IC Insights recently released its latest report, updating its forecasts for 33 major IC product categories such as DRAM and NAND flash memory.

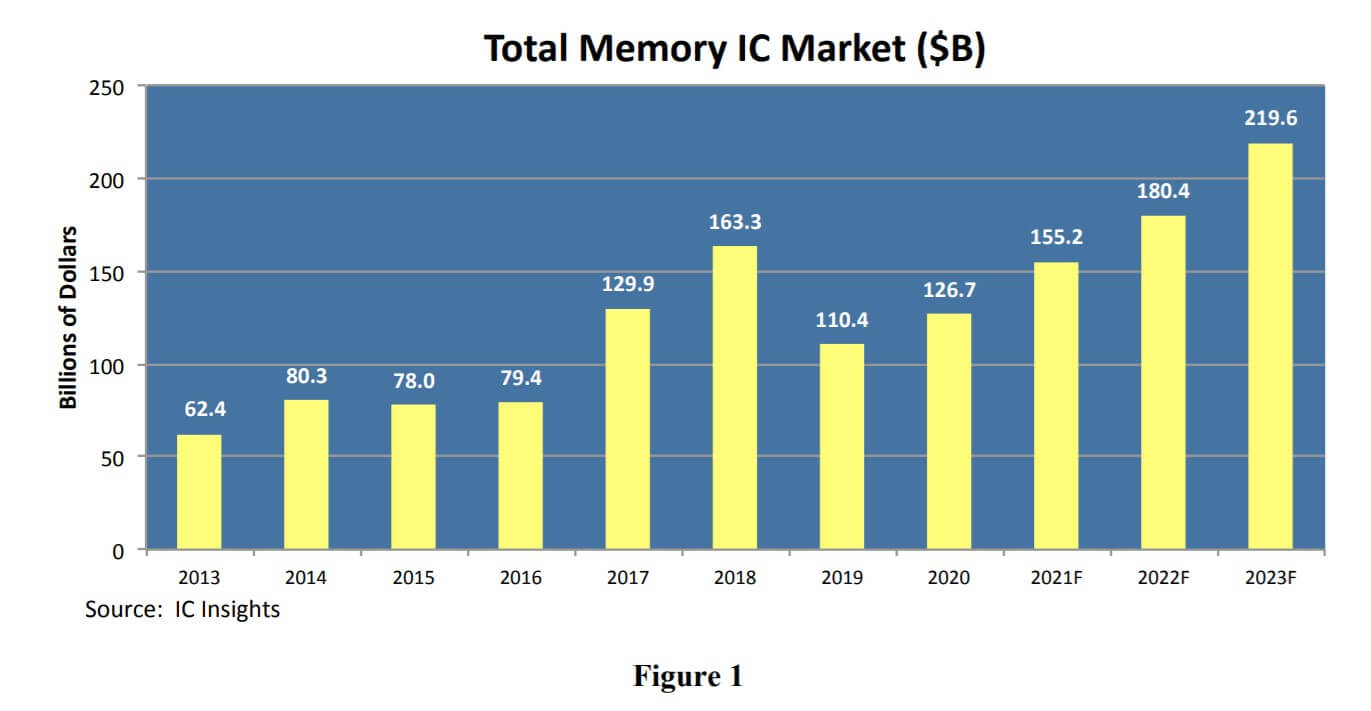

The updated forecast shows that after a steep drop in 2019, sales of memory ICs rebounded 15% during COVID-plagued 2020. Following up on that increase, stronger DRAM pricing is expected to lift total memory revenue 23% this year to $155.2 billion. The average selling price for DRAM jumped 8% sequentially in the first quarter of this year, and nearly all of the leading memory suppliers stated in their most recent quarterly financial presentations that they expected stronger demand in 2Q21

IC Insights pointed out that the memory upturn is forecast to continue into 2022 when total memory sales are expected to rise 16% to $180.4 billion, which would break the previous all-time high of $163.3 billion set in 2018 at the peak of the previous memory cycle. The memory market is forecast to reach its next cyclical peak in 2023, when revenue grows to nearly $220.0 billion—smashing through the $200.0 billion sales level for the first time— before a cooling period returns in 2024. From 2020 through 2025, IC Insights forecast the total memory market will grow by a CAGR of 10.6%.

