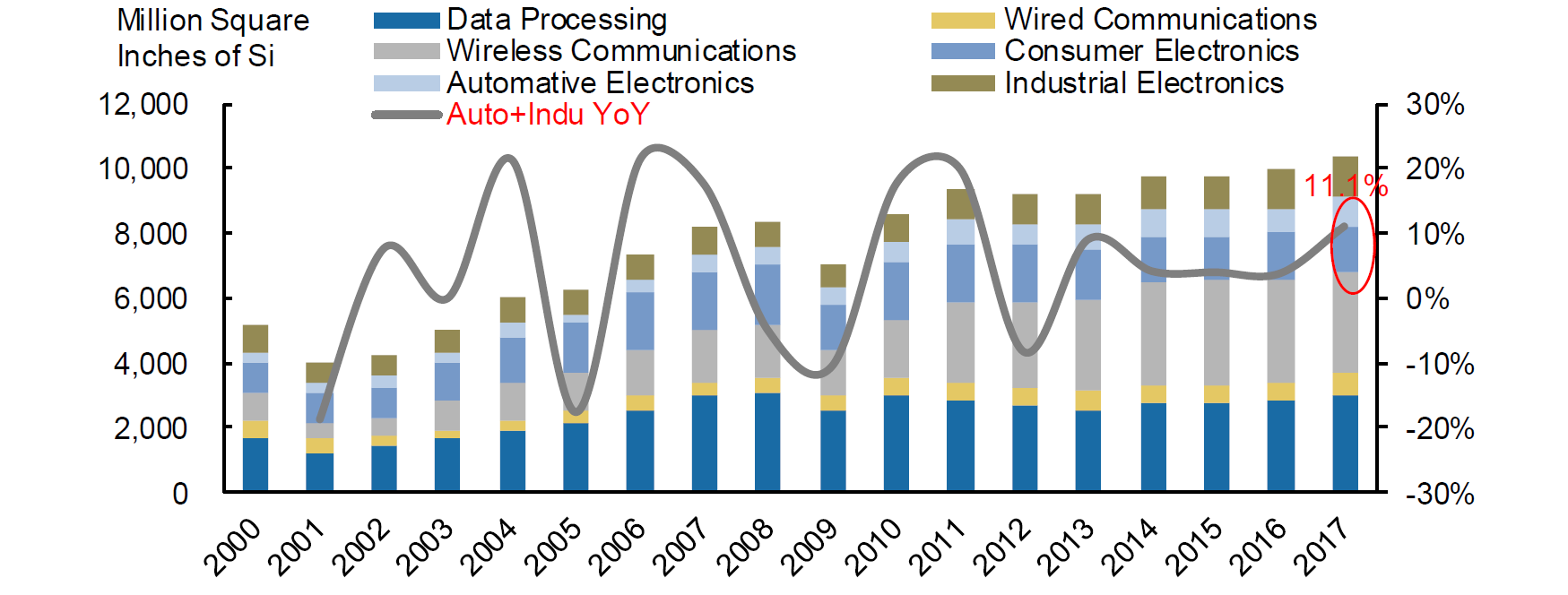

From the perspective of wafer capacity requirements for semiconductor products used in the automotive and industrial sectors, according to IHS data, the demand area for wafers for automobiles and industry in 2017 increased by 11.1% from 2016.

Different wafer application areas for downstream applications

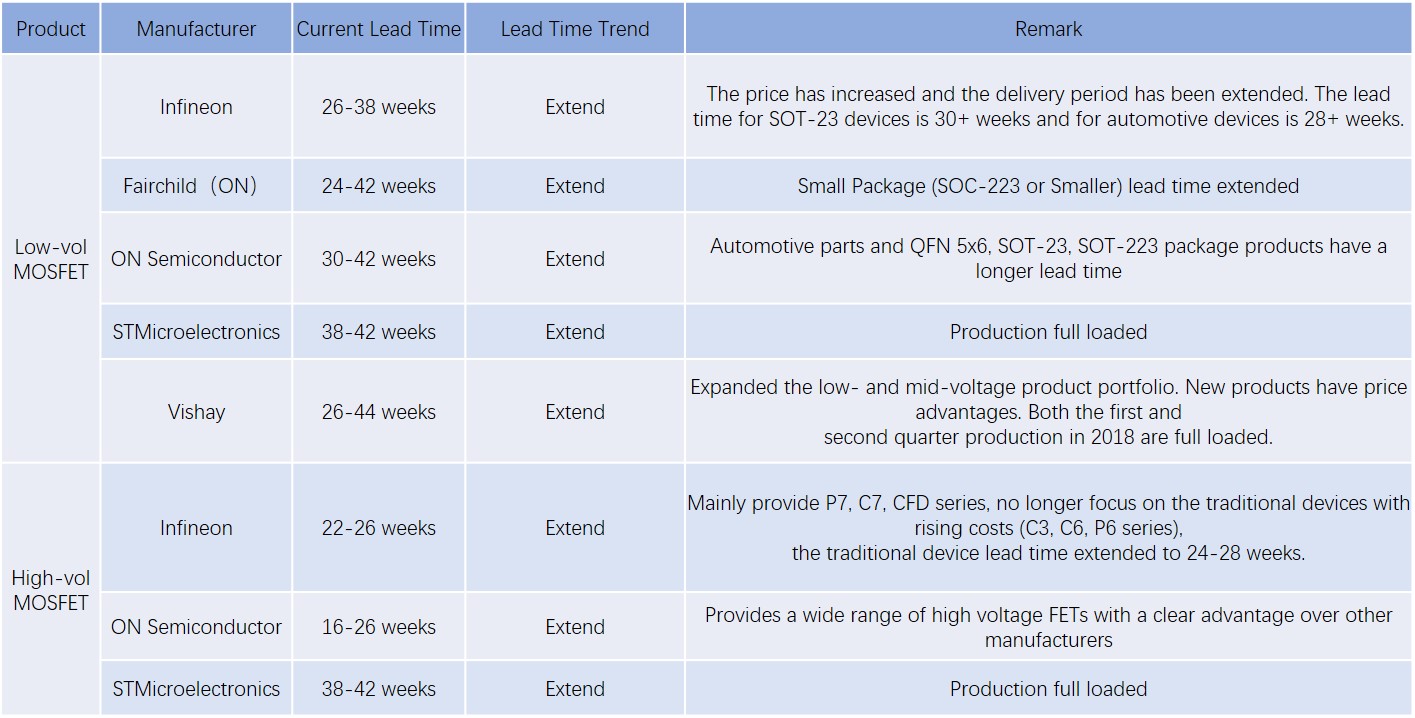

Since the second half of 2016, the price of MOSFETs, IGBTs and other products has been rising due to the demand for automobiles.

