On April 12th, Automotive News Europe published a report titled Path Out of Chip Shortage: New Capacity, New Thinking - and Patience. The report elaborated on the recent difficulties faced by the automotive industry in chip supply, and gave meaningful insights into the future of the automotive industry in chip procurement.

The report point out that, the automotive industry has been able to work through most supply disruptions, but the chip shortage that has brought persistent production stoppages since December -- with no end in sight -- has baffled even the most hardened veterans.

"I have been in this industry for 31 years, and this is a situation I have never experienced before," said Peter Schiefer, president of the automotive division at Infineon Technologies, one of the largest automotive semiconductor makers, especially for power electronics.

Autonews stated that from Japan to Europe to North America, automakers have been forced to halt production lines for days or weeks. Some, including General Motors and Ford Motor, have resorted to omitting key components from vehicles to keep factories running. Others have strategically shifted toward building high-value vehicles at the expense of others -- but in a cruel twist, those more expensive cars also use more of the scarce microprocessors that are in such short supply.

There is no easy path to preventing such a situation in the future, experts said, because of the cost and complexity of the global semiconductor industry.

"In the short term, it's about trying to squeeze more capacity out of any place you can," said Phil Amsrud, a senior principal automotive semiconductor analyst at IHS Markit.

In the longer term, he and other experts said, the auto industry will have to rethink how it sources semiconductors and also wait for commitments to increase capacity from the EU, other governments and major chipmakers to become reality -- a process that will take years.

Automakers and analysts were optimistic that the shortage would work itself out in the second half of this year, but recently those predictions have changed for the worse.

A fire in mid-March at a Renesas factory in Japan that charred equipment and contaminated clean rooms. That followed a rare winter storm in Texas in February that knocked out power for up to a month at factories owned by NXP Semiconductors, Infineon and Samsung.

James Norris, an analyst with LMC Automotive, said at the end of March that the "latest incoming information suggests that production disruptions will be more severe than initially thought," with the shortage "expected to drag on until the closing months of 2021 and undermine the capacity for automakers to catch up lost volumes in the second half."

LMC is now forecasting that chip shortages will cost Europe 330,000 units this year, with the main losses at Daimler, Ford, Renault and Volkswagen Group.

The global deficit could be 2 to 3 million vehicles, said Ondrej Burkacky, a leader of consulting firm McKinsey's global semiconductor practice.

Even if supply contraints begin to ease in the third quarter, danger lurks because of the seasonal nature of semiconductor demand: Ahead are Black Friday in the U.S. and Singles Day in China, when buyers rush for holiday bargains.

"That's High Noon for producing all the chips that go into these consumer electronics devices," Burkacky said. "I would expect the second half of the year to be tougher."

Infineon's Schiefer said he also expects disruptions to last throughout the year. "This will not be sorted out in the next few weeks," he said, because of the long lead time needed to source and produce chips, not to mention the years it could take to build out new capacity.

The ultimate cost to automakers is difficult to calculate. Production losses from the chip shortage are a small fraction of total output and are difficult to untangle from pandemic-related demand levels. In other words, if demand is down, a temporary factory halt may not be as serious as if demand were high. And other costs such as for expediting materials and starting and stopping an assembly plant could be shared among the supply chain. IHS Markit says price hikes of 10 to 15 percent for MCUs are "plausible."

