Recently, FH Advanced Technology, the biggest MLCC producer in mainland China, has released the announcement of the revised semi-annual performance forecast for 2018. The company had expected net profit for the first half of the year to be 280 million yuan to 320 million yuan. After the amendment, the value was 405 million yuan to 440 million yuan, a year-on-year increase of 262.61%-293.95%.

FH Advanced stated that the company's substantial growth in performance was mainly due to the positive impact of the company's main product market demand, product price increases and product structure adjustment. The company's performance exceeded expectations mainly due to the continued high demand of the passive components, especially the overall price increase of the MLCC and chip resistor.

In addition to benefiting from the optimization of industry supply and demand pattern, MLCC is currently in the boom cycle:

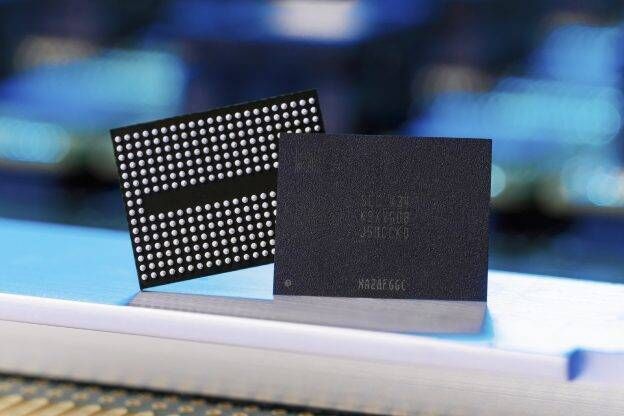

(1) Smart phone hardware upgrades, automotive electronics, and electric vehicles are booming, and downstream demand for MLCC is strong.

(2) MLCC industry giants adopt a conservative capacity expansion strategy and old capacity switching, resulting in tight supply capacity. Considering that it will take some time for the global MLCC capacity expansion to be effective, it is expected that this round of industry boom will continue until the first quarter of 2019.

At present, the main production capacity of the global MLCC is controlled by Japanese (Murata, Taiteng, TDK, etc.), Korean (Samsung), Taiwanese (Yageo, Walsin, etc.), and the industry price increase in the first quarter of 2017-2018 is mainly Taiwanese manufacturers dominate. The Taiwanese MLCC manufacturers adopted a bidding approach, resulting in a significant increase in average prices, while Japanese MLCC vendors adopted a robust supply chain cooperation strategy, and the increase in prices was relatively low.

At present, the industry has begun to enter the third quarter of the peak season, Japanese manufacturers may begin to lead the new industry price increase cycle. It is estimated that in the subsequent price increase cycle, the price increase of Japanese (Murata, Taiteng, TDK) and mainland (FH Advanced, CCTC, Eyang) companies will be higher than that of Taiwanese companies.

All Comments (0)