MOSFET is a kind of field effect transistor that can be applied to analog circuits and digital circuits. It is widely used in consumer electronics, electric vehicles, and IOT. According to IHS data, the 2016 MOSFET chip market size was US$20.5 billion. The ST’s high- and low-voltage MOSFETs have been fully loaded in the second quarter of 2018. The current lead time is 38 to 42 weeks, which is much longer than before. In addition to MOSFETs and IGBTs, the overall lead times for rectifiers, digital/general transistors, etc. have increased.

In the second quarter of 2018, the lead time of major MOSFET manufacturers has been extended.

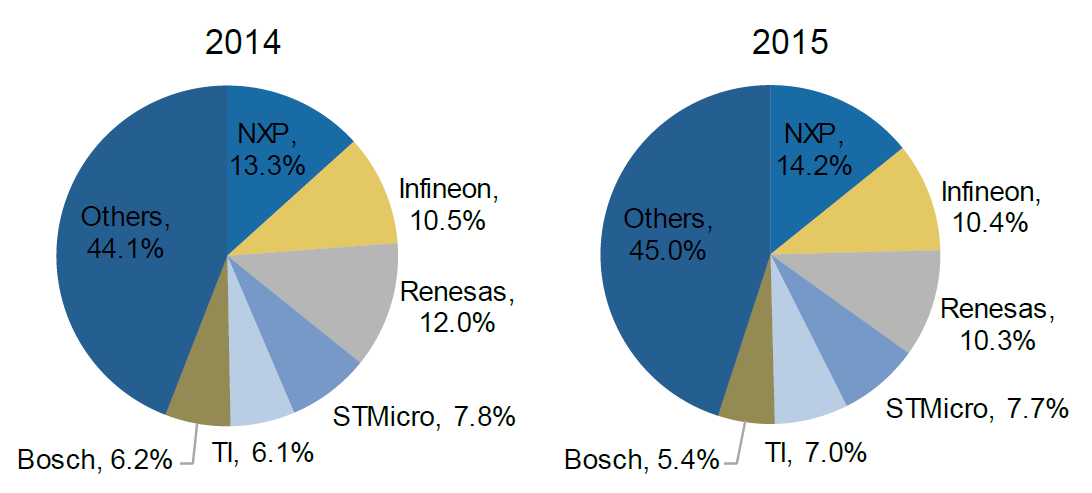

On the industry upstream side, in terms of manufacturer competition, the semiconductors currently used in the automotive sector are mainly supplied by NXP, Infineon, Renesas Semiconductor, STMicroelectronics, Texas Instruments, and Bosch. The total ratio is more than 55%, and the semiconductors supplied by these vendors are mainly non-memory. Memory is mainly supplied by conventional memory giants such as Micron, Samsung, Hynix, and cypress, and memory also has a higher proportion in automotive semiconductors, so the automotive semiconductor market Mainly occupied by the traditional IDM companies such as NXP, Infineon, Renesas Semiconductor, STMicroelectronics and Texas Instruments…etc.

Source: Strategy Analytics

Global automotive electronics semiconductor supplier competition

NXP, Infineon, STMicroelectronics and other traditional IDM companies which focused on automotive electronics are mainly owns 8-inch and 6-inch wafers with technology nodes above 40nm, while producing analog chips, power devices and sensors, they are more focus on the uniqueness of technology, not the advancement of technology nodes. At the same time, in the context of the 2008 global financial crisis and the 12-inch wafer fab becoming mainstream, the IDM companies did not carry out the expansion schedule for 8-inch wafers, and as the demand for automotive semiconductors gradually became stronger and the production capacity utilization rate further increased, the IDMs outsourced some of its products to the 8-inch foundries, which eventually led to production capacity short supply.

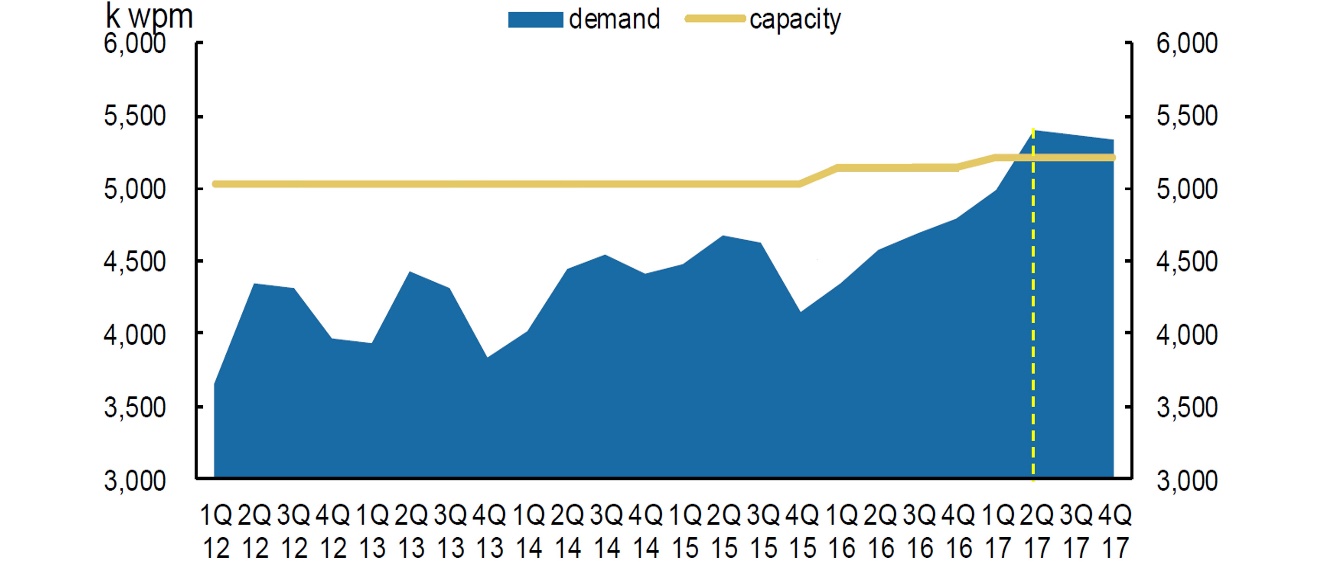

In fact, after 2007, the global 8-inch wafer production capacity has gradually declined, and has remained stable after 2011 and has increased slightly.