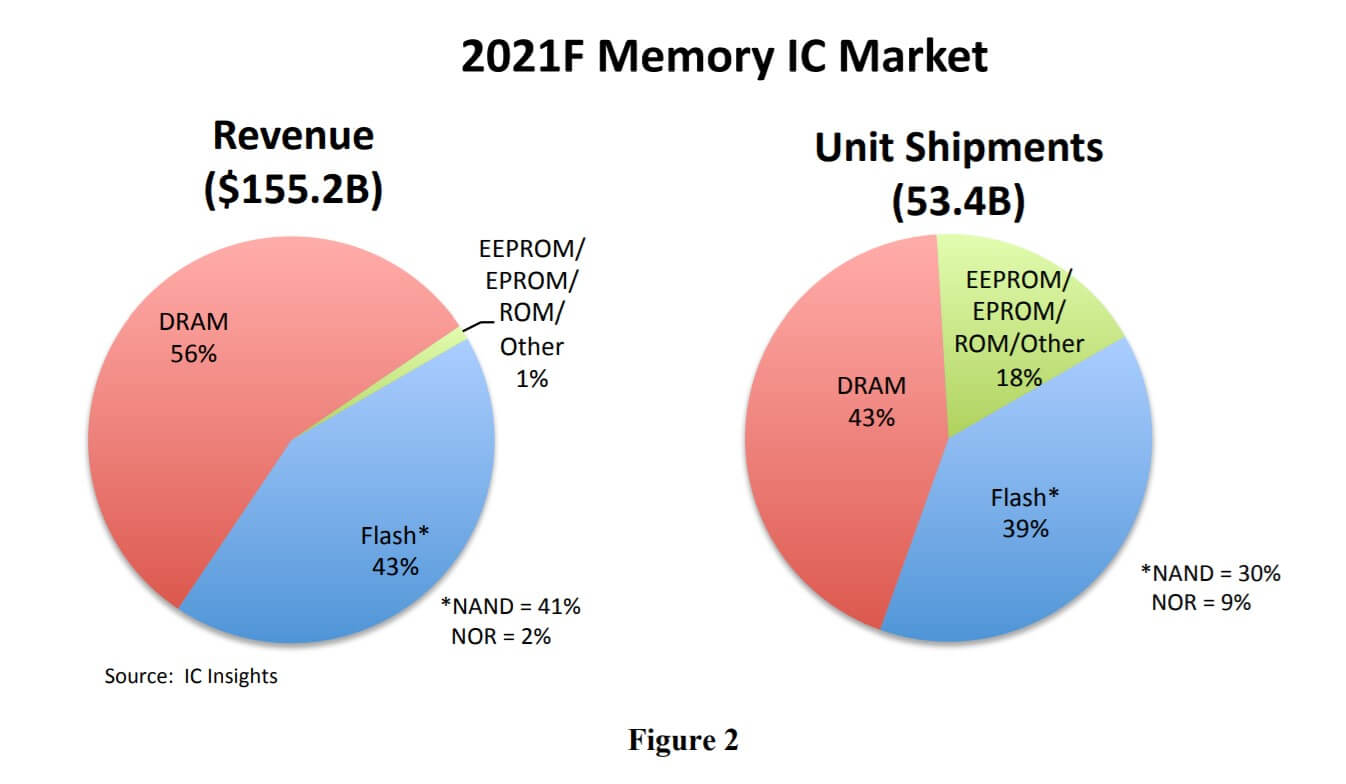

The report stated that in 2021, DRAM is expected to account for 56% of the memory market (Figure 2) with flash memory accounting for 43% share. DRAM is also forecast to represent the bulk of memory unit shipments this year. Though there remains a viable market for other memory products (EEPROM, EPROM, ROM, SRAM, etc.), it is unlikely these segments will account for much more market share than they currently do.

All Comments (0)