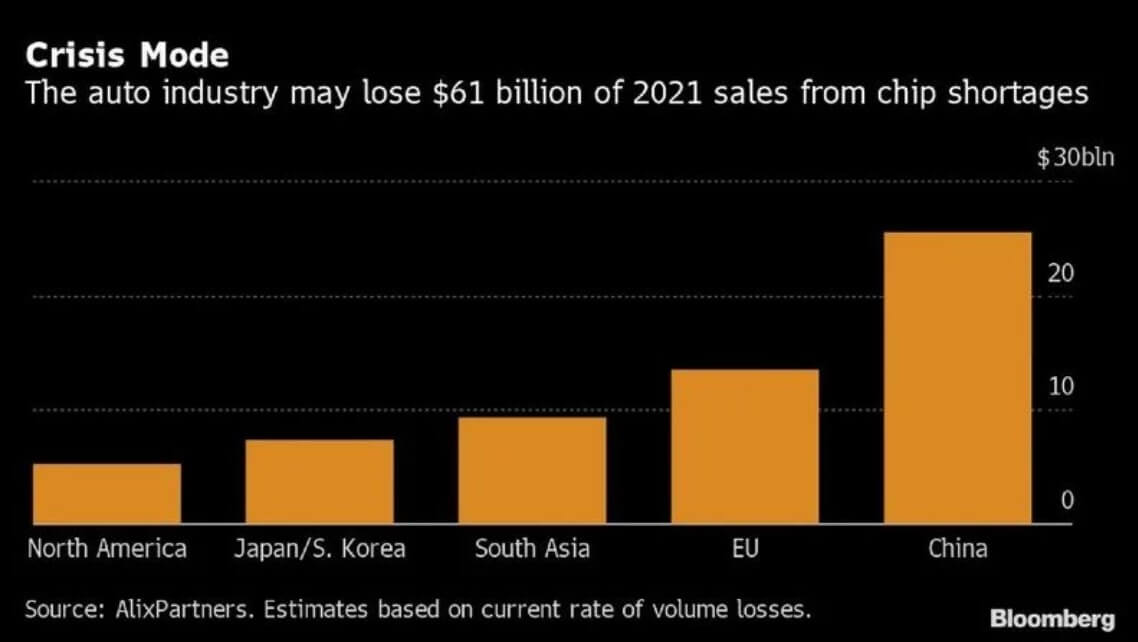

Nonetheless, Ford has said profits could be hit this year by $1 billion to $2.5 billion, and GM has cited a figure of $2 billion. AlixPartners has estimated that the total hit to the automotive industry, across the full supply chain, could be as much as $60 billion.

How did we get here?

The global semiconductor market is huge, with an estimated value of 450 million euros ($530 billion) -- but automotive applications make up 10 percent or less of that figure, analysts said.

Infineon's Schiefer said the total semiconductor content per vehicle of an internal combustion engine car is about $450, but that number doubles for a full-electric vehicle due to the electronics needed to manage the power flow.

There is scarcely a system in the modern car that does not rely on semiconductors, from power electronics that control the flow of energy in an electric vehicle to advanced driving assistance systems (ADAS) to infotainment to sensors that operate interior lights.

The megatrends driving the automotive business -- connectivity, electrification, autonomous vehicles -- are also pushing up the need for semiconductors. McKinsey's Burkacky says growth will be about 5 percent annually, even with a decrease in automotive production, as content per vehicle increases.

Asif Anwar, a director at consultancy Strategy Analytics who specializes in automotive semiconductors, says the total value by 2027 will be about $66 billion -- almost double that of 2020.

But not all of these semiconductors are affected by the recent shortages. Many automotive applications use older technologies that are very specific and nontransferable.

The key measurement is "process nodes," which refer generally to a semiconductor technology generation. These nodes are measured by nanometer (nm). Typically, the smaller the process mode, the more advanced the application.

For example, common MEMS sensors are built using a 180 nanometer process mode and are mostly made in-house by suppliers. At the other end of the scale are AI chips, systems on chip (SoCs) and graphics processing units (GPUs) that are used on ADAS domain controllers, which are built on process nodes below 16 nm. These chips, and the next sizes up, are largely built in staggeringly expensive "foundries" mostly operated by Taiwan Semiconductor Manufacturing, or TSMC, whose presence looms large over the automotive chip shortage, as well as by Samsung.

But the automotive sweet spot is microcontroller units (MCUs), integrated circuits that are used in every domain -- powertrain, chassis, body and ADAS -- where they are essential to the electronic control units that enable functions such as antilock brakes, stability control, airbags and automated parking.

MCUs are generally built on 16 nm to 40 nm process nodes -- and TSMC produces about 70 percent of all automotive MCUs, according to IHS Markit.

"What makes them so special is that they are everywhere in the car," IHS' Amsrud said. "There are almost no systems that come to mind right now that don't have an MCU in them."

IHS found that an Audi Q7 SUV has 38 MCUs, from seven different suppliers, including five each in the infotainment and chassis/body control domains.

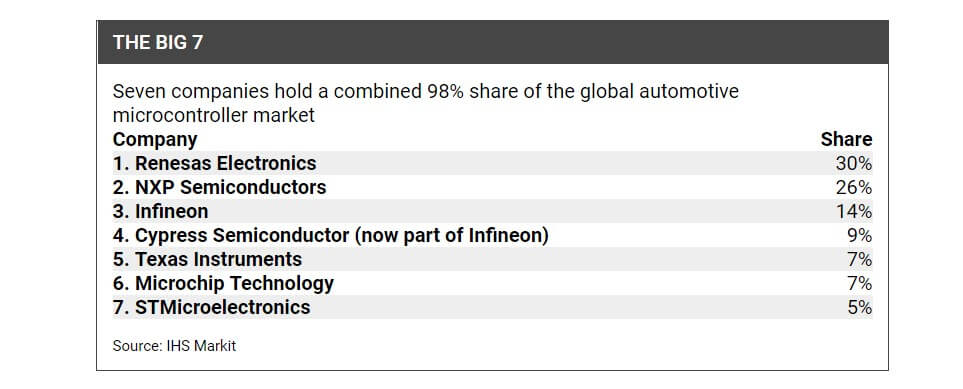

Those seven suppliers control 98 percent of the automotive market, with Renesas of Japan holding a 30 percent share, NXP at 26 percent and Infineon at 25 percent, (including newly acquired Cypress Semiconductor, the fifth-largest supplier).

The other big names are Texas Instruments, Microchip Technology and STMicroelectronics (see chart, below).

Reliance on Taiwan

As MCUs have gotten more sophisticated and process node size decreased, automotive chipmakers have outsourced production in the past decade to silicon foundries, mostly to TSMC, Amsrud said.