Global 8-inch fab capacity change between supply and demand

Prior to 2016, the global average level of capacity utilization of 8-inch wafer fabs was approximately 78-85%. In recent years, the average annual utilization rate has increased by 4%. The capacity utilization rate reached a record high in 2017.

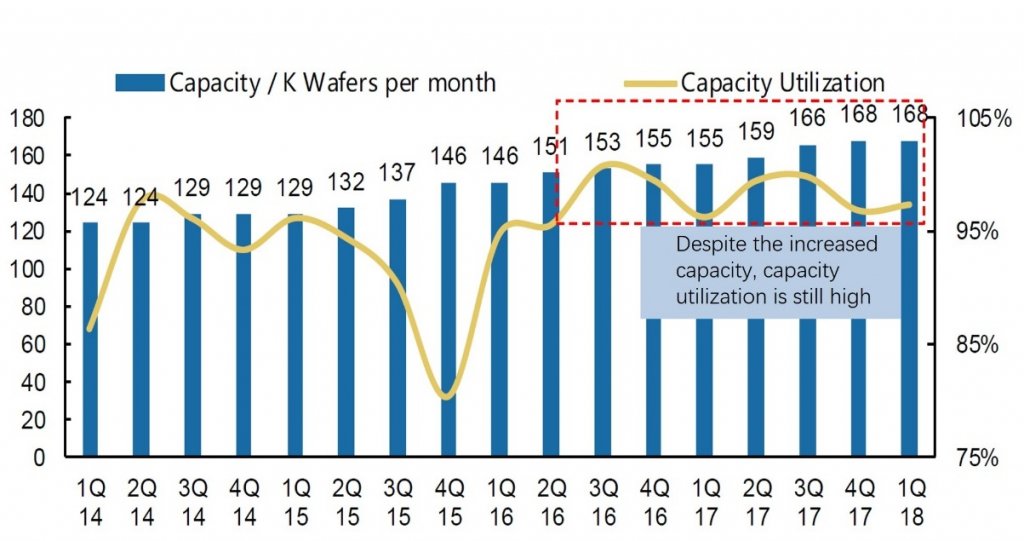

HHGrace Quarterly Capacity and Capacity Utilization

Judging from the data disclosed in the 2017 annual report, currently UMC's 8-inch wafer production capacity accounts for about half of the total production capacity, in 2016, the average capacity utilization rate was 88.6%, and it climbed to 94.4% in 2017. HHGrace is the world's leading 8-inch wafer foundry. Although the company has continued to expand production capacity since the second half of 2016, its capacity utilization rate continues to remain high, and the utilization rate of other 8-inch wafer fabs remains high as well. According to industry chain research information, at the beginning of 2018 HHGrace, TSMC and other 8-inch wafer fabs were still in short supply.

