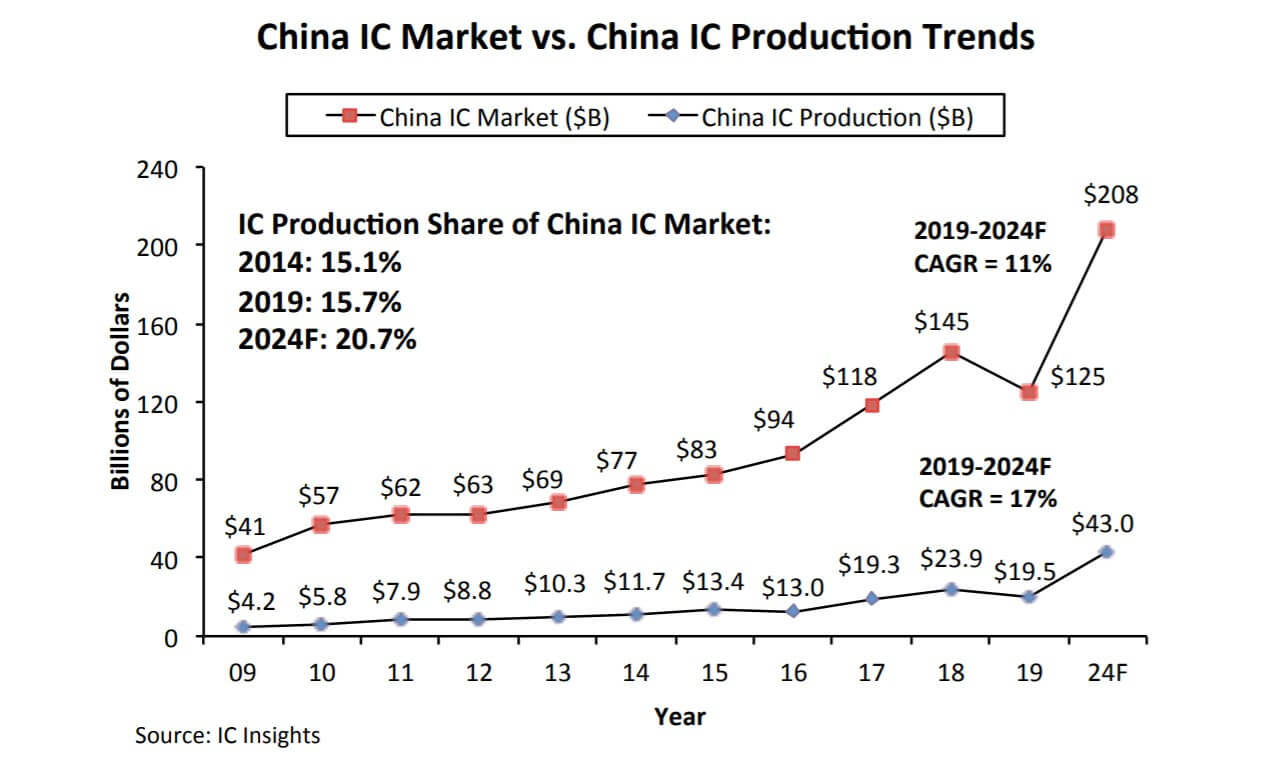

According to the latest report released by IC Insights, in 2019, China's IC production accounted for 15.7% of the global $125 billion IC market, only slightly higher than 15.1% in 2014. IC Insights predicts that this share will increase by 5% to 20.7% by 2024.

The report pointed out that among the $19.5 billion worth of ICs made in China last year, mainland China-based companies produced only $7.6 billion (38.7%), accounting for only 6.1% of China's $124.6 billion IC market. Among them, about $1.8 billion from IDM, $5.8 billion from foundries such as SMIC. IC Insights pointed out that in 2019, most of the IC production capacity in mainland China comes from SK Hynix, Samsung, Intel and TSMC and other international semiconductor manufacturers with factories in mainland China.

IC Insights predicts that by 2024, the total amount of ICs made in China will increase to $43 billion, accounting for 8.5% of the forecasted global IC market of $507.5 billion in 2024. Even after the substantial increase in IC sales of some Chinese OEM manufacturers, by 2024, China’s IC output may still account for only about 10% of the global IC market.

Even though Chinese startups YMTC and CXMT are building new IC production lines, IC Insights still believes that international semiconductor manufacturers will become important contributors to China's IC production capacity in the future. Therefore, IC Insights predicts that by 2024, at least 50% of China ’s IC output will come from these international companies, such as SK Hynix, Samsung, Intel, TSMC, UMC, and Powerchip, which have factories in China.

IC Insights emphasized that analog, mixed-signal, server MPU, MCU, and logic IC accounted for more than half of China's IC market last year, but mainland China still lacks these non-memory technologies. These markets are still dominated by foreign IC manufacturers such as ADI, Texas Instruments, STMicroelectronics and Intel.

Despite China's rapid development in the memory market, the non-memory IC field is a more serious challenge for China. IC Insights believes that it will take decades for Chinese companies to gain competitiveness in the field of non-memory IC products.

All Comments (0)