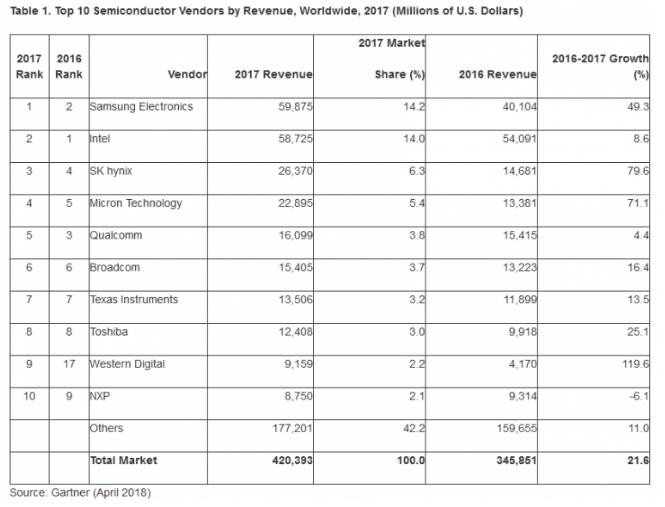

Gartner Research Director George Brocklehurst said: "In 2017, the semiconductor industry has two milestones, that is, more than 400 billion US dollars in revenue, and Intel's number one in the past 25 years has been defeated by Samsung Electronics. Both milestones are due to the rapid growth of the memory market. As a result, insufficient supply has led to higher prices for DRAM and NAND flash memory."

The memory market soared nearly 50 billion U.S. dollars in 2017 to reach US$130 billion, an increase of 61.8% over 2016. In 2017, Samsung’s memory revenue increased by nearly US$20 billion, making its semiconductor revenue the highest in 2017. Gartner predicts that the company’s leading position will be short-lived and will drop when the memory market enters the recession in late 2019.

The boom in the memory market masked strong growth in other categories in 2017. The non-memory semiconductor market grew by 24.8 billion U.S. dollars, reaching 290 billion U.S. dollars, with a growth rate of 9.3%.

Samsung and SK Hynix continued to maintain high growth in semiconductor profits in 2018.

According to Samsung’s financial report for the first quarter, the company’s operating profit was US$ 14.7 billion in the first quarter of March. Analysts had expected an average of 13.6 billion U.S. dollars. The company's first-quarter revenue reached 56 billion US dollars, after analysts expected an average of 57 billion US dollars.

The semiconductor business contributed the most profits for Samsung. According to data from InSpectrum Tech Inc., the price of 128Gigabits multi-level cell NAND flash memory chips fell by 10.7% from the same period of last year, while 32Gigabits over the same period last year. The contract price of the DRAM server module increased by 5.6% year-on-year.

SK Hynix Financial Report pointed out that in the first quarter of 2018, revenue rose by 38.6% compared to the same period in 2017 and came to 8.7 trillion won. The operating profit was 4.4 trillion won, which was better than Wall Street analyst expectations of 4.3 trillion won, but it was lower than the 4.47 trillion won in the fourth quarter of 2017. It also ended the four-quarter growth record. In this regard, SK Hynix pointed out that sales were mainly weak in the mobile business sector.

The total revenue of the top 10 semiconductor manufacturers increased by 30.6% in 2017, accounting for 58% of the total market, while other manufacturers' revenue increased by 11.0%.

In 2017, the M&A transactions in the semiconductor industry fell sharply. The volume of transactions only half of 2016. However, the scale of transactions in the semiconductor industry continues to rise and become more complex, so completing M&A becomes more challenging. Avago bought Broadcom for $37 billion in 2016, but the record was quickly broken by $44 billion from Qualcomm's acquisition of NXP Semiconductors.

The growth of the IoT has had a significant impact on the semiconductor market. In 2017, the ASSP for consumer applications grew by 14.3%, and the industrial ASSP grew by 19.1%. In spite of rising component prices and the slowdown in the smart phone industry, semiconductor growth for wireless connectivity increased by 19.3% in 2017 and exceeded US$10 billion for the first time.

All Comments (0)