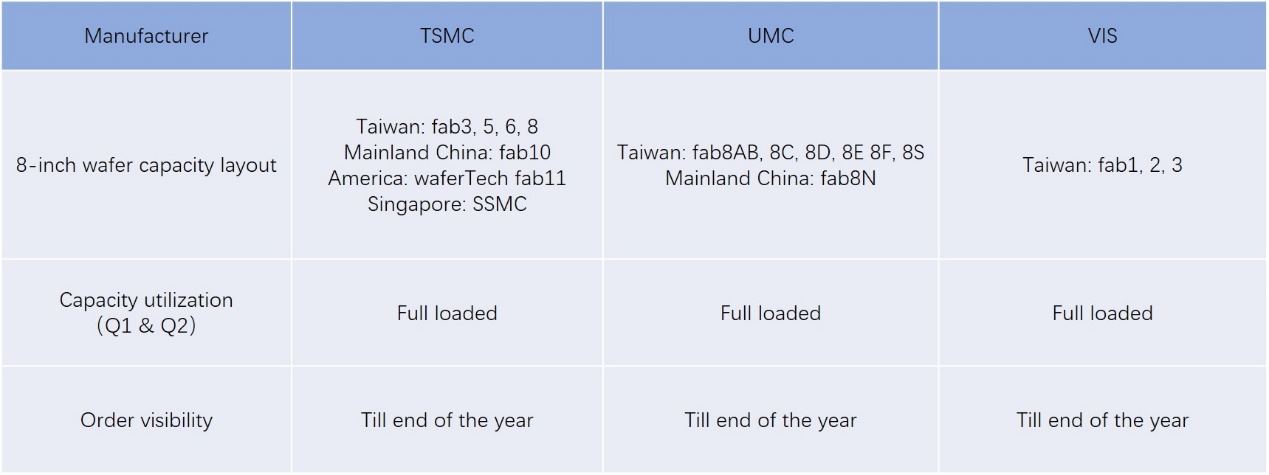

Taiwan wafer foundry 2018 8-inch factory operation status

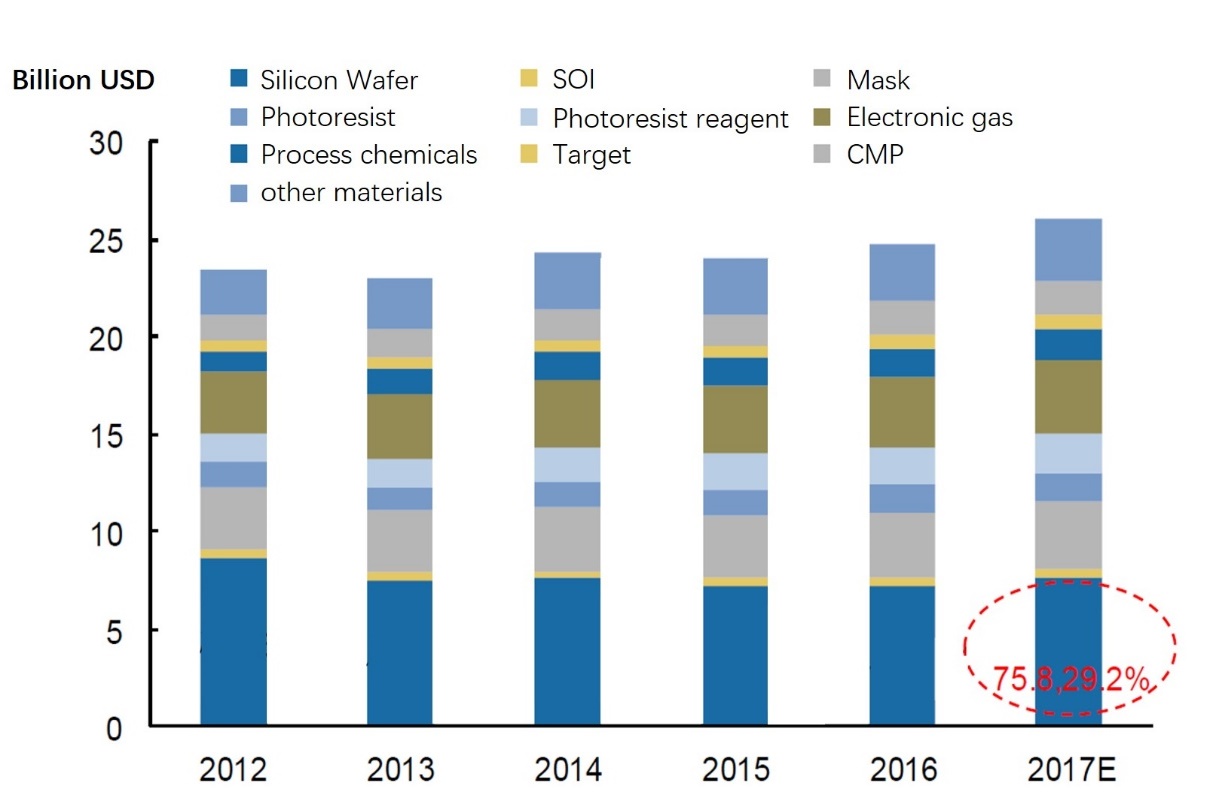

Silicon wafer is the most basic raw material for semiconductor products. Because of its irreplaceability, it limits the capacity of wafer fabs worldwide. The proportion of silicon wafers in wafer product cost is related to fab equipment depreciation. According to SEMI's data, the global silicon wafer market in 2017 was approximately US$7.58 billion, accounting for 29.8% of the wafer manufacturing materials market

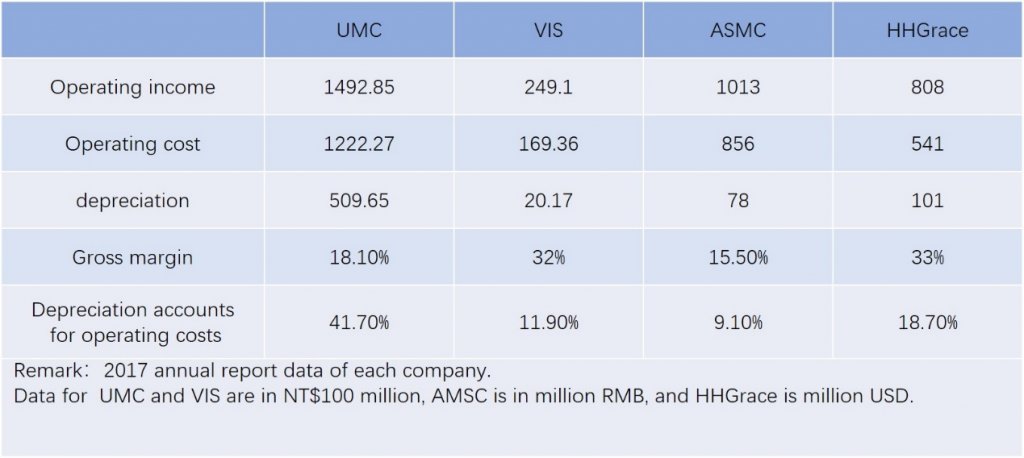

Comparison of UMC、 VIS、 ASMC and HHGrace

The depreciation amounts of different fabs have different effects on costs, so the proportion of silicon wafer in the total cost differs greatly under different depreciation ratios. Take UMC, VSI, ASMC, and HHGrace as examples. UMC and HHGrace has expanded production in recent years, depreciation occupies a relatively high proportion of the total cost. The cost of wafers has a minor impact on the total cost, while ASMC and VSI’s depreciation account for a relatively small proportion of the total cost. Therefore, the silicon cost is more sensitive to the total cost. Most 8-inch fabs have been depreciated, so 8-inch fabs are more sensitive to the price of silicon wafer.

