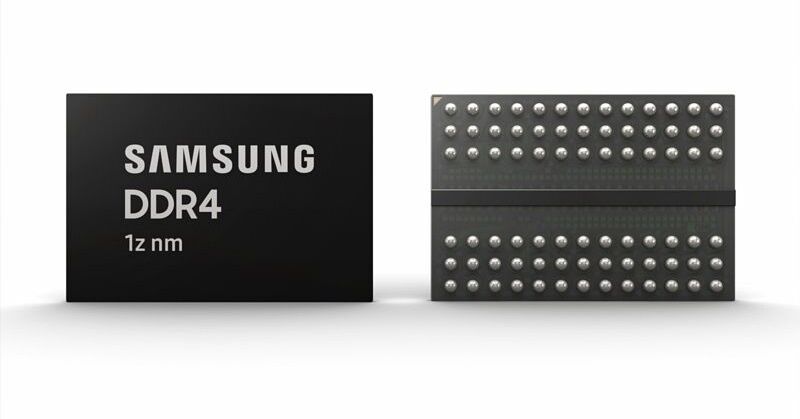

Samsung recently announced its first-quarter earnings report, which showed that Samsung’s first-quarter revenue was 55.33 trillion won (about $45.297), an increase of 5.61% from 52.39 trillion won in the same period last year. As for net profit, it was 4.88 trillion won (about $4 billion), which was 3.15% lower than 5.04 trillion won in the same period last year, but it was better than previous financial estimates.

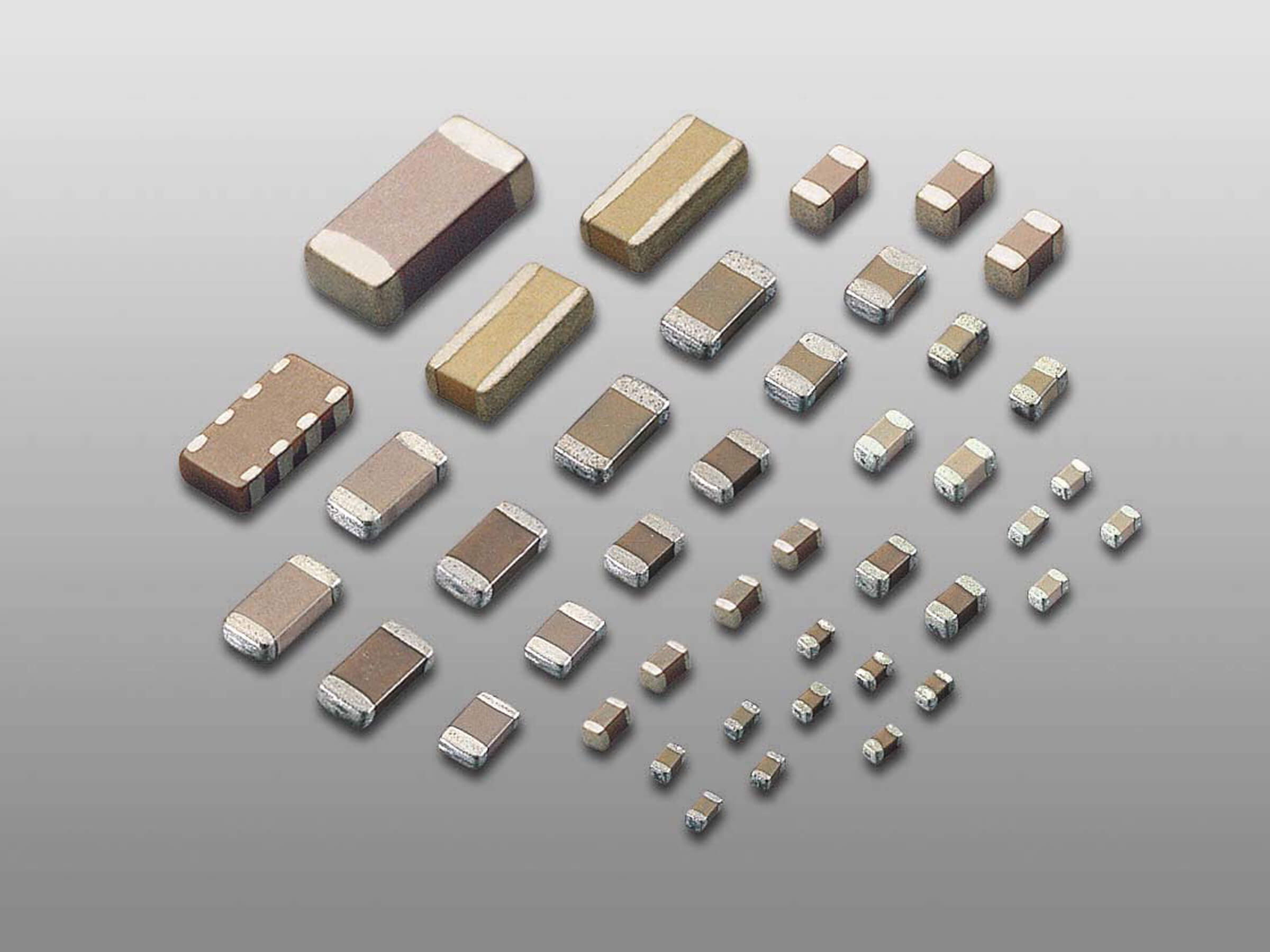

Analyst Shinhan Investment said that Samsung’s first-quarter earnings report was higher than expected due to Chinese smartphone manufacturers’ inventory adjustment of electronic components, and the demand for components from strategic customers remained strong. In addition, some customers have advanced their purchase plans due to concerns about supply disruption. Overall, Samsung's MLCC shipments and average sales price in the first quarter increased by 6% and 2%, respectively.

However, analysts also pointed out that the impact of the COVID-19 pandemic on Samsung will show up in the second quarter. Weak smartphone sales and weaker-than-expected market demand will lead to lower sales.

In the short term, the demand outlook for MLCC is uncertain, and due to the disruption of production in the Philippines and Japan, the overall market supply should be reduced. However, under the rising trend of global 5G and automotive demand, analysts are optimistic about the medium- and long-term demand of MLCC, and it is expected that the demand for Samsung MLCC will increase significantly in 2021.

All Comments (0)