According to CNBC reports, CEO Tom Caulfield said in a recent interview that GlobalFoundries plans to invest US$1.4 billion in its chip factories this year and may double this investment next year.

Caufield said the company’s manufacturing capacity is completely booked and that industrywide semiconductor supply could lag behind demand until 2022 or later.

“Right now all our fabs are not only more than 100% utilized, we are adding capacity as fast as we can,” Caulfield said.

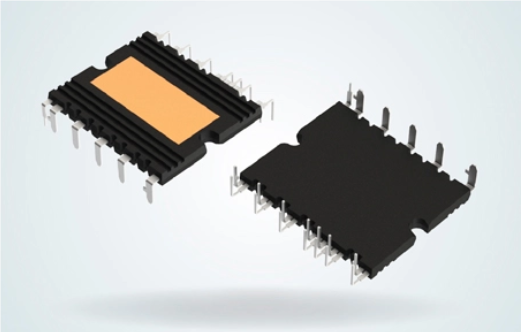

CNBC point out that GlobalFoundries manufactures secure chips for contactless payments, battery power management and touch display drivers. These chips first were used in large quantities for smartphones, but are now included in a wide range of products from cars to appliances, which has created a surge in demand.

However, most of the investments in the foundry world have been for building bleeding-edge, high-speed chips. That all changed last year when the pandemic hit, and sales of electronics including laptops, monitors, and game consoles rose when people bought equipment to work or go to school from home.

GlobalFoundries warned it will take months before it can increase the number of chips on the market, but that the capacity boost makes sense for long-term investments. “The minute you say, I want to make more capacity, it’s a 12-month cycle,” Caulfield said.

“The semi industry going into Covid was projecting a 5% annual growth rate for five years. We’re projecting that to almost double now,” Caulfield said. “It’s not a one-time thing. It’s a structural shift, that the pervasive need for semiconductors is accelerating.”

All Comments (0)