Global wafer manufacturing material market size

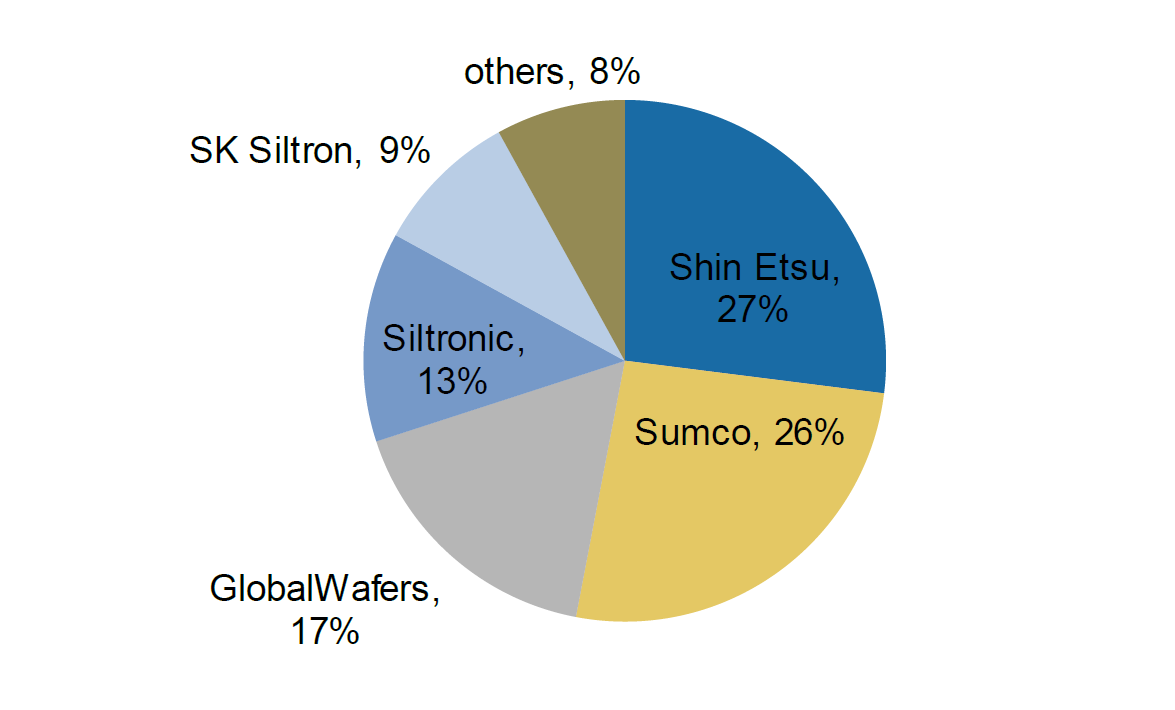

On the supply side, suppliers of silicon wafers include Shin-Etsu, SUMCO, Globalwafers, Germany Silitronic, and SK Siltron. The top five manufacturers have a combined market share of more than 90%. In addition, Wafer Works from Taiwan and Ferrotec are also important suppliers of 8-inch silicon wafers. At the end of 2017, the global 8-inch silicon wafer production capacity is approximately 5.4M/wpm.

Global silicon wafer market share

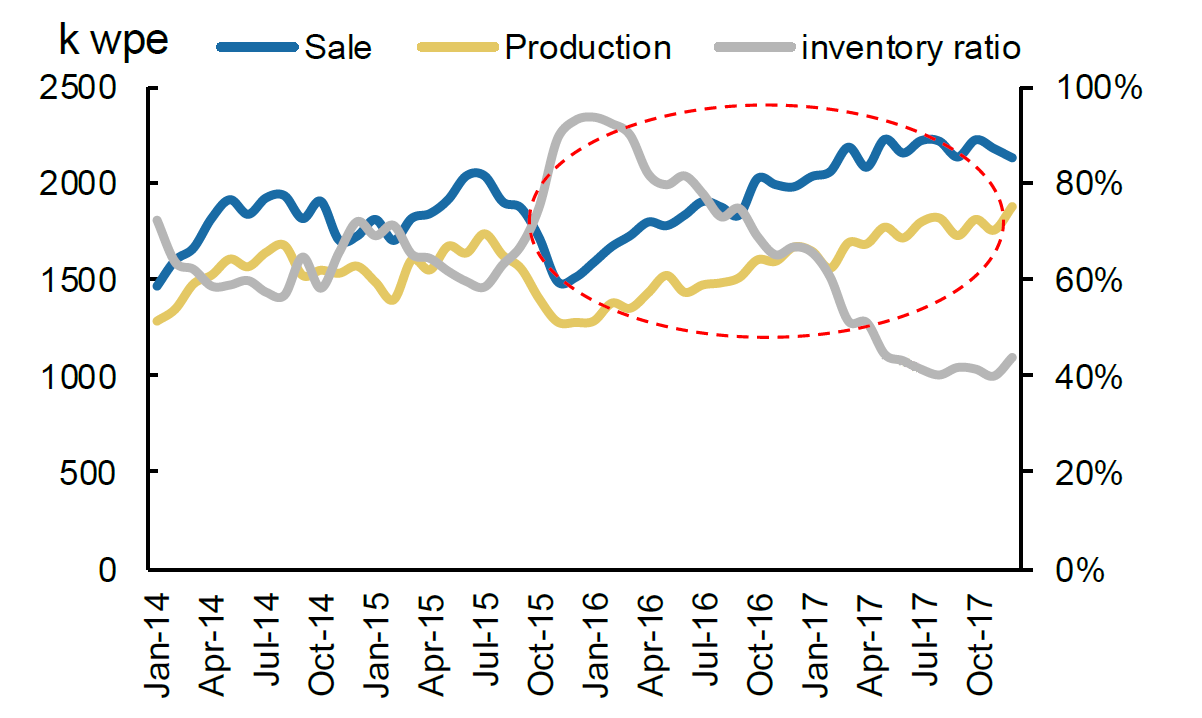

With the gradual increase in the utilization rate of 8-inch wafer fabs worldwide, the production of 8-inch silicon wafers has gradually increased and the inventory level has gradually declined. More than one-third of the world's 8-inch silicon wafers are produced in Japan. According to METI data, the production and sales volume of 8-inch silicon wafers in Japan began to increase at the beginning of 2016, while inventory levels gradually declined, and inventory ratios from the highest point of 90 % dropped to 44% at the end of 2017. The continuous increase in demand stimulated the tight supply of 8-inch wafers in the first quarter of 2017, and started to increase prices from then. It is reported that the overall price increase in 2017 was approximately 3%. In the first quarter of 2018, 8-inch wafers continued to be in short supply and prices rose by about 10%.

Japanese 8-inch wafer production sales and inventory levels

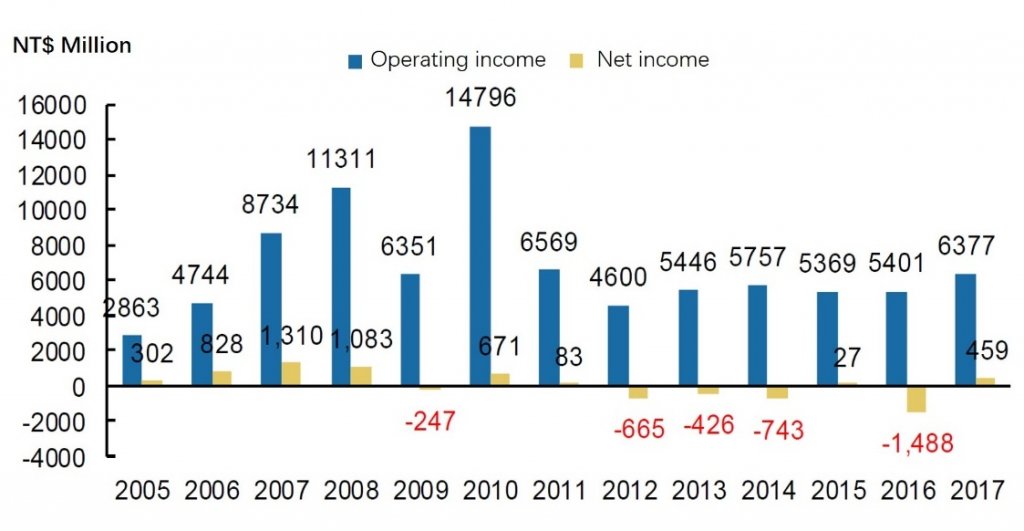

Due to the limited price increase and the limitation of the expansion cycle, the tense situation of 8-inch wafers cannot be effectively alleviated in the short term. Although the price of 8-inch silicon wafers has risen by more than 10% since beginning of 2018, the current 8-inch silicon wafer price is still at historically low levels from a long period of time. Since 2007, 8-inch silicon wafer prices have dropped by about 40%. Most 8-inch silicon wafer factories have been lost for many years, so even if the price of 8-inch silicon wafers increases, the willingness of the silicon wafer producer to expand production is still low. In addition, the expansion period of silicon wafers is at least one year or more. Therefore, the industry generally believes that the shortage of 8-inch silicon wafers and the price increase will continue in the short-term. The shortage of silicon wafer production capacity may limit the production capacity of 8-inch wafer fabs in downstream.

WAFER WORKS’ lost during the past years

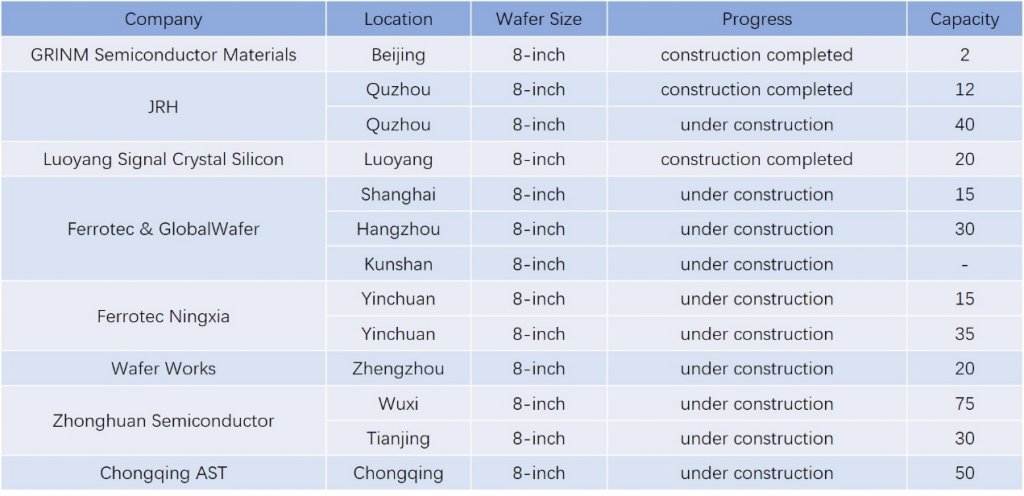

At present, the manufacturers that actively expand 8-inch silicon wafers include WAFER WORKS from Taiwan, Ferrotec from Japan, Gritek, JRH, and AST from mainland China.

In mid-2017, Globalwafers and Ferrotec announced a partnership. Ferrotec is responsible for the production of 8-inch wafers, while Globalwafers is responsible for providing technology and ensuring quality. The cooperation is divided into three phases, each phase plans to increase the monthly production capacity of 150,000pcs of 8-inch wafers. Therefore, it is expected that the global 8-inch silicon wafer production capacity will increase by 0.35M/wpe in 2018, an increase of about 6% over 2017, and the overall supply of silicon wafers will remain relatively tight.

8-inch wafer expansion schedule worldwide

Forecast for the future: The impact of tight 8-inch wafer capacity on the industry chain

We believe that the main factors affecting the supply and demand relationship of 8-inch wafer production capacity are:

1) 8-inch wafer capacity and demand;

2) The impact of the 6-inch wafer production line and 12-inch wafer production capacity changes on the supply and demand of 8-inch wafer production capacity;

3) The shortage of 8-inch silicon wafers limited the full release of actual capacity.

