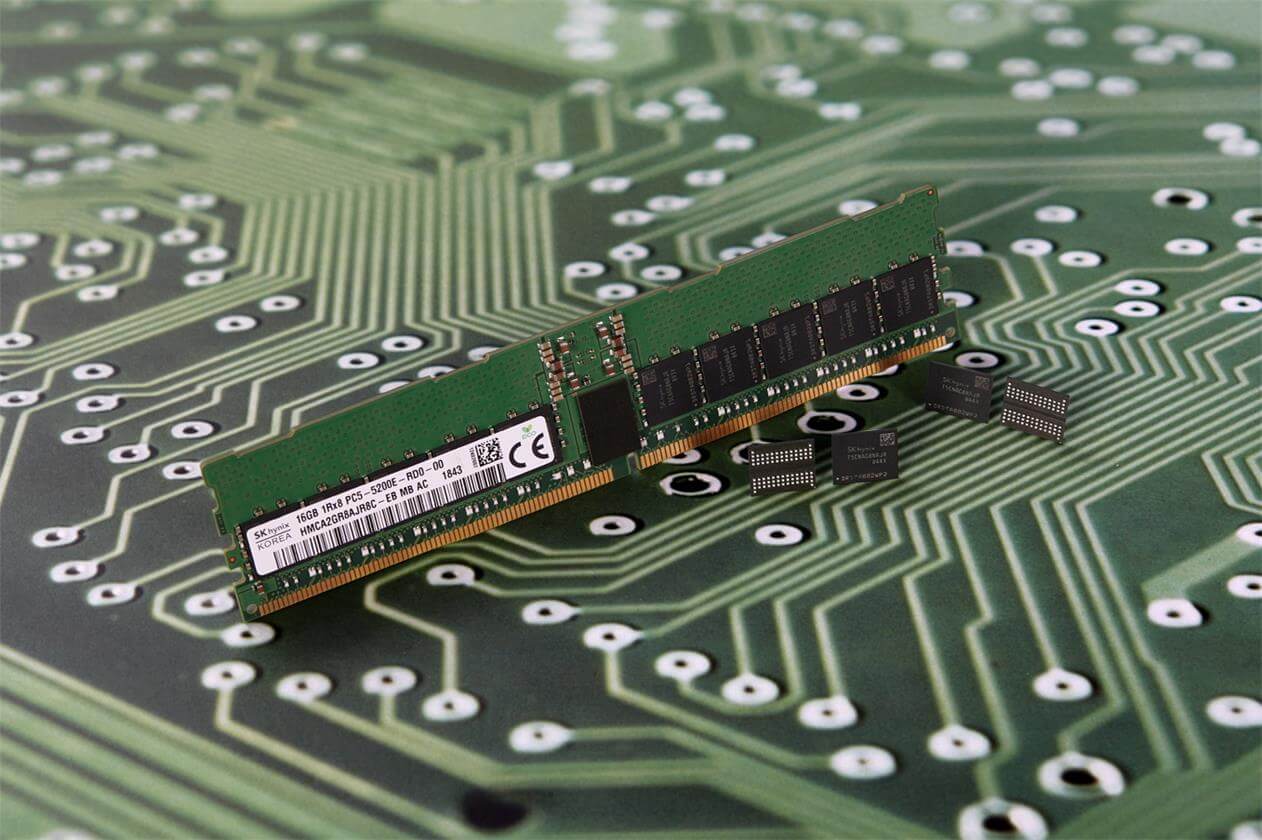

According to the latest survey by DRAMeXchange, the DRAM price in the fourth quarter was slightly lower than the previous quarter, about 5%. The volume of transactions in October increased significantly compared to the first month of the previous quarter. DRAMeXchange pointed out that once the supplier's inventory is reduced, it will help DRAM prices to stabilize and rebound in 2020.

Regarding DRAM price trends, DRAMeXchange estimates that DRAM prices will decline by 50% in 2019 compared to last year, and the quarterly decline in the first quarter of next year will be kept below 10% compared to the fourth quarter of this year.

In response to recent media reports on the expansion of the memory industry, DRAMeXchange believes that Samsung will not increase its plans for the first half of next year. The current capital expenditure plan is only to purchase new equipment for 1Z nano-process; SK Hynix will reduce Next year's capital expenditures, which means that supply growth will slow down next year; although Micron Semiconductor has not formally announced its capital expenditure plan next year, it is expected to be conservative this year.

In the spot market, DRAMeXchange pointed out that compared with the contract market, the spot market momentum is much weaker. Since the trading volume of the spot market has dropped sharply, the price is likely to fluctuate drastically due to market news.

DRAMeXchange further stated that the current spot price trend is still within the expected range. As long as the contract price trend is stable and demand does not fall, the short-term spot price trend will not affect the overall market conditions.

All Comments (0)