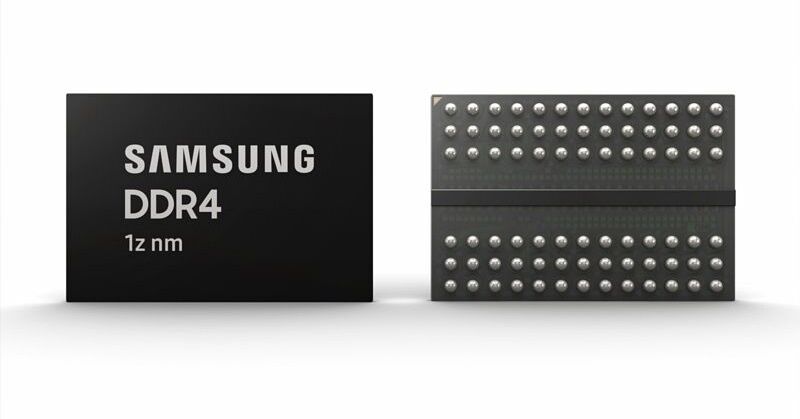

According to the latest report released by DRAMeXchange, the contract price of both DRAM chips and NAND Flash chips has declined, with DRAM forecasts down 5% or more.

Although the strategy of the main supplier of DRAM is to adjust the supply to control the price decline rate, for example, Samsung has clearly released the signal to slow down the investment in increasing production capacity. However, as the 1X/1Y nm yield rises and the market demand is not high enough, the supply quantity increased from the third quarter.

DRAMeXchange even gave a forecast of 2019 that DRAM prices may fall by as much as 15~20%. If buyers are on the sidelines, it may cause a bigger drop in DRAM prices.

As for NAND Flash, 2018 is declining throughout the year and will not change in the fourth quarter. According to some studies, the current 64-layer 3D TLC yield is as high as 90%, and the 72-layer next year will further compress the profit margin of NAND flash.

All Comments (0)