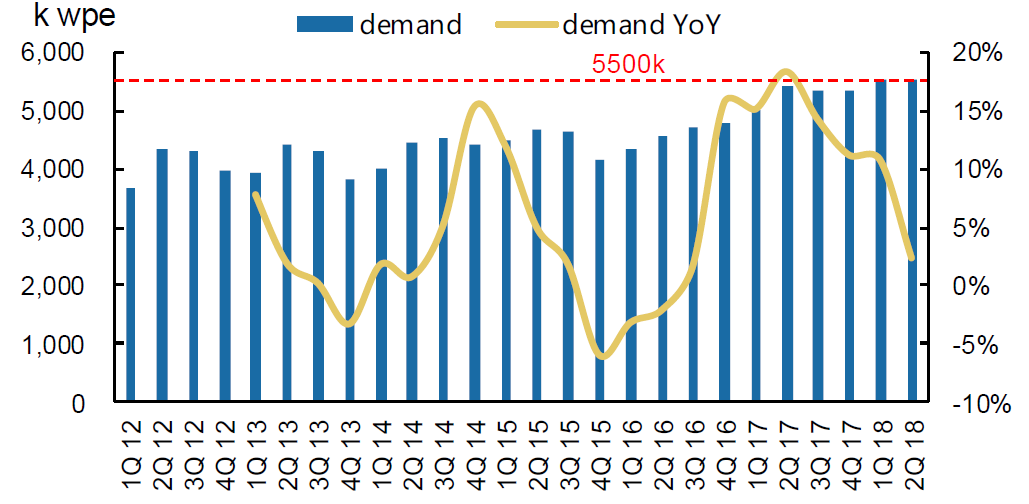

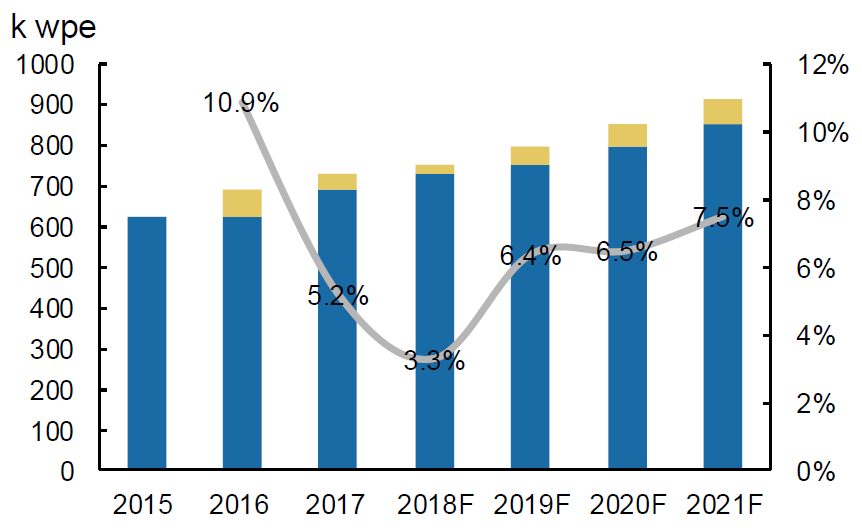

On the demand side, according to SUMCO's report at the first quarter’s performance briefing, the global 8-inch wafer demand for the first quarter of 2018 was about 5.5M/Wpe, which we consider that SUMCO has observed through downstream fabs’demands. Due to the current 8-inch wafers shortage, the exact demand of the downstream is not fully reflected in this figure, the actual global demand for 8-inch wafer capacity is higher than 5.5M/wpe.

Source:SUMCO

SUMCO predicts global 8-inch wafer demand

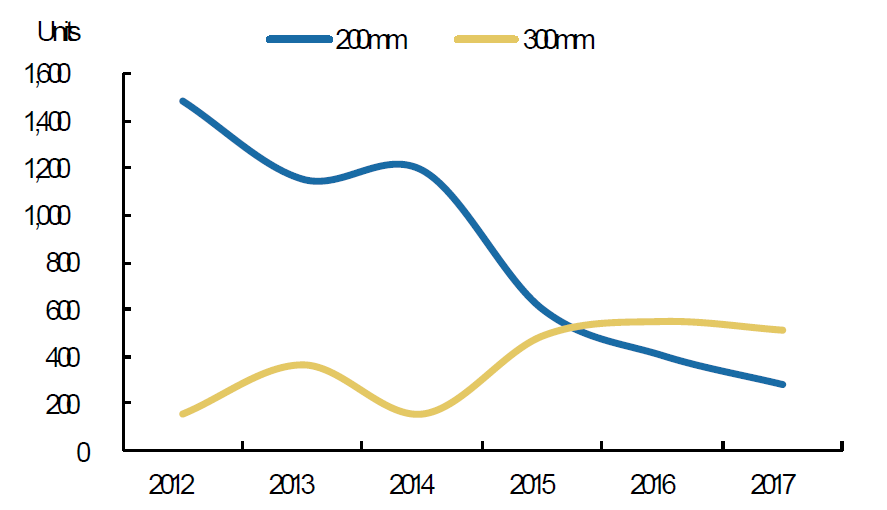

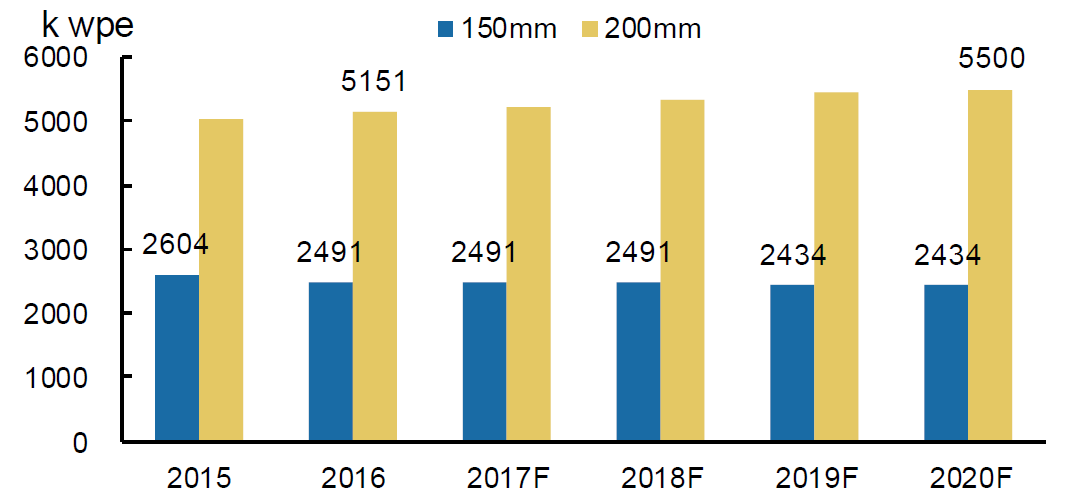

On the supply side, according to the SEMI report, 27 new 8-inch wafer fabs will be put into operation worldwide from 2015 to 2020. It is expected that the global 8-inch wafer production capacity will reach 5.5M/wpe by 2020. As the fab's capacity cannot continue to reach 100% utilization, if the actual capacity utilization rate is considered, the supply of 8-inch wafer capacity will remain tight by 2020.

