ADATA, a memory module maker in Taiwan, was affected by the end-of-year settlement of customers in December 2017. However, the combined revenue in the fourth quarter reached NT$8.228 billion, operating performance remained high, and grew 10.8% from the same period of the previous year; consolidated revenue for 2017 NTD 32.225 billion, grew 38.8% from the previous year.

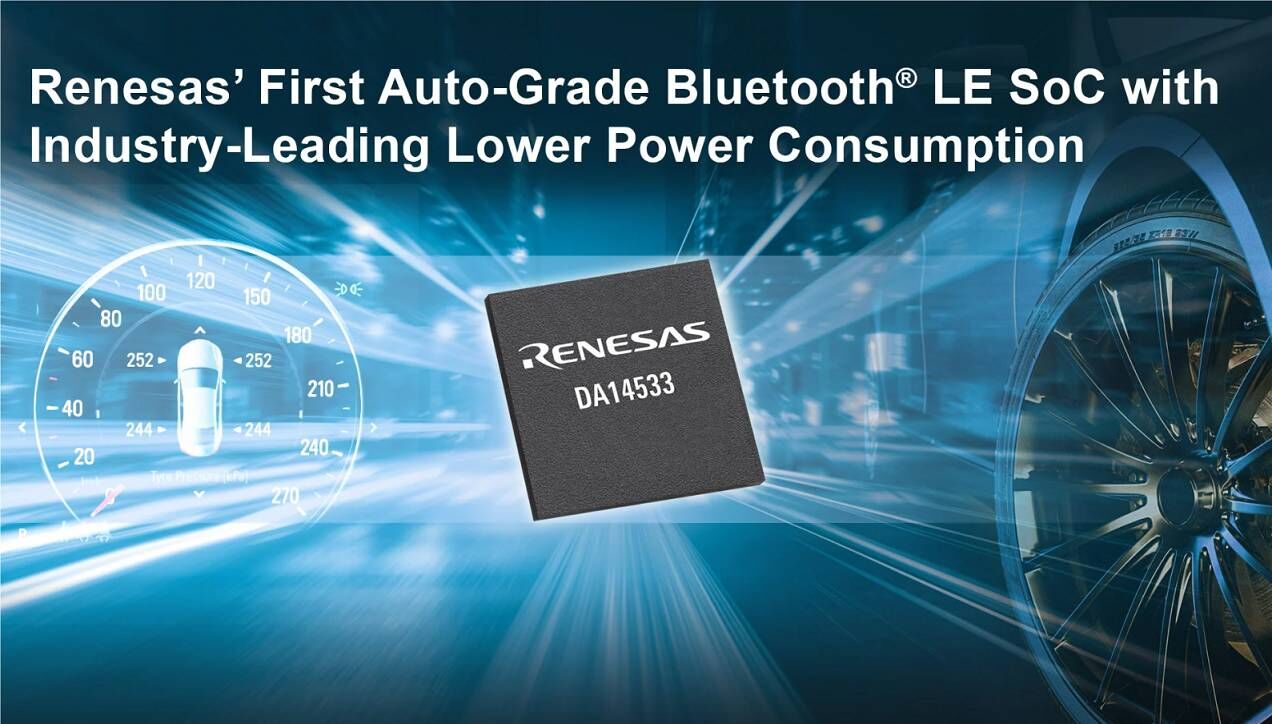

In terms of DRAM, founder and president of ADATA, Simon, pointed out that the point that people are afraid of this year is mainly Samsung’s production expansion. However, Samsung is also very cautious about the expansion of production. Therefore, the market trend of DRAM this year has already reached a decisive trend.

Simon further analyzed that the market is concerned that Samsung will change the second floor of the 12-inch Pyeongtaek plant into a DRAM factory, but the new production capacity still cannot affect the market demand and supply, but Samsung is very careful about expanding DRAM production capability. In particular, most of the Samsung’s profits last year are from DRAM. Second, NAND has battles to fight this year, Samsung will not disrupt the profitable DRAM market itself.

About NAND, Simon stated that there has been so much price increase in 2017, with more production capacity added this year, the first half of the year will be under the condition of production reduction. The market believes that the price will drops in the first quarter of this year. However, after entering the third quarter, the supply will naturally get tight because of the mobile phone demand.

Simon pointed out that the capacity of DRAMs and NAND flash devices on new smart phones will increase. Therefore, DRAMs that have been in shortage since the first half will be even tighter in the second half of the year. NAND Flash’s oversupply in the first half of the year and the price will fall. But may stop falling and get stable after the third quarter.

All Comments (0)