"Right now, MCUs are the poster child" for the industry's reliance on TSMC, he said.

In-house production at automotive suppliers is limited to specialized products, mostly on larger nodes, Amsrud said. Infineon, for example, has five factories in Europe that make sensors and chips for power electronics; Robert Bosch will have two "wafer fabs" in operation by the year-end for its own needs.

"We mostly build sensors and power electronics in our own factories," Infineon's Schiefer said, "but for MCUs 90 nanometers and under we use silicon foundry partners. That is why in the first wave of the shortage the impact at Infineon was basically in microcontrollers."

TSMC has a grip on the automotive MCU market, but automotive applications make up just 3 percent of its business.

"You are talking millions of units of annual vehicle production, but billions of handsets being produced," Strategy Analytics' Anwar said. "So, the automotive industry finds itself at the back of the queue." TSMC might want the automotive business, he said, but clients such as Apple, Intel, Samsung and Sony can dwarf what an automotive supplier might order.

And TSMC, as a pure chip foundry, is one of the few companies that can justify the construction of a "clean room" factory for the smallest nanometer nodes. Such a facility can cost $10 to $15 billion, analysts said, and needs to run at 75 percent and ideally 90 percent capacity to be profitable, so a diversified customer base in critical.

A semiconductor supplier farther up the value chain such as Infineon cannot make the business case for such a facility, analysts said.

In ADAS or infotainment, which require small-node chips, "You would need to have 25 to 30 percent global market share on all vehicles for that to pay off investing in your own manufacturing, and nobody has such a share," McKinsey's Burkacky said.

A 'perfect storm'

Production lines around the world ground to a halt last spring as the coronavirus outbreak became a pandemic. Desperate to conserve cash, automakers cut back or halted orders for all components. This had dire consequences for suppliers that depended on their auto clients, but had little effect on TSMC or at other foundries, which were benefiting from a wave of demand from other sectors.

Therefore, when automakers ramped up production last autumn, they found they had lost their place in line at the foundries.

It was a "perfect storm" of conditions working against automakers and their suppliers, Amsrud said.

Consumer electronics sales surged during the pandemic, as did demand for personal computers and servers to run applications such as Zoom so more people could work from home. The overall semiconductor market rose by 9 percent, Burkacky said.

Analysts said the auto industry was hamstrung in its efforts to get the needed chips by a number of other structural biases:

A focus on "just-in-time" sourcing in which automakers commit with purchase orders as little as three weeks ahead, Burkacky said, compared with a semiconductor industry that requires months' notice. IHS says MCU lead times are 26 weeks or more.

Optimizing for the bill of materials, which can lead to a wider variety of chipsets being sourced. "That leads to super-fragmentation on the manufacturing side," Burkacky said, noting that only one kind of chip can be made per line and making dual sourcing nearly impossible.

The way forward

Governments have waded into the chip crisis, pressuring Taiwan to increase capacity, but there is little they can do in the short term, analysts said.

The EU has declared microelectronics to be strategically important for the bloc's economic health. As with battery cells for electric vehicles, the EU has created an Important Project of Common European Interest, or IPCEI, to steer investment into the chip sector.

A microelectronics IPCEI dating to 2018, with 29 companies involved in 40 projects, and total initial financing of 1.75 billion euros, has helped Infineon and Bosch finance new chip facilities. A second microelectronics IPCEI is in the works.

While that may not seem like much money, "there is a multiplicative effect," Amsrud of IHS said, perhaps 10 times the initial investment. "We are talking about some real money," he added.

As an example, last month the European Commission approved 146 million euros in Austrian state aid to NXP and Infineon and another company for microelectronics research, which is expected to unlock 530 million euros in private funding.

And also last month, the EU said it was targeting a 20 percent value share of advanced semiconducting manufacturing by 2030, now an area dominated by TSMC and Samsung. The EU provided few details about how it would finance such an effort -- there are no such facilities currently in Europe -- and analysts questioned whether there would be regional demand for such chips.

Absent new capacity, analysts said the best path forward for the auto industry is to decouple chip sourcing from other components, by committing to earlier purchase orders, building up a buffer inventory and continuing to order chips through a downturn.

"The production of a car is a just-in-time thing, and it's the right philosophy, but semiconductor manufacturing is a very complex, time-consuming process. If you bring these two systems together, you will typically need a buffer [of inventory] to decouple them," said Schiefer of Infineon.

Toyota, for example, drew lessons from the Fukushima earthquake in 2011 and economic crisis in 2008-09 and built up a stockpile of chips, partly insulating it from disruption (Toyota also had its own semiconductor plant until 2019 when it transferred it to Denso). Others automakers that have managed their chip supply well include Hyundai and BMW, analysts said.

"Automotive players need to rethink how they do semiconductor sourcing," Burkacky of McKinsey said, "because they are not only competing against themselves, they are also competing against consumer electronics, against PCs and servers."

Editor's note: This post is reprinted from autonews.com, please visit Autonews for the original post.

All Comments (0)