After 2016, the 6-inch wafer production capacity is relatively stable and shows a slight downward trend. It is expected that the production capacity will drop slightly by 57k/wpe in 2019, which equle to 32k/wpe for 8-inch wafers. Therefore, the reduction in the 6-inch wafer production capacity makes the 8-inch wafer capacity demand increased slightly.

Source: SEMI

Global 6-inch and 8-inch wafer capacity forecast.

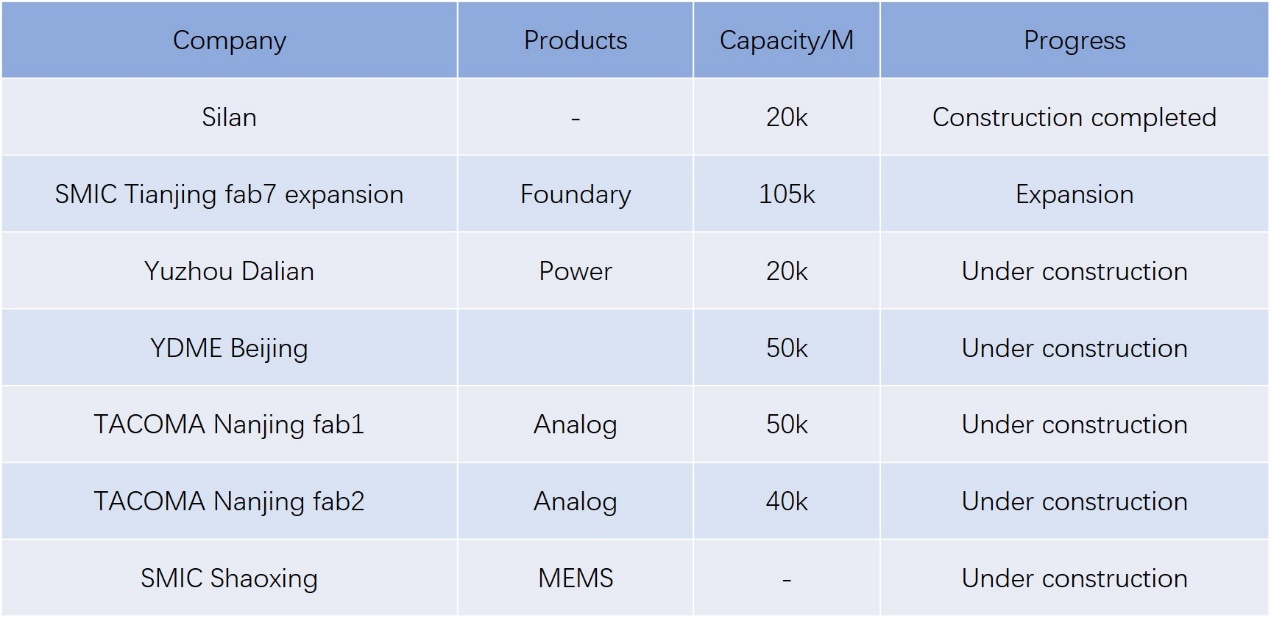

Among them, about half of 8-inch wafer production capacity expansions from 2015 to 2020 are from mainland China. According to the data released by SEMI in July 2017, the currently-produced 8-inch wafer production capacity in the mainland is approximately 0.7M/wpe, and is expected to reach 0.9M/wpe by the end of 2021. From 2016 to 2021, China will add 8 wafer fabs, including 2 foundries, 2 for analog chips, 2 for MEMS, 1 for power semiconductors, and 1 for digital chips.

New wafer production lines in mainland China since 2015

Source: Semi

Mainland China 200mm wafer fab capacity

The 12-inch wafer fab built by Nexchip (a joint venture between Taiwan Powerchip and Hefei Government) is expected to have a significant impact on the global 8-inch wafers market share. Nexchip plans to build four 12-inch wafer fabs in Hefei. The first N1 plant was completed in trial production in June 2017, and it will enter mass production by the end of 2017. It is expected that the capacity will reach 10,000 pcs monthly in the second quarter of 2018 and reach 40,000 pcs per month in 2019. The N1 plant will introduce 150, 110, and 90nm processes in the early stage, mainly producing panel driver ICs, PMICs, etc., while almost all LCD driver ICs and PMICs will be produced by 8-inch fabs. After the full mass production of the N1 plant in 2019, it will increase the capacity of 90,000 wafers per month for 8-inch wafers. The tight supply and demand relationship of the 8-inch wafer will be slightly eased by then.

In addition, manufacturers such as Infineon are planning 12-inch wafer fabs to produce products previously produced in 8-inch fabs, which will also affect the supply and demand of 8-inch wafers. On May 18, 2018, Infineon announced that it will invest 1.6 billion euros to build a 12-inch wafer fab in Austria, mainly for the production of power semiconductors. Construction began in the first half of 2019 and mass production will begin in 2021. In addition, STMicroelectronics stated in its January 2018 conference that it is preparing a 12-inch wafer test line in Agrate. By then, the imbalance in the supply and demand of 8-inch wafers will be further eased.

Based on the calculation of the supply and demand of 8-inch wafer capacity and the capacity of 6-inch and 12-inch wafers, according to estimates, the global 8-inch wafer capacity supply can reach 5.43M/wpe in 2019, and the new capacity needs to be ramped up, so the actual capacity will be slightly less than this figure, and the overall demand is at least 5.53 + 0.03 (6-inch wafer transfer order) -0.09 (Nexchip 12-inch fab) = 5.47M/wpe. Therefore, in 2019, global 8-inch wafer production capacity will remain tight.

